Ho Ho Ho. Santa Claus Rally Continues

- Santa Claus rally a self-fulfilling prophecy

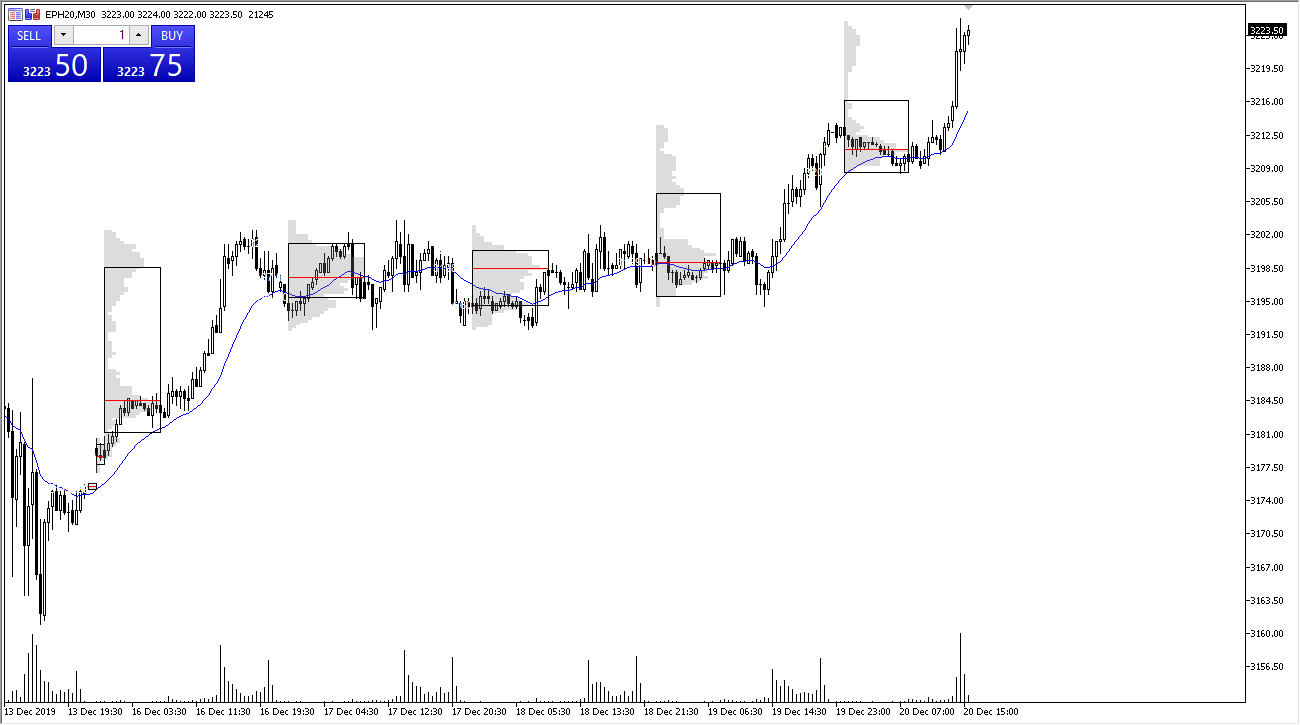

- EMA grinding higher

During the trading session on Friday we continue to see quite some momentum in the US stock indices, as denoted by the E-mini S&P 500 contract. The market continues to reach fresh, new highs, and shows no signs of giving up. This is particularly telling due to the multitude of headlines around the world that are continuing to make people nervous.

Santa Claus rally

The Christmas period is typically a time for buyers to step into the stock market. There are a multitude of reasons for this, but the primary one is money managers trying to pad their results for the year. This is one final push to try to impress clients to keep their money under management. This is typically good for a few percent in the stock markets and will run until Christmas Eve. This doesn’t mean that we absolutely have to rally, but statistically speaking this time of year tends to be one of the better performing ones.

The low-volume situation also exacerbates this type of move, so a lot of traders will come into the markets to try to pick up easy gains. Previously, we had seen a targeted move based upon an ascending triangle that should send the S&P 500 to the 3200 level. However, there are a lot of pundits on Wall Street suggesting 3250 as the high for the year. It looks as if the Santa Claus rally may make that happen.

Technical structure

E-Mini S&P 500 chart

The technical structure of the S&P 500 is very bullish and looking at the volume profile you can see that there has been a sudden surge higher on relatively low volume. This suggests that the market is starting to enter that “holiday mode”, and therefore profits could be relatively easy to come by.

The one thing that is also worth paying attention to is that the 20 EMA is offering quite a bit of support over the last several days, as seen on the 30 minute chart. There was a huge volume spike at the beginning of the session, and now it looks likely that we will continue to go higher.

Even if the market was to pullback, it looks as if the point of control near the 3210 level should offer support, followed by the 3198 level. All things being equal it’s very likely that the S&P 500 continues to be bullish for the next day or two, and then perhaps model through the rest of the week towards New Year’s Day.

On the other hand, the exact opposite could happen on a bad headline and throw the technical structure out the window.