Gold Markets Trying to Break Out

- Major downtrend line broken

- Moving averages turning higher

- $1500 just above

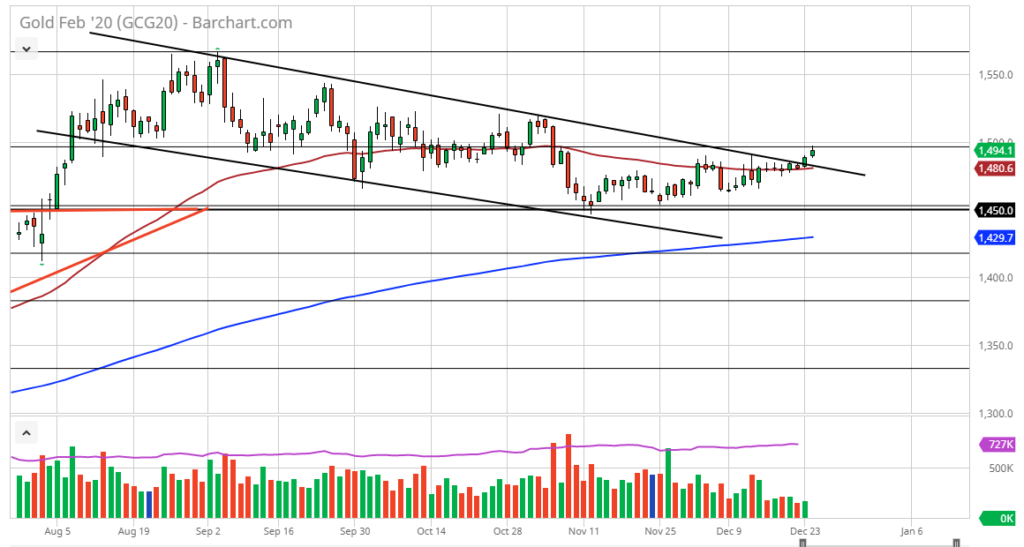

The gold markets rallied significantly during the trading session on Tuesday, going into the Christmas holiday. We did not break above the $1500 level right away, but it does look like an area that we will be challenging. That level being broken to the outside should send this market much higher, as it is a psychological barrier. Ultimately, gold is a reflection of both the US dollar and sometimes a reflection of risk appetite in general. It has been trying to reach higher, and we are likely to continue the longer-term uptrend that we have seen.

Technical Analysis

Gold chart

Data shows that gold markets have rallied significantly during the trading session on Tuesday, which is interesting considering the volumes are low and it has allowed traders to finally break out of the descending channel that you see on the chart. The $1500 level is a psychologically important level, and if we can break above there then it should bring in fresh buying. In the meantime, if the market pulls back, there are a couple of things that could keep it somewhat lifted. The 50 day EMA is curling higher and it looks as if it is starting to offer dynamic support. The downtrend line should also be supportive, as resistance then becomes support.

To the upside, if we do break above the $1500 level it’s likely that the market goes looking towards the $1520 level next. That’s an area that should offer resistance, but after that, it’s likely that the market then goes looking towards the $1550 level next. Ultimately, this is a market that looks ready to continue the longer-term uptrend, as the support at the $1450 level has been showing itself to be supportive. Plus the 38.2% Fibonacci retracement level is found there as well. The fact that the market pulls back to the 38.2% Fibonacci retracement level and then bounces shows just how strong the longer-term uptrend could be. With that in mind, it’s very likely the gold has further to go.

The trade going forward

The trade going forward with gold is to simply buy pullbacks as they will then give you an opportunity to pick up a bit of value. As long as the market can stay above the 50 day EMA it’s likely that the market will continue to go higher.

To the downside, it’s not until we break down below the $1450 level that the market would be showing signs of exhaustion and a potential breakdown. Ultimately though, it does look as if gold is ready to go higher, perhaps even for a longer-term move towards the highs again.