Euro Awaits ECB Meeting

- Euro waiting for ECB meeting on Friday

- Currency continues to deteriorate

- Testing major support level and psychological number

The Euro fell hard during the trading session on Wednesday as we reached towards the 1.10 EUR level. This attracted a lot of attention as it is a psychologically significant round figure. That’s not a huge surprise, as it had previously attracted a lot of attention on the news channels. Ultimately though, the real game changer is going to be what happens next at the European Central Bank (ECB) meeting on Friday.

Monetary policy decision

The monetary policy decision coming from the ECB should be rather dovish and perhaps offer more quantitative easing. However, that doesn’t necessarily mean that the market is suddenly going to collapse, because at this point the markets aren’t completely sure about what’s about to come.

Obviously, an interest rate cut could be further down the road, but then the question becomes whether or not there is more quantitative easing. Are the bond markets in the European Union about to be flooded with ECB money again? If that’s the case, then we get even further negative yields in the bond market, driving money away from the continent and into the arms of the United States, where there’s more in the way of yield.

Recessionary headwinds

There are also serious concerns about recessionary headwinds coming out of the European Union. Germany is just about there, Italy is too, and growth is anemic around the entire continent. As such, it does make sense that the Euro continues to go lower. It doesn’t necessarily mean that it needs to collapse, but the trend is most certainly a downward one, and with very good reason.

Technical analysis

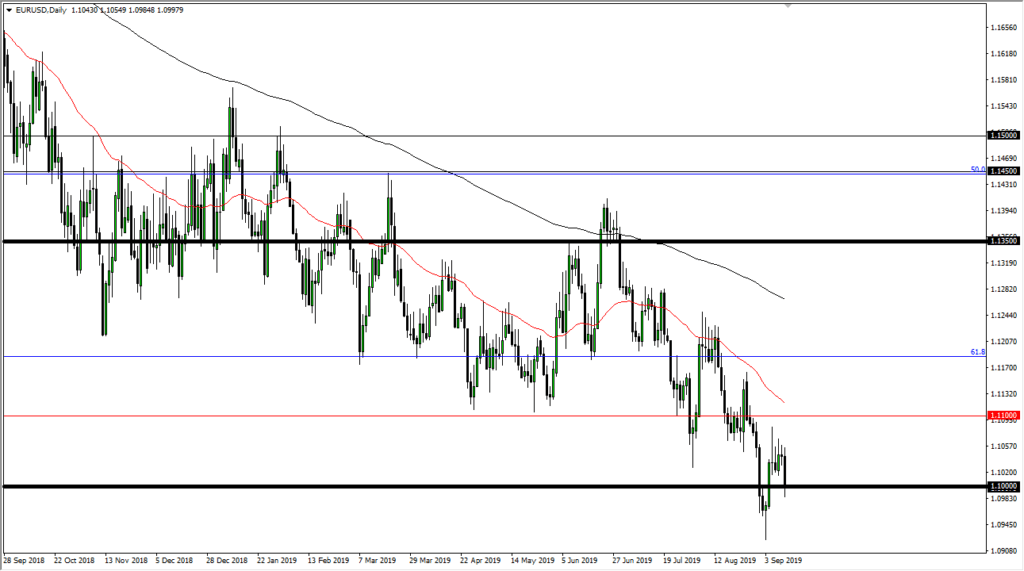

EUR/USD daily chart

The market is well below the 61.8% Fibonacci retracement level and looks likely to go looking towards the 100% Fibonacci retracement level. From a longer-term perspective, that means we could be falling toward the 1.05 EUR level. However, this pair doesn’t tend to move very quickly, so this should be thought of as more than likely a potential grind lower.

To the upside, the 1.11 EUR level will cause significant resistance, just as the 50-day EMA will, which is just above there. Simply put, unless the ECB completely surprises and shocks the market, it’s very likely that the Euro will continue to fall from here and reach towards even lower levels.

There seems to be very little interest in buying the Euro, especially as global concern continues to pick up. Ultimately, the US dollar continues to attract a lot of flow against other currencies as well, and with all of the problems currently going on in the European Union, it makes sense that we continue to see the downtrend. Let us not forget that the European Union is also going to be hurt by Brexit, so that is yet another reason to think that the downside continues to be the favored one.