Ethereum to Drift Lower

- Ethereum fails to hang onto gains

- 50-day EMA tilting lower

- Running into resistance

- Crypto under pressure overall

As the cryptocurrency markets have been under significant pressure recently, it should not be much of a surprise that Ethereum has fallen as well. It hasn’t exactly been a meltdown, but it certainly has been somewhat relentless in its bearish pressure. It’s very possible that crypto is about to get hammered for a longer-term move.

Moving averages

ETH/USD weekly chart

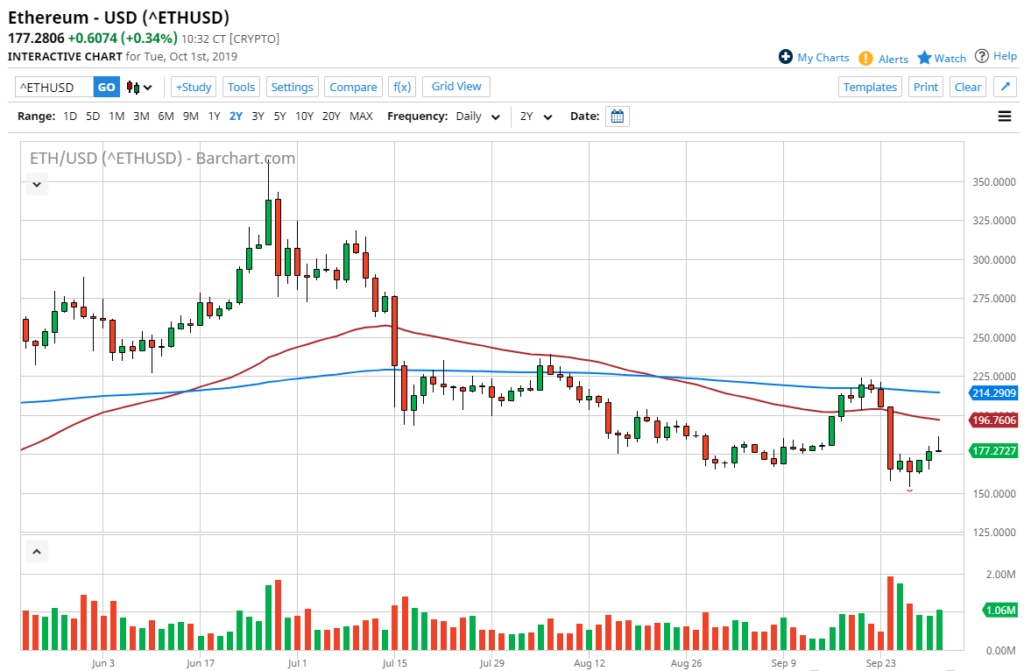

Looking at the chart, there is a 50-day moving average just above that is tilting lower, and that will bring the short-term sellers. Above there, the 200-day EMA is found at $215, and it is now starting to slope a bit lower as well. As there is a decent spread between these two major moving averages, it suggests that the market is ready to go lower for the longer-term move. Recently, the market had tested just above the $150 level, which has a certain amount of psychological importance attached to it. That doesn’t mean it can’t be broken down though, and it’s very likely that there will be a significant attempt to do just that.

Lack of use

There has been a serious lack of use when it comes to real-world application, and this is starting to become a serious problem for crypto in general. In fact, the question now is whether or not crypto will survive in its current form? The reality is probably not, but there will more than likely be a few survivors. As Ethereum is one of the top cryptocurrencies, it’s likely that it will be around in a few years. That doesn’t mean it has any business whatsoever in trying to break higher from here. The best thing that can happen for crypto is that it drops in value overall, as it is far too expensive and volatile to be taken seriously as a currency, or even as a way to transact.

The trade going forward

Looking at the Ethereum chart, and the fact that the buyers disappeared later in the trading session on Tuesday, suggests that selling short-term rallies should continue to be the way forward. The 50-day EMA should be used as a benchmark for selling as well if the opportunity arises, and it’s likely that the market will roll over and go looking towards the $150 level. A break down below that level will open up the door to the $125 level next, and then possibly the $100 level after that.

It is not until the market breaks significantly above the 200-day EMA that the buyers will be followed by a longer-term group of traders that can truly push this market to the upside.