S&P 500 Continues to Find Support

- Federal Reserve likely to be accommodating

- On the verge of major breakout

- Volume profile suggests several support areas

The S&P 500 E-mini contract is currently testing the highs again, after initially dipping overnight. This was the same story that was seen ahead of the Federal Reserve statement. Now that that is out of the way, traders will start to focus on fundamentals and then liquidity measures after that. Jerome Powell made it very clear that the Federal Reserve was watching the markets, and traders will take a certain amount of solace in that idea.

Volume profile

S&P 500 September contract

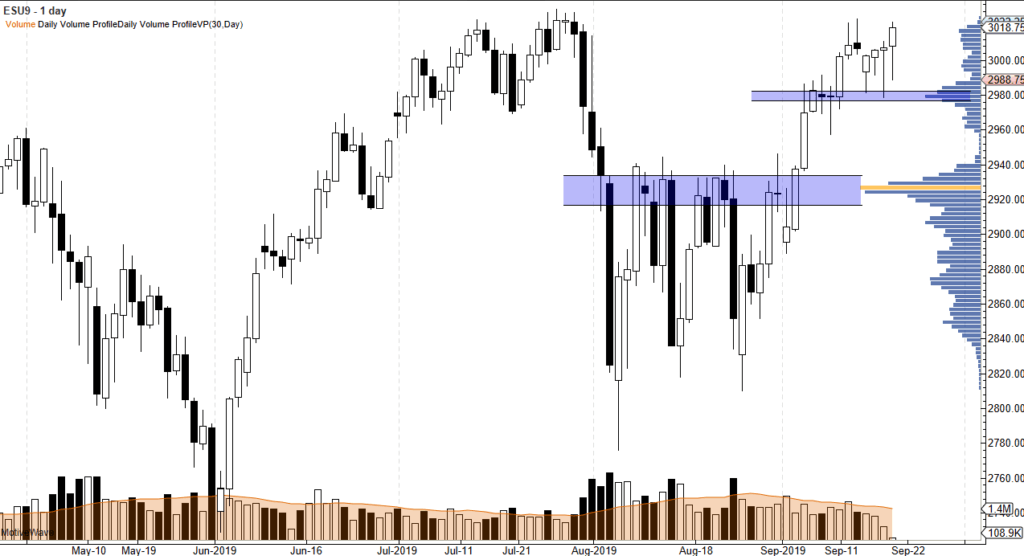

The volume profile suggests that over the last 30 days, the most volume has been at either end of the 2980 level, or below at the 2940 level. There had been a significant amount of resistance at the 2940 level previously, but now that the market has cleared that area, it should act as support.

The 2980 level has offered support several times over the last ten trading sessions or so, as the price level was previously showing resistance. As the volume profile extends out further in that area, it shows that there is obviously quite a bit of interest in that region. Simply put, the volume profile over the last 30 days suggests that there are buyers at both of these levels.

Federal Reserve to elevate market

The stock market loves low rate environments. This is because traders will be forced to find yield in equities instead of bonds. If the “risk-free rate” is extraordinarily low, like it has been for the last ten years, then treasuries offer very little as far as appeal is concerned. Beyond that, the Federal Reserve looks ready to step in and do what it can to elevate the markets.

While the interest rate cut was only 25 bps, the reality is that the Federal Reserve also left the door open to further cuts. That’s exactly what the stock market wants to hear. Beyond that, we are on the verge of breaking the highs again. This isn’t necessarily what one would expect, based on some of the extraordinarily bearish rhetoric that has made its rounds lately.

The trade going forward

The trade going forward in this market is quite simple: buying the dips continues to work. The 3000 level will offer some psychological support, as it is a large, round, psychologically significant whole number. Below there, the two support levels come into play. It isn’t necessarily a case of the market exploding to the upside and continuing to go forward, but it certainly looks as if pressure is building for such a type of move to happen. Do not be surprised if it takes a couple more attempts, but short-term traders can continue to look for value on these pullbacks, as it seems as if momentum is bullish.