Ethereum Looks to Break Out

- Ethereum trading at large round figure

- 50-day EMA in focus

- Bullish session on Monday

The Ethereum markets rallied quite significantly during the trading session on Monday as markets opened up from the weekend. Crypto did fairly well as traders looked for safety after the drone attacks in Saudi Arabia, with alternative assets doing fairly well during the day. Beyond that, Ethereum managed to test a major, large, round, psychologically significant figure in the form of $200.

Technical analysis

ETH/USD daily chart

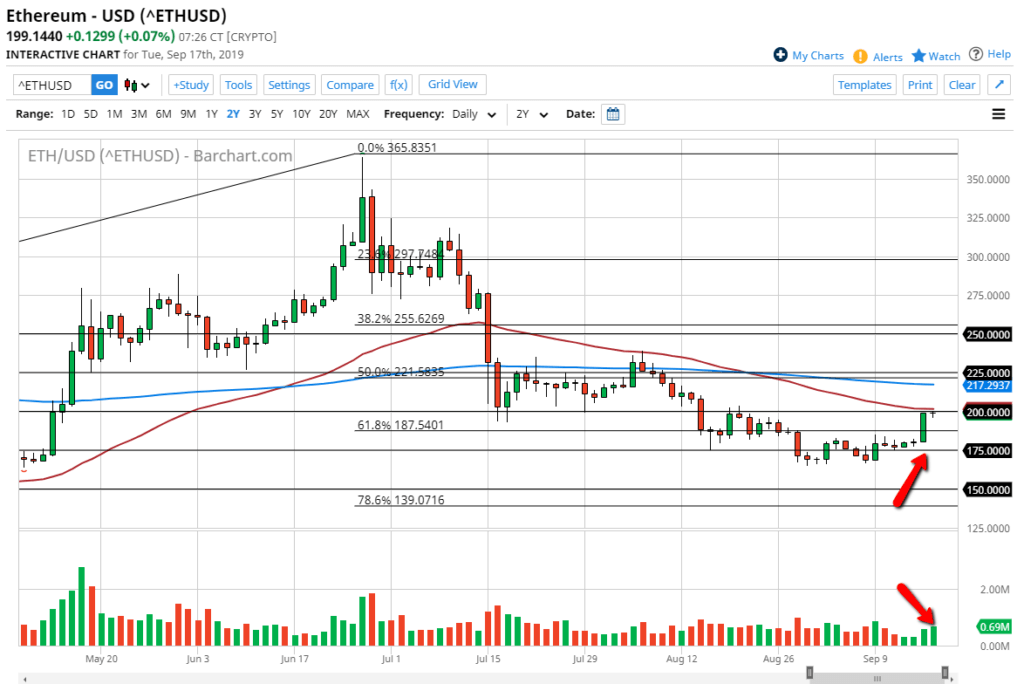

The technical analysis in the Ethereum/USD pair is rather interesting currently, as we are testing several different factors at one time. The first thing that should be noted is that the volume picked up quite a bit on Monday as we shot towards the $200 level. This level in itself is crucial, because it has a certain amount of psychological importance to it, as well as structural resistance from about 30 days ago. As such, it’s not a huge surprise that the market stopped right at that level.

Further compounding that area as resistance, the 50-day EMA is flattening out just above that handle. It makes sense, then, that the market may stall in this general vicinity. However, if it were to clear the $200 level on an hourly close, that could be the beginning of a move towards the blue 200-day EMA closer to the $220 level.

Beyond all of that, the market looks as if it has just formed a so-called “rounded bottom”, which is a bullish reversal signal. A break above the $200 level with any substance at all would kick off that bullish signal, which measures for a move to the $230 level above. Beyond that, the Federal Reserve will have an interest rate announcement during the trading session on Wednesday. If the US dollar gets hit, it could send Ethereum up in terms of US dollars as well.

The trade going forward

The trade going forward is to simply look for pullbacks to take advantage of value. Buying breakouts also works as well. Longer-term, this is a market that looks as if it is trying to rally significantly, as Ethereum has some catching up to do when it comes to the trend versus Bitcoin, for example. After the Monday session, it’s obvious that there is still a significant amount of interest in this market – and, of course, significant demand.

As long as the market can stay above the $175 level, selling seems difficult, and it does appear that the market is trying to change the overall trend. This is definitely a currency pair worth watching as the Bitcoin market has already made a significant move over the last few months, while Ethereum has lagged. It is possible that some of the altcoins are going to attract attention going forward, which is going to be good for the entire crypto market in general.