Ethereum rallies right along with the rest of crypto

Ethereum has rallied during Wednesday trading to break above the $250 level, just as the crypto market has been rallying for some time. It looks as if the market is simply going to bounce around in this general vicinity, but there are a convergence of issues right now that tells me it’s likely that we are going to continue to see buyers underneath and therefore I like Ethereum at the moment.

Round figure

Obviously, we are slicing through the $250 level during the trading session on Wednesday. This is a large, round, psychologically significant figure, so therefore it will attract a lot of of attention. Remember, large funds tend to try to jump into the marketplace at large round numbers, so that they don’t push the market too far against their own position immediately.

Technical set up

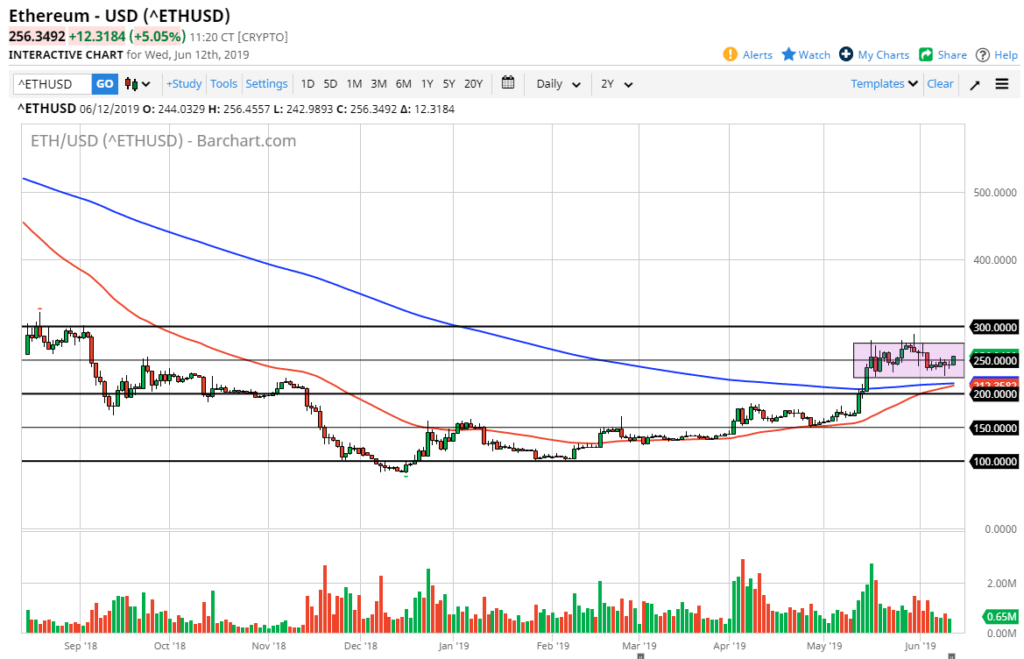

ETH/USD chart

Looking at the chart, there are several things that jump out at me right away. The 50 day EMA which is pictured in red looks as if it is ready to cross above the 200 day EMA which is pictured in blue. This is what is known as a “golden cross”, so therefore a lot of longer-term traders may be looking into getting involved as well from a longer-term standpoint. This of course helps because it keeps money in the market or the long-term thereby providing a bit of a “base.”

Beyond that, the Monday candle stick ended up forming a hammer, so that’s a bullish sign. That being said, the $275 level recently printed some type of shooting star. That shooting star extends to the $300 level above, so even though there’s a lot of noise above, I do think that we are trying to build up the inertia to have a bit of a “beach ball held underwater” moment here, meaning that once we finally do break the $300 level, this market is going to rocket to the upside.

Main take away

Without a doubt, the crypto market has come alive as of late. Although Ethereum takes a backseat to Bitcoin, the reality is that it does follow right along. If you superimpose one chart on top of the other, you essentially have the same thing. With that in mind I like buying dips in Ethereum and believe that as long as we can stay above the 50 day EMA, it’s probably going to remain bullish although it might be choppy. However, with a little bit of patient you should see a lot of reward at the end of the move.

Once we break above the $300 level on a daily chart, I would be willing to add to the position as I think we could pick up another $100 rather quickly. This market does tend to move in $50 increments, so keep in mind that the $350 level could cause a bit of an issue, but it will be temporary at best. Keep your position size reasonable, but you do have an obvious area to start to get even more aggressive.