E-Mini S&P 500 to Continue Going Higher

- S&P 500 shoots higher after FOMC

- Pulls back early on Thursday

- Still in major uptrend

The S&P 500 has pulled back during trading on Thursday, reaching down towards the 3030 level. At this point, the market has taken back a lot of the gains during the training session on Wednesday.

Keep in mind that the jobs number comes out on Friday, as that is going to have a monumental influence on this market. With this being the case, it’s very likely that the value hunters will start to appear, especially if the jobs number looks relatively good.

Federal Reserve

The Federal Reserve released its interest rate statement yesterday, and while the market had already priced in the idea of the 25 bases point cut, it was the statement that was crucial. The statement suggested that the Federal Reserve was possibly on the sidelines for a while, and although it was implied that rate cuts weren’t coming anytime soon, the door was left open in case the data did warrant that type of action.

Remember, the S&P 500 and the stock markets in general move on liquidity measures by the Federal Reserve, and not necessarily earnings, like they used to. This has been exacerbated by the advent of so-called “passive investing” as large funds are starting to jump into ETF markets.

As long as the Federal Reserve seems willing to keep an easy monetary policy, that should continue to drive the market higher. That doesn’t mean there won’t be the occasional pullback, but the Federal Reserve has essentially been “trained” recently that they can’t tighten monetary policy anytime soon. This was due to the massive sell-off in December in reaction to the slightest hint of hawkish behavior from Jerome Powell.

Technical analysis

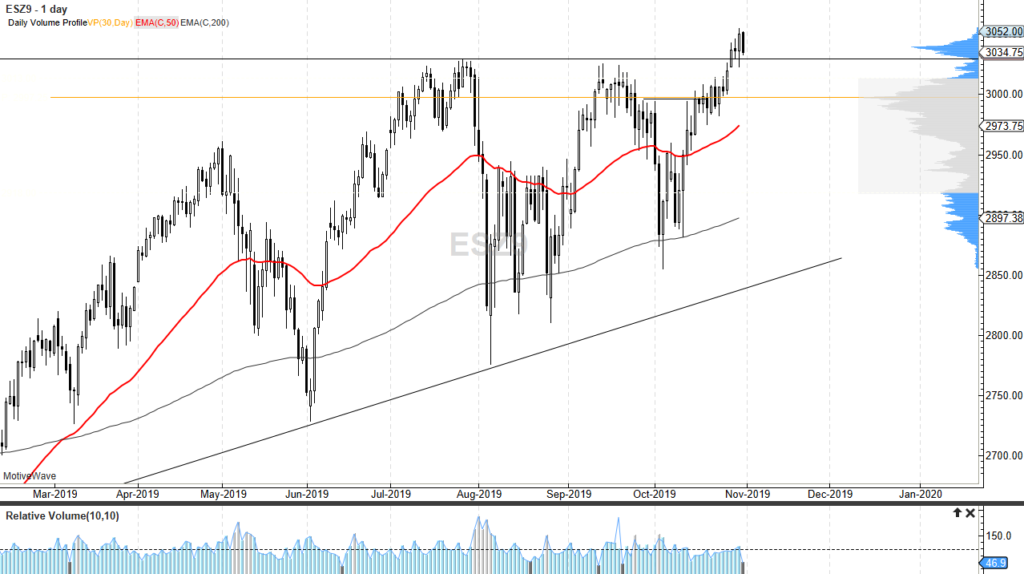

Dec. 2019 S&P 500 futures

The technical analysis for the market continues to show a bullish uptrend, as the 50-day EMA is starting to curl much higher. The 200-day EMA has offered significant support every time the S&P 500 E-mini contract has reached towards it, and therefore it looks as if traders continue to find dips as potential buying opportunities.

The 3000 level is the “point of control” over the last 30 days. This is an area where we have seen the most amount of trading, meaning it should continue to offer support. This major area of interest has the most probability of showing buying pressure.

Beyond that, the beginning of the “value area” starts at the 3010 level, which is the beginning of 70% of volume. In other words, there is a lot of water flow underneath it should continue to send this market to the upside.

It’s very likely that an initial “knee-jerk reaction” to a jobs number could be an opportunity to buy this market at lower levels.