Gold Looking to Bounce

- Trend line looking to hold

- Major support level below

- Buying started in Asia

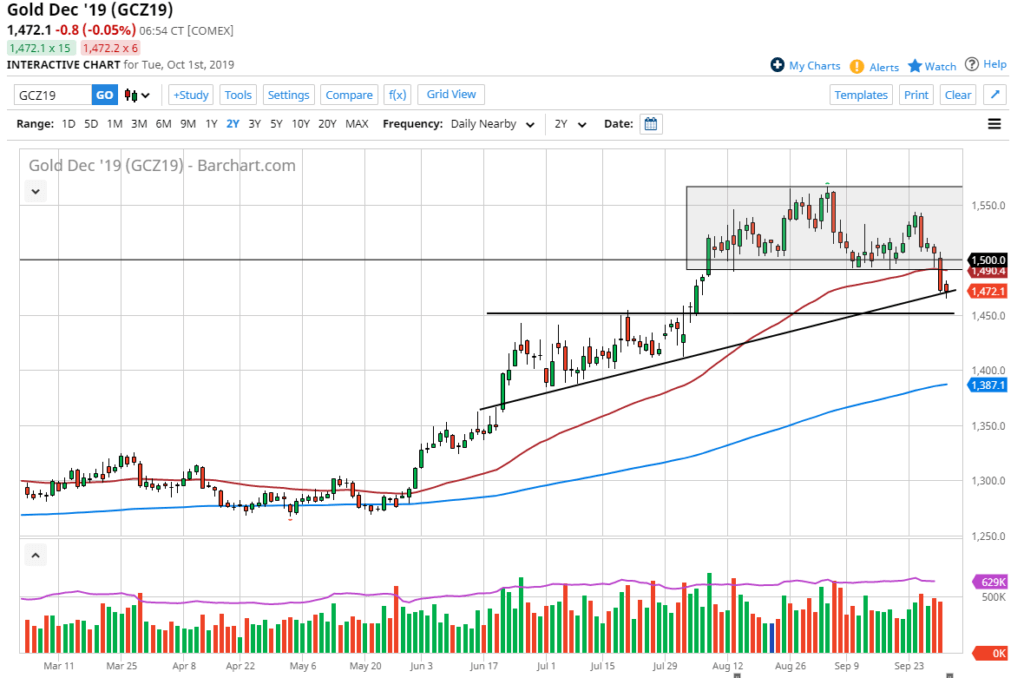

Gold markets fell initially during trading on Tuesday, but they have turned around to break back above the trend line as the American session opened. At this point, the market looks as if it is trying to form a hammer, but there is still a significant amount of noise above that is going to cause some issues.

All of that being said, the market has been in an uptrend for some time. It’s likely that we are going to see buyers step in and try to push this market towards the 50-day EMA again, which is currently sitting at the $1490 level. That provided massive support, and the fact that it was broken is a negative turn of events, but not enough to change the overall trend. At this point, it’s very likely that gold will find buyers sooner rather than later.

Major support underneath

Gold chart

Looking at the gold market, it’s easy to see that there is major support at the $1450 level, due to the fact that it was the top of the ascending triangle laid out on the chart. Ultimately, there should be a lot of buying pressure in that area as well, and that’s assuming that we can even get down there. Trying to buy gold in small increments makes sense, as it will perhaps allow traders to bid for a larger core position.

Global fear moving markets

Gold markets will eventually get a boost due to the central banks looking to ease monetary policy, or global fears in general. After all, we have seen several central banks cut interest rates or start one form of quantitative easing or another.

Levels to watch

There are several levels to watch above, the first of which is the $1490 level, followed by the psychologically important $1500 level. A move above there opens up the door to the $1525 level and finally the $1540 level. Those are all the immediate levels that the market will be aiming for, with the longer-term outlook of possibly reaching as high as $1600 after that.

This doesn’t mean that the move higher will be easy, but it certainly could be helped by the occasional headline that seems to be an almost weekly event now. One thing is for sure: recently, we have seen more risk to the upside for safety assets than down. In the big picture, not much has changed that would put bearish pressure on gold, at least for a significant move.