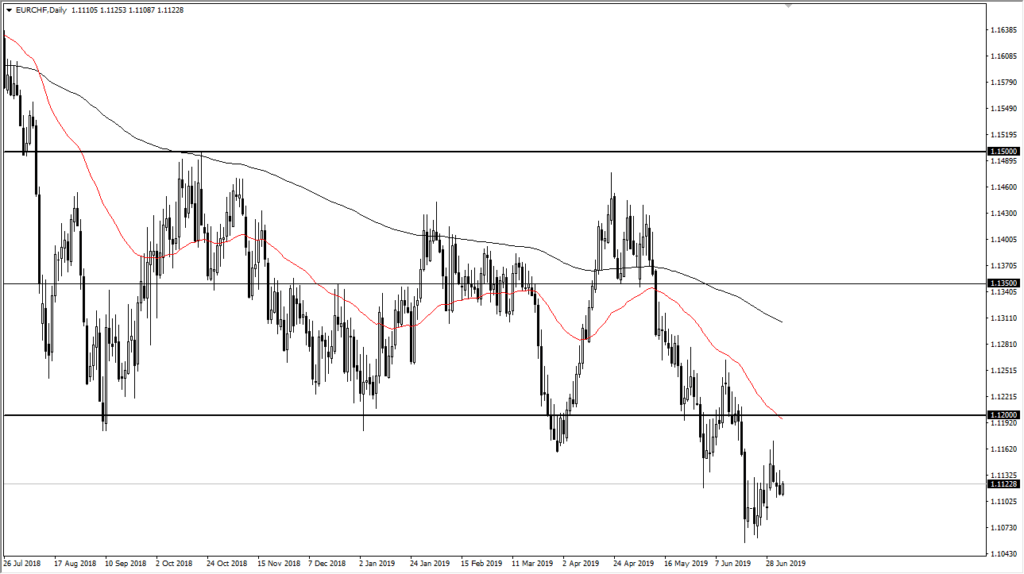

Euro Continues to Grind Lower Against Swiss Franc

The Euro has rallied slightly during the early hours, but at the end of the day it should be pointed out that we are most certainly grinding lower overall and have been in a very strong downtrend. This suggests of course that there is a certain amount of “risk off” expectations out there, which makes quite a bit of sense. Ultimately, this is money flowing out of the European Union, reaching towards the safety of Swiss banks.

Swiss Franc Strength

When you look at the Forex markets, you can see that the Swiss franc has enjoyed a bit of strength as of late, and if you think about it makes perfect sense. After all, the US/China trade tensions have people worried about global growth, and that, of course, favors safety currency such as the Swiss franc. Beyond that, we also have the tensions between the United States and the Islamic Republic of Iran, various arguments between OPEC nations, Venezuela, Syria, and so on. In a situation like that, it makes a lot of sense that people will be looking for the safety of a place like Switzerland.

Moving Averages

The moving averages that I typically follow, the 50 day EMA and the 200 day EMA both offer negative momentum, as we have been falling for some time. Overall, this is a market that should continue to drift lower based upon longer-term money, and the fact that we broke down below the 1.12 level a couple of weeks ago suggests that we are going to probably drift towards the 1.10 level given enough time.

Keep in mind that this market does tend to move rather slowly, as the two economies are so highly leveraged towards each other. That being said though, in the type of environment that we find ourselves in, a bit of calm trading might be just what the doctor ordered.

EURCHF Chart

The Play Going Forward

The play going forward is rather simple: don’t fight the overall trend. It doesn’t mean that we should just jump in with both feet and start shorting like crazy, but it does mean that we should look at short-term rallies as selling opportunities. A perfect example of this happened a couple of days ago, as we formed a shooting star. A shooting star in what is a longer-term downtrend makes a lot of sense to sellers. At this point it’s very likely that any rally will be faded and we will probably go to the lows in the short term. However, given enough time rallies will pick up more sellers, and we should continue to reach towards the 1.10 level.

That being said, the alternate scenario is that we break above the 1.12 level, and at that point you should look at it as a market that is trying to turn around for a longer-term bullish move. Currently, the downside is still favored so looking for opportunities to pick up the Swiss franc as it gets cheaper makes quite a bit of sense.