Gold Continues Sideways Grind With Holidays in Focus

- Gold markets relatively flat

- Holidays weigh upon volume

- 50-day EMA acting as a magnet

During trading on Thursday, the gold markets were flat yet again, as we have seen all week. This isn’t much of a surprise, because there are a lot of moving pieces right now and there a lot of different things coming into focus at the same time.

Multiple factors influencing the gold markets

There are multiple factors affecting the gold markets right now, as well as many of the other markets around the world. At this point, the majority of market participants are paying more attention to the holidays than what’s going on in the markets, and this is reflected in the lack of movement.

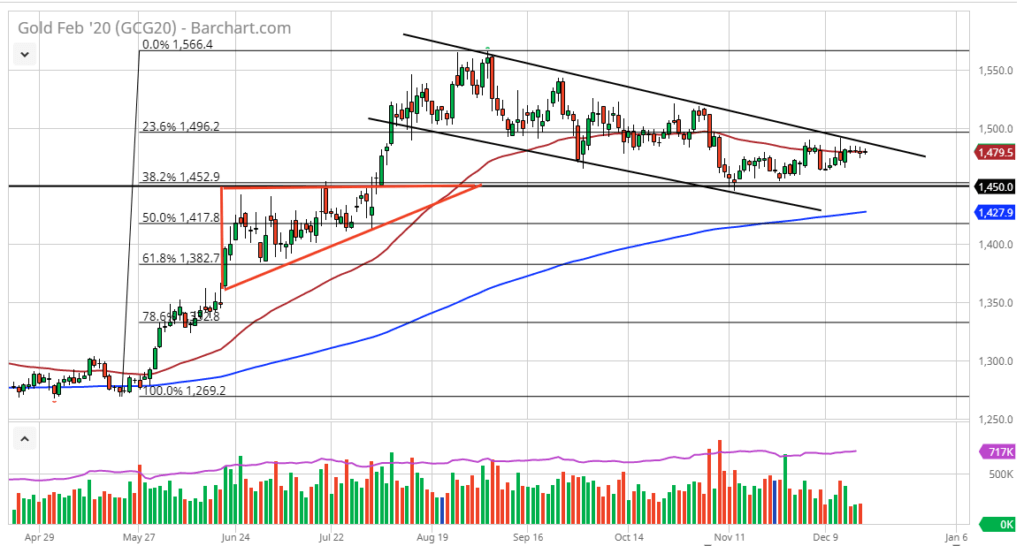

The technical analysis suggests that the down trending channel is still in play, and it looks as if the gold market simply has nowhere to be. That’s because of the 50-day EMA and the downtrend line at the top of this channel. There are a lot of things going on at the same time that could keep this market soft.

Gold chart

Underneath, there is the $1450 level which has been a massive support lately. Recently, the market has been using that level as a “floor”, and with the multitudes of problems out there, it makes sense that gold would have a little bit of support somewhere. This is also the 38.2% Fibonacci retracement level from the previous move, and this little pullback is probably healthy for the longer term uptrend.

Beyond all of this, gold has been doing nothing against the backdrop of the US/China trade deal. Granted, there has been a potential breakthrough in the idea of a “Phase 1 deal”, but it seems very unlikely that we are going to get any type of clarity in the short term. After all, the deal has been light on details, and for that matter has been very quiet since the announcement. It’s as if the “risk on/risk off” attitude of gold shows just how the market feels right now, in a state of confusion.

Going forward

Going forward, it’s very likely that gold will try to make a breakout from here. At this point though, it needs some type of catalyst and right now it doesn’t exist. The support level at the $1450 handle is extraordinarily strong, and therefore it makes sense that we would continue to see this level be respected by the market overall. Therefore, a bounce makes more sense than not from a technical standpoint. All it takes now is some type of negative headline out of the US/China situation, and gold will be poised to take off to the upside. In the meantime, the next couple of weeks might be relatively quiet without that.