Monero Has Best Day in Months Due to Risk Aversion

- Crypto gets boost after the assassination of an Iranian general

- Traders around the world running for cover

- Massive gap

It’s been a while since Monero has attracted any significant amount of attention, as it has been suffering right along with the rest of the cryptocurrency market, even Bitcoin. Monero is most certainly a “second-tier” currency, but it looks as if traders around the world have been running away from fiat currency in a bid to protect wealth.

Monero gaps higher, sparked by the assassination of Qassim Suleimani, one of the most important Iranian generals to the regime. This was due to an airstrike in Baghdad, launched by the Americans. This was in reaction to Iranian backed attacks on the US Embassy, marking a significant escalation in tensions for the region. The Iranians have vowed “harsh retaliation” after the airstrike was announced and acknowledged in Tehran.

Monero gaps higher – technical analysis

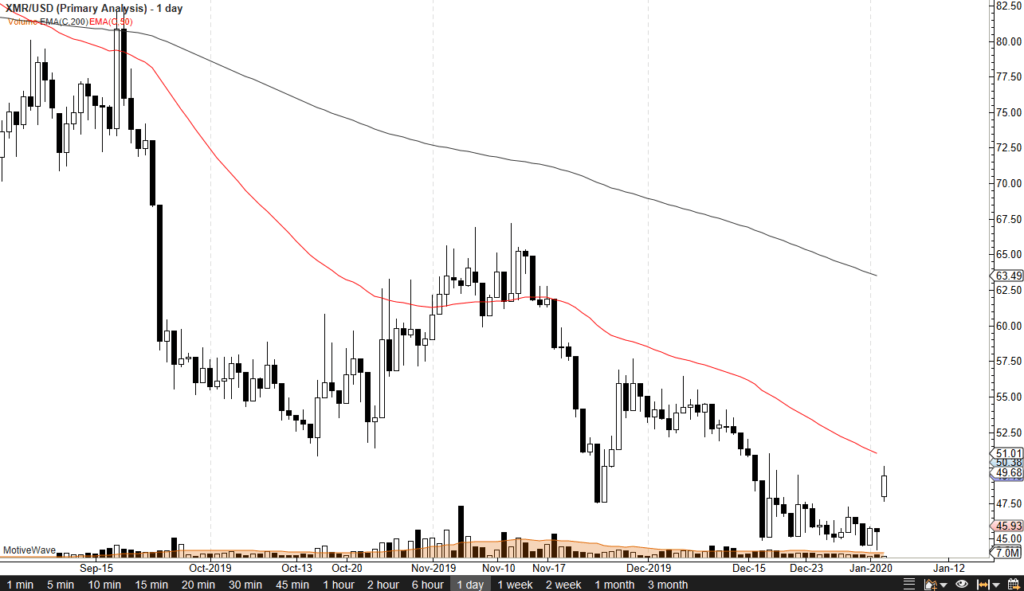

Monero chart

It’s been a while since traders could get excited about owning any type of cryptocurrency, let alone Monero. By gapping how it has reached towards the $50.38 level, it has gained well over 8%. This is a massive gain, one that hasn’t been seen in quite some time. The 50 day EMA is sitting just above, and racing towards this price, currently hanging around the $51 level. At this point, Monero is starting to run into the first vestiges of resistance.

While the technical analysis suggests some type of turnaround, this turnaround will more than likely be short-lived. The $50 level has a certain amount of psychological resistance built-in. Beyond that the 50 day EMA is turning lower, and things are well below the 200 day EMA. The market has been in a downtrend for some time, but this reaction was probably more or less driven by panic and fear than any type of fundamental change in the demand for Monero. It should also be noted that even in this massive gap, volumes were extraordinarily low.

The main take away and play going forward

The main take away from the Monero market is that although things look very bullish in the short term, it should be kept in mind that the market is still in a much longer-term downtrend. The $55 level would need to be broken to the upside to see a major trend change.

Most of the time, when a reaction like this is seen in a very thin market, the move almost always gets reversed. It is much easier for this market to fall from here than it is to rise. It’s very likely that looking back this will have been an excellent opportunity to short this market. The $45 level underneath it looks to be rather supportive but vulnerable, to say the least.