Gold Markets Attracting Support and Approaching Vital Level

- Gold approaching support level

- Bottom of massive rectangle

- Moving averages still going higher

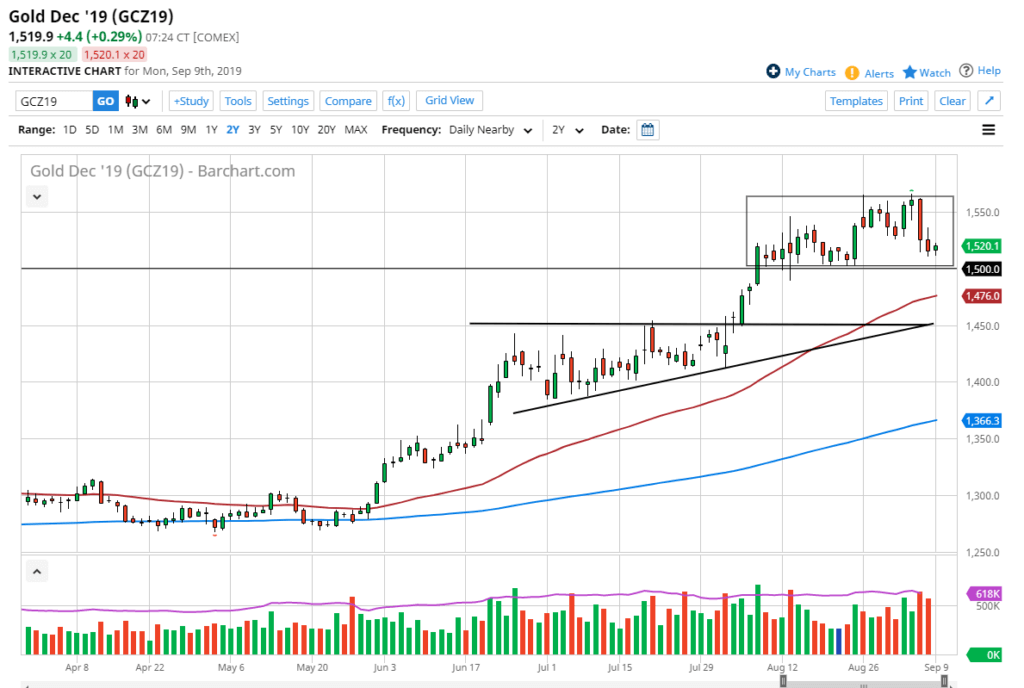

Gold markets found a little buying pressure early on Monday as they approached the crucial $1500 level. There is significant support at that level, not only from a psychological standpoint, but from a structural one too. Ultimately, this is a market that continues to attract a lot of inflow with the recent longer-term uptrend. With that being the case, it’s very unlikely that sellers will gain any significant traction.

Gold will continue to act as a buffer against global concerns of slowing growth, the US/China trade war, Brexit, and a whole host of other issues. It’s highly plausible that gold markets will continue to be one of the favorite trades for traders around the world.

Capital controls and broken resistance

Keep in mind that there are capital controls people will need to deal with in places such as China and Venezuela. So, gold ends up being one way to protect wealth in a situation such as that of Hong Kong, or the economic meltdown in Venezuela. Gold will continue to go higher for the longer term, simply because we have broken through so many resistance levels underneath. Ultimately, this is yet another confirmation of just how strong this market will be, and therefore a lot of traders will be active due to a “fear of missing out”.

Moving averages

Moving averages come into play for longer-term traders. The 50-day EMA is sitting at the $1475 level, and then even lower at the 200-day EMA at the $1366 level. Overall, there are plenty of reasons to think that support will come into play even if we were to break down below the $1500 handle. Furthermore, we also have an uptrend line that is underneath near the $1450 level, so it’s likely that we will see plenty of reasons to “buy on the dips” if this does become the case.

Gold Chart Analysis, September 9

Gold going forward

Going forward, gold should continue to rise for the longer term. Not only is it a hedge against global and geopolitical uncertainty, but it’s also a way to deal with central banks around the world cutting interest rates and loosening monetary policy. In the end, that’s probably the biggest driver, but they all point in the same direction: upwards.

Looking at this chart, we have seen a significant pullback, but it is a short-duration selling and what has been a longer-term buying opportunity. The $1500 level could be a good opportunity for longer-term traders to buy gold, as you don’t want to “jump all in” in this area. If the trade works out and goes higher, it’s very likely that we continue to go higher, perhaps reaching towards the $1550 level, and then eventually clearing that level and reaching towards the much higher levels that we have seen in the past, with the $1600 level being the first major barrier. All things being equal, this is a market that will continue to find plenty of interest.