Ripple Trying to Make a Stand

- Ripple has been in a freefall this month

- Bitcoin not helping the situation

- Holding above major technical level

Ripple has gotten hammered over the last month, dropping down towards the $0.20 level. This is a large, round, psychologically significant figure that should continue to be paid attention to.

This level has caused noise more than once when it comes to Ripple, and therefore it’s likely there will continue to be a lot of buying pressure in that area.

No help from crypto markets

There has been no help from the cryptocurrency markets in general as they continue to experience a lot of volatility. The market certainly requires support from Bitcoin since it tends to drive the direction of crypto in general.

That being the case, it’s likely that the likes of Ripple will continue to struggle as Bitcoin drives most of the volume. It’s the correlated markets that continue to drive crypto in its general direction.

There seems to be a lack of desire to own crypto. At this point, Ripple will suffer at the hands of Bitcoin selling. Ultimately, this is a market that needs a bit of good news in general. What with the Chinese threatening to crack down on a lot of cryptocurrency, and the fact that Ripple simply isn’t being adopted as widely as once thought, there’s no reason to think that rallies are to be trusted at this point.

Technical analysis

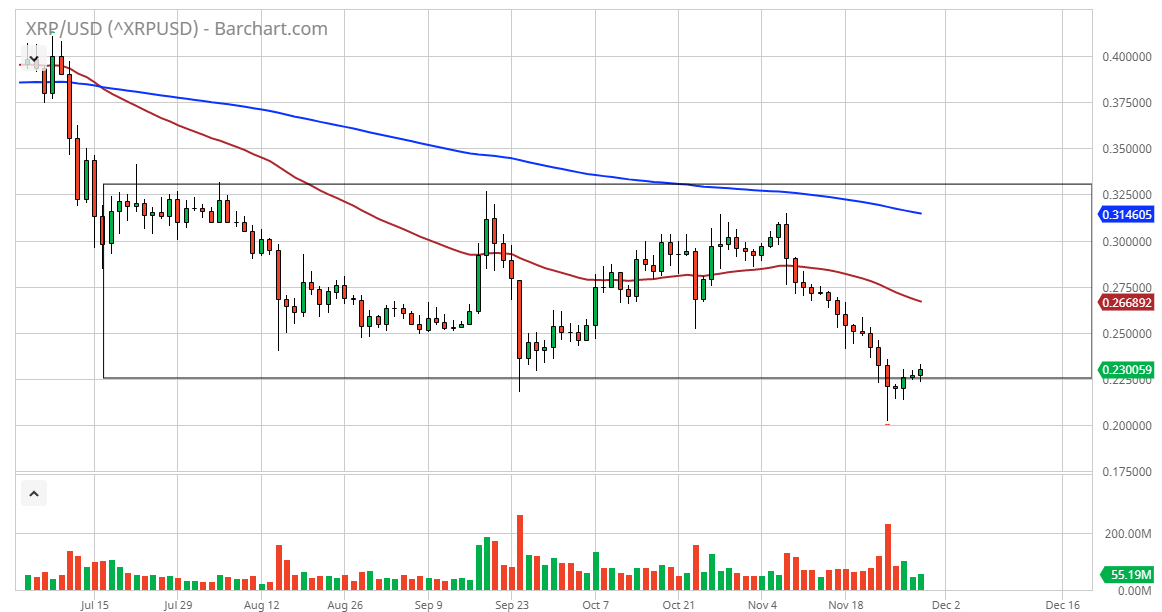

Ripple/USD chart

The technical analysis for this pair is rather dour. The hammer that formed on Monday bounced from the $0.20 level. That said, it’s still rather weak, with a string of 20 negative candles forming before the last couple of positive ones. This tells us that Ripple is still not to be trusted. It’s also likely that the 50-day EMA, currently trading at $0.266, will continue to cause a significant amount of resistance.

Markets can’t go down forever, so this bounce should be thought of as a short-covering rally, and an opportunity to take advantage of what has been a very strong downtrend. Otherwise, if one were to break to the upside, the market could reach towards the $0.325 level, which is the top of the overall consolidation area that the market had been trading in.

At this point, if we were to break down below the $0.20 level, it’s hard to tell where we would end up because it would be like a trapdoor opening. With this, it’s difficult to make an argument for buying, although it does at least “look cheap”.