Forex.com DMA Trading Account – What Does It Offer?

Modern trading has become very sophisticated and it is not a surprising fact because Forex has evolved rapidly in recent years. A lot of traders are looking forward to flawless execution, high resiliency, attractive spreads, and transparent pricing from a broker.

That is why it is so important for a broker to build a competent scheme for working with client orders and choose reliable liquidity providers. In this context, DMA (Direct Market Access) liquidity gives the broker an edge that will help him differentiate himself from the competition and gain customer confidence.

On Forex.com you can access a DMA trading account that comes with a wide variety of advantages. Direct Market Access is for experienced traders who seek deep liquidity and the possibility to use rapid price movements to their advantage. On Forex.com you will be able to trade on prices from major banks and liquidity providers. You will also see real-time pricing and place orders within the top of book spreads.

What is DMA liquidity?

The main advantage of DMA (Direct Market Access) technology is direct access to the market: all orders are sent immediately to liquidity providers, without the intervention of a broker. Orders using DMA technology are sent directly to the exchange, bypassing the brokerage company, increasing the speed of transaction execution. Thus, traders receive the most transparent execution at the best market price based on the Best Bid – Best Ask principle. Each order goes directly to the liquidity provider.

Why does DMA Liquidity Appeal to Brokers?

There are several reasons why brokers go for DMA Liquidity:

- High resiliency due to aggregated liquidity from multiple providers.

- Competitive advantages due to reduced order execution time and lower transaction costs.

- Single margin account – no need to open accounts with every liquidity provider.

- Predictable and stable cash flows – the broker receives money regardless of whether traders make or lose.

- By minimizing risks.

- Lack of conflict of interest and, as a result, loyalty and trust of traders.

How To Open a DMA Account on Forex.com?

In order to use the DMA account of the broker’s website first, you need to open one. On Forex.com the process is simple and the steps are different for new and existing customers. Let’s have a look at how to open an account.

New customers who decided to sign up on the broker’s website should fill out a special form, where they need to provide personal information. The link is available on the Forex.com website and is easily accessible. Other customers, such as joint or corporate, should submit an application.

For existing customers, everything is simpler – go to the MyAccount, press on “Account Settings” and choose the Forex.com DMA account. You will be emailed by the broker itself about login credentials.

Features of DMA account

The DMA account on Forex.com comes with countless features and advantages. First of all, you can trade with direct market access through different tools including advanced desktop and web trading platforms. Over 80 technical indicators and powerful charting tools are provided. You can integrate trading ideas, tools, and market insights harmoniously with each other. Other features also include:

- High transparency of transactions and guarantee of market execution;

- The best prices from multiple liquidity providers;

- Opening deals without going through an intermediary;

- Lack of requotes;

- Non-fixed spreads without extra charges;

- The opportunity to use any trading style (scalping, news trading, long-term trading, and so on).

Forex.com DMA Account – Pros and Cons

Forex.com DMA account is an innovative feature that is not available on many brokers’ websites. With this account you can get a lot of benefits, however, there are some disadvantages worth mentioning. Let’s have a look at both of them below.

Pros

Obviously, there are more advantages and positive aspects of using the DMA account, than disadvantages. First of all, you earn 1% APY (Annual Percentage Yield) interest on your average daily available margin. Secondly, you get professional guidance from the experienced Market Strategist who will provide you with a competent trading plan.

You also become eligible for priority services, meaning that your requests will be handled personally and receive top priority over the other ones. All wire transfers as well will be reimbursed by the broker itself, so you do not need to care about any additional commission.

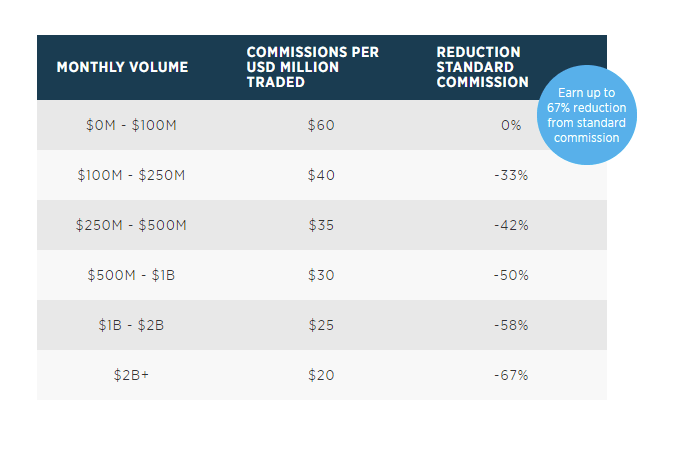

When you trade with DMA on Forex.com you are free from paying spreads. Also, you will hugely benefit from the volume discounts as your trading increases. In every way, as we can notice, the Forex.com DMA account is a perfect solution for traders, with a plethora of advantages.

Cons

In addition to the range of pros, there are several cons to using a DMA account. First of all, if a trader decides to work with a broker whose trading is as transparent as possible, he should take into account several flaws of this system. First of all, there is a lot of volatility in the market, and in the event of a mistake, the trader will lose a large amount. Thus, only professional and wealthy traders usually work through Direct Market Access technology. It should also be noted that DMA trading is heavily regulated and can make the process of trading less flexible compared to OTC trades.

The Bottom Line

As we have reviewed, the Forex.com DMA account is an innovative approach to trading. With this account, you can get access to numerous features, earn annual interest, get guidance from professional strategists and be absent from bank fees. When you trade Direct Market Access bank fees are reimbursed by the broker itself – you can forget about extra commission and charge. At the same time opening such an account on the Forex.com website is simpler whether you are a new or an already-existing customer. However, keep in mind that you need a lot of experience and knowledge to start trading on this account and it is advisable for beginners to abstain from using this account for some time.

FAQ

How to open a Forex.com DMA account?

Opening a Forex.com DMA account is simple. Individual customers should fill out the form, which is available on the website through a specific link. Joint or corporate customers should submit a separate application and wait for the broker.

As for existing customers, they need to check the MyAccount section, click Account Settings and choose a Forex.com DMA account. The broker will email login details, as soon as the account is ready.

Should I Pay Spreads?

No, you do not need to pay Forex.com spread when you trade with DMA. You also get benefits from the broker the more you trade. In general, you are charged a standard commission and you will earn discounted commission depending on your trading volume.