Gold Gaps Higher Amid Drone Attacks in Saudi Arabia

- Drone attack sends traders looking for safety

- Market testing resistance

- 20-day EMA in focus

Gold markets gapped higher during the open on Monday as the world finally had a chance to react to the drone attacks in Saudi Arabia. Gold was being used for a safety trade, as this could lead to significant market corrections around the world. Because of the gap, one would expect upward pressure, but it had already turned around to fill some of that gap. It should be noted that after the Asian session, the gold markets seemed to calm down a bit.

Technical analysis

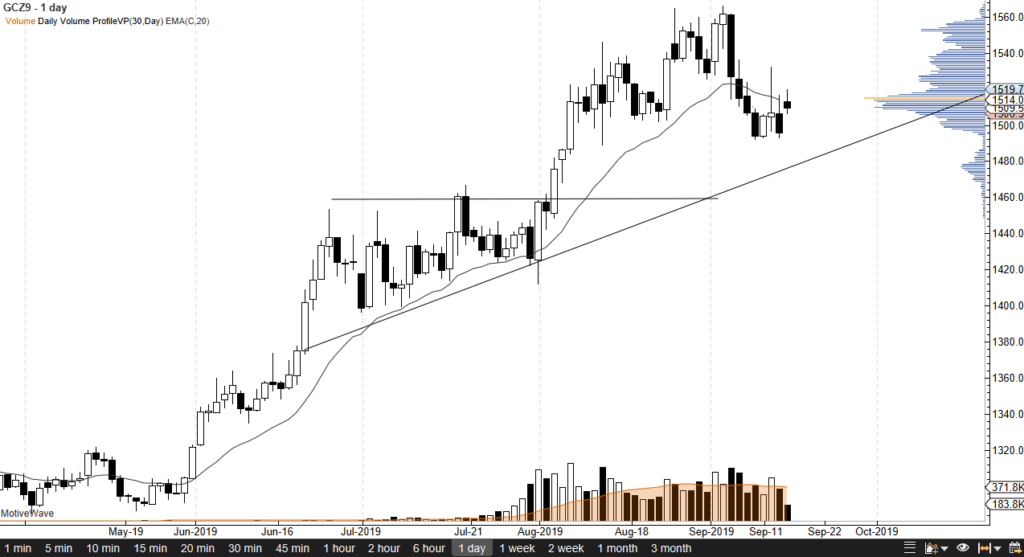

Gold September 19 daily chart

The gap is very bullish-looking, but in typical fashion, the gap will eventually get filled. This means that gold could pull back a bit in the process to reach the $1495 level. If that level gets broken to the downside, it will be a very negative sign. A gap that gets filled and then broken through is one of the more negative technical signals out there.

The 20-day EMA is slicing right through the candlestick as well. This is worth paying attention to, as it has been relatively reliable as dynamic support and resistance. In other words, there is a certain amount of resistance just above, and it should be pointed out that the yellow bar on the volume profile for the last 30 days suggests we are just below the highest volume of the last month. In other words, it may be difficult to go higher from here. Also, the fact that the markets have calmed down suggests that perhaps there was a measure of overreaction at the open.

All that being said, there is a nice trend line underneath that should offer some support anyway. That means you may be able to pick up gold on the cheap in the next few days. It should also be pointed out that silver rallied well over 2%, while gold only did 1%. In other words, silver seems like it still wants to outperform when it comes to the metal sector.

The trade going forward

The trade going forward is to simply wait for the gap to be filled and take advantage of any bounce that shows up. Ultimately, if we were to break above the highs of the trading session on Monday, that would also be a buying opportunity. If none of those scenarios show, then we start to look at the trend line a little closer to the $1480 region. There is no reason to be short of gold at this point, but realistically speaking, we have been overbought for some time. Looking at the chart, there should be plenty of opportunities to go long over the next couple of weeks. If the trend line were to be broken, then the market would more than likely go looking towards the $1450 level underneath.