Silver Looking for Direction

- Silver pulls back slightly

- 50-day EMA just below

- $18.00 an area of interest

Silver markets have been somewhat choppy during trading on Thursday, as the market comes to terms with the idea of the $18.00 level being tested. Lately, the market has pulled back from breaking above the previous uptrend line, showing signs of exhaustion. Much of this was due to the assassination of General Soleimani by the Americans and a run towards safety assets.

Since then, we have seen a little drop, but there are a couple of technical factors coming into play that could keep this market very interesting, to say the least.

Technical analysis

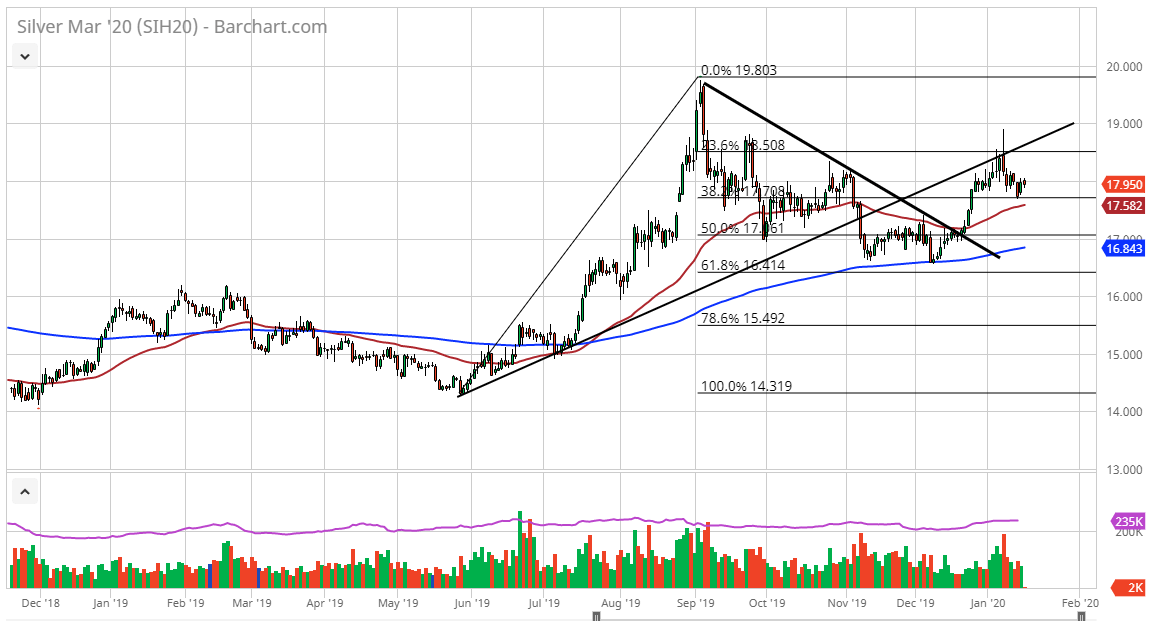

Silver daily chart

The technical analysis for silver is a bit mixed, but it is most certainly at a major inflection point that will determine where it will go next. Because of this, the market is probably a bit cautious, and traders should be as well. The argument can be made for both directions, but there are clear areas that will determine where the market will go next if broken.

The previous uptrend line being broken was the first sign of a downtrend, and it’s hard not to notice that the market tried to break above it and then pulled back. That in and of itself is a very negative sign and has quite a few traders out there concerned.

However, the fact that the market formed a bit of a double bottom at the 200-day EMA and bounced from that 61.8% Fibonacci retracement area suggests that it is still very much in an uptrend. Furthermore, the 50-day EMA is sitting just below and turning higher.

All things being equal, it will probably favor the upside, but one clearly has to be aware that it could go either way.

Risk appetite

Silver is a bit of a strange animal because it can be thought of as a precious metal, but it can also be thought of as an industrial metal. This is because there are so many different uses for silver. In times of fear (read negative headlines), silver will rally based on the same fundamental reasons that gold will. People are trying to protect their wealth.

Even more influential at times is the value of the US dollar. That being said, the currency is starting to lose a little bit of its luster against some of its rivals, and that could send commodities higher in and of itself. This might be the biggest factor that people will see over the next several weeks, now that the US-China trade tensions seem to be easing, albeit only temporarily.

If the market can break above the highs of the week at $18.12, it’s very likely that silver will go looking towards the $18.50 level. If the silver market breaks down below the 50-day EMA, then it’s likely that it goes hunting the $17.00 level. There is going to be a lot of noise, but we are in an area where a decision for a bigger move is trying to be arranged.