Ethereum Likely Building a Base

- Sitting just above 50-day EMA

- Stubborn price action

- Recent “double bottom”

Ethereum has been relatively quiet over the last several weeks as the month of October saw the cryptocurrency trade between $160 on the bottom and $190 on the top. This is a relatively tight range for an entire month, as the market tends to be very impulsive at times.

Because of this, there are a couple of questions that could come to mind rather quickly. One such question would be whether or not Ethereum is trying to build a base pattern from which to jump higher.

Technical analysis

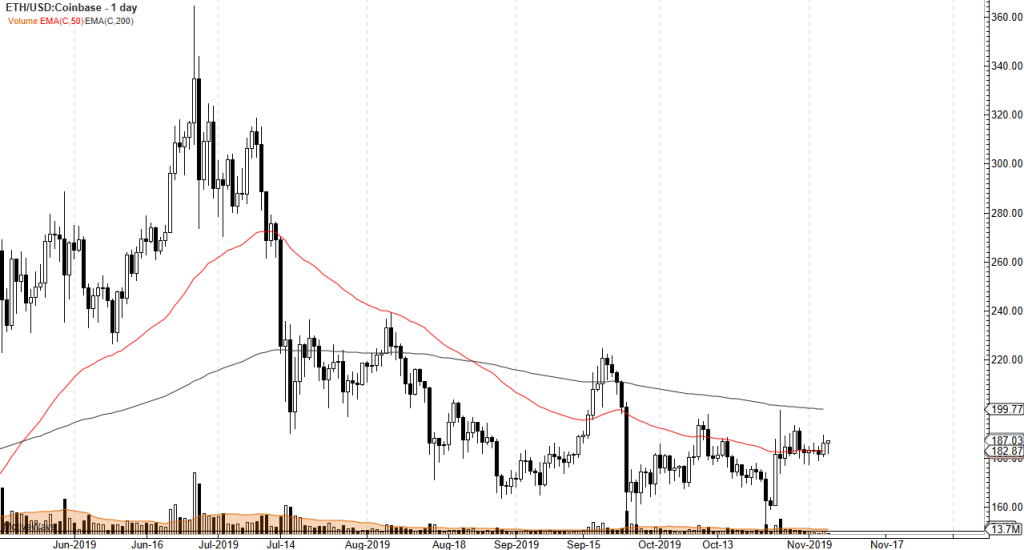

ETH/USD 6-month chart

Ethereum has been relatively quiet, but that isn’t necessarily a bad thing. After all, the summertime saw a lot of selling when it came to the cryptocurrency markets in general, and the fact that we have decelerated the selling is a very good sign to begin with.

Beyond that, the market has recently formed a bit of a “double bottom” near the $160 level. This should continue to be looked at as a “floor” in the market, as long as we can stay relatively stable.

The 200-day EMA is just above, which could cause some issues as far as resistance is concerned, but it is close to the $200 level. Ultimately, this is a market that will probably be relatively quiet, but again, that could very well be a good thing.

The trade going forward

Using the recent double bottom as a bit of a floor allows traders to build a core position to go forward. Short-term dips can offer buying opportunities, and if you take advantage of the opportunity to buy in small bits and pieces, the ability to build up a larger core position will be one of the biggest advantages of being a retail trader.

At this point, as long as the market stays above that double bottom from the month of October, buying little bits and pieces along the way can mitigate the amount of potential loss that you could be facing.

On a break above the 200-day EMA, especially on a daily close above that level, it should send the market much higher. At that point, Ethereum is likely to go looking towards the $220 level, and eventually the $250 level after that.

If the market does break below that double bottom, reaching the $150 level would be extraordinarily negative. It would also probably send the Ethereum market looking towards the $125 level, and even quite possibly down to the $100 level.

All things being equal though, it does look like buyers are starting to create an opportunity.