eToro Earnings Report – Why Do You Need It?

An earnings report is a report that contains information about the profit received by an economic unit for a certain time. In accordance with international accounting standards, net income is measured on an accrual basis. When it comes to Forex trading this data could provide a valuable piece of information that will help you analyze the market more comprehensively and earn income.

Earnings report explained

An earnings report or statement of earnings is prepared in accordance with the requirement that a firm must “disclose” its income for a certain period of time and provide a full report on the factors affecting income during that period. Thus, the meaning of an income statement is to link a firm’s expenses to income for the entire reporting period (be it a week, month, quarter, or fiscal year). The difference between a firm’s income and all expenses, including taxes, is Net Income, which in some cases is also called Net Earnings or Profit after Tax of the firm for the period.

It is very important to understand that the amount of the company’s net income and its cash flows for the same period are different amounts, and only by chance they can coincide. There are certain nominally Noncash Expenses, such as the depreciation of assets and depreciation of fixed assets (fixed capital), which reduce net income but do not affect cash flows, since nominally cash expenses do not involve cash transfer operations amounts.

All expenses are deducted from the firm’s income and affect the amount of net profit, but not all expenses require a real money transfer. Also, not all cash payments are recorded as expenses: the purchase of inventories or property, a plant, equipment is not an expense.

In accordance with the rules, the income statement begins with a measure of the total amount of Revenues of Sales for the period. This amount is deducted from the cost of producing goods or services, or the cost of goods sold (Cost of Goods Sold or Cost of Sales).

How does the eToro earnings report work?

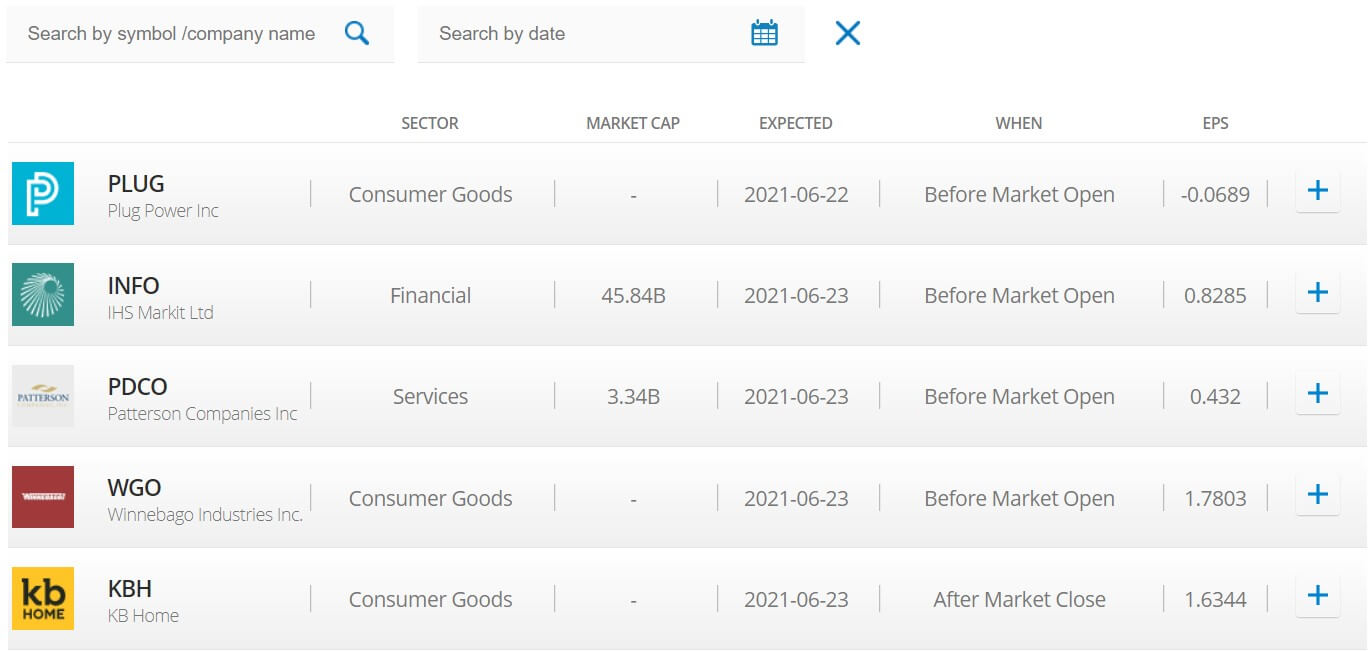

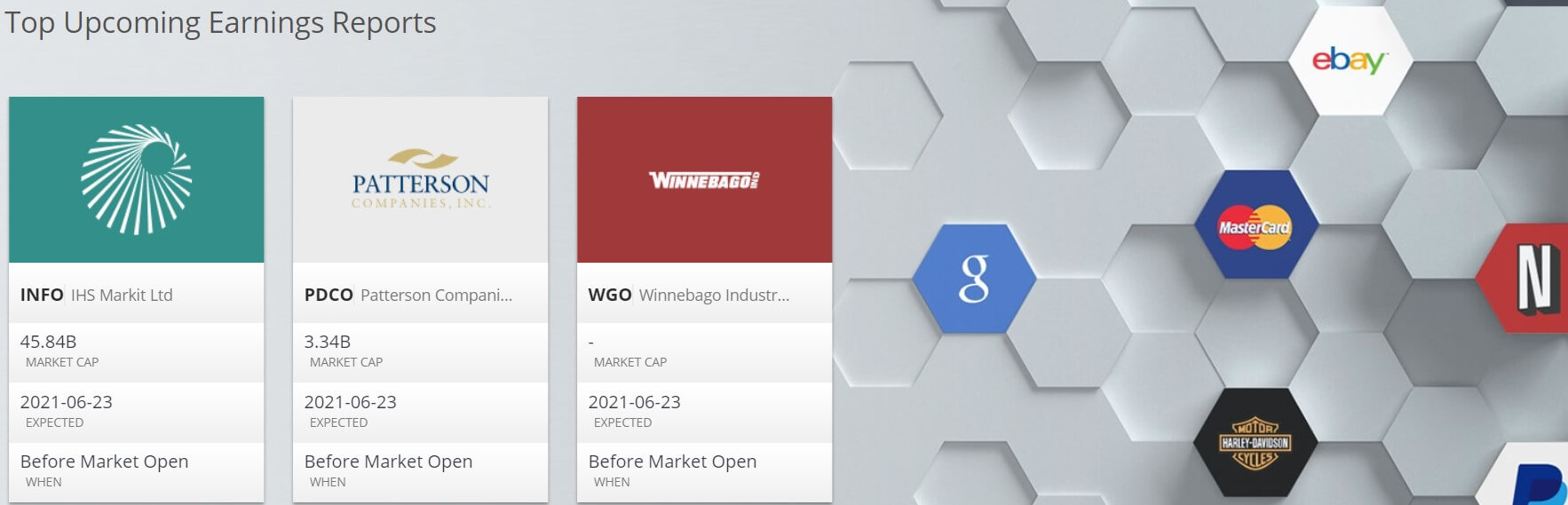

It should be noted that the eToro earnings report works the same way as we have mentioned above. The broker provides an economic calendar, where you can see upcoming earnings reports that are scheduled to be released. In addition, they show sector, market cap, expected date of launch, and whether they will be available After Market Close/Before Market Open. However, past performances and statistics are not guaranteed to deliver the same results in the future, thus you need to consider that.

Trading is all about receiving information and choosing the right moment to sell or buy assets. With the eToro earnings report and calendar, you will receive updates and insights, detect fluctuations. Earnings season is another key indicator of describing the period when financial reports are published by prominent companies. In simple words, it is quite a useful tool for beginners to start trading and for experienced traders as well.

In addition to providing financial reports and information, companies will also publish additional data on the budget. If you are interested in Netflix for example, you might see the report on new subscribers.

Market analysts often make predictions about the market before these reports are published. Sometimes they turn out to be wrong. This information is precise and completely reliable. The earnings report also affects stock trading in the sense that stock values could improve in a particular period of time.

eToro Earnings Reports – Pros and Cons

The eToro earnings report is a fantastic tool and feature that is not available on many brokers’ websites. While there are numerous advantages of using this feature, of course, we can also have a look at some cons. Below we will go each by each thoroughly.

Pros

When the reports are published they can provide traders with valuable information about the price change. The latter is necessary because that’s what traders need to earn money in Forex. At the same time, the economic calendar holds information about different indicators such as consumer goods, market cap. The performance of different businesses could be helpful in providing the overall economic situation in the market.

As for other advantages, the tool is extremely simple to use, with a decent user experience and good design. Developers in eToro paid a lot of attention to this segment and it does not disappoint.

Cons

There are not too many cons in the eToro earnings report. The first thing is that you need to have prior knowledge and experience to pick the information out of the economic calendar and report correctly. It is a good idea to have someone as a mentor who will guide you through everything.

Another thing is that past performance does not always mean that in the future everything will work out the same way. Novice traders are under the illusion that everything will follow the same pattern, but an earnings report is only an additional tool, aimed at making traders’ tasks easier.

The Bottom Line

We have reviewed the eToro earnings report and its advantages and disadvantages. It goes without saying that it is a special tool particularly for those who are experienced and have some knowledge regarding trading. At the same time, the reports are categorized – you can have a look at various details, for example, when they are going to be available. The feature will definitely make the trading process simplified and easier.

FAQ

What is an earnings report?

The earnings report reflects the performance of the firm for the reporting period based on its profitability. It is a quarterly or annual report of an enterprise about its profits for the past period. The report reflects the income, expenses, net profit, or loss of the company for the current period. The report is a public document of the enterprise – it can be published in print media, sent by email, or passed on to shareholders. In trading, it can deliver valuable information and assistance to traders.