Silver Markets Continue to Grind Higher

- Trend line further supports market

- Uptrend continues its upward journey

- Several support levels underneath

- Central banks continue to ease monetary policy

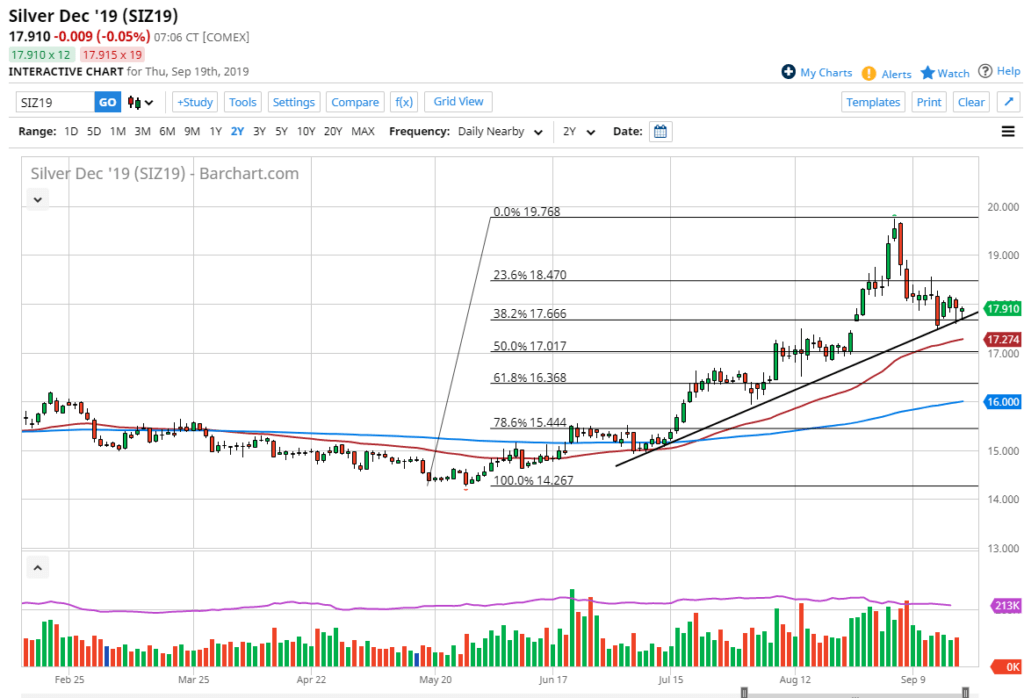

Silver markets continued to grind higher during the last several sessions, forming a nice-looking set of hammers. There is also a major trend line underneath that continues to support this market, with the $17.50 level also offering a certain amount of psychological support. Below that level, there is also a gap, so it’s very likely that the market continues to find plenty of buyers underneath.

Uptrend continues

Silver daily chart

Silver markets will continue the overall uptrend, at least until they can break down below the $17.00 level. That is an area that has a lot of psychological support attached to it, as it is a large, round, psychologically significant figure. There has also been a significant amount of buying pressure at this level, so that should attract some attention as well.

Central banks and interest rate cuts

Central banks around the world continue to cut interest rates or add quantitative easing (QE), so that is good for precious metals. Precious metals continue to pick up, based on the fact that fiat currencies are being devalued by bankers. As a result of this and of the fact that more QE is yet to come, it makes sense that silver should continue to reach towards the $18.00 level, and then perhaps even the $20.00 level.

Technical analysis

The trend line is the first thing to stand out when doing the technical analysis work on this market. Beyond that, the 50-day EMA is sitting near the $17.28 level, which should also offer a bit of support. Additionally, there is a gap just below that level that has recently been filled, so there should still be a significant amount of buying pressure underneath.

To the upside, there should be a significant amount of resistance built into the $18.00 level. However, the market has been above there before, so it’s very likely that it won’t be as difficult to get through the next time. The $20.00 level is very difficult to get above, though, and may take several attempts. In other words, this is a market that is probably going to continue to rally over the longer term but pull back occasionally, which is what the value hunters will be interested in.

As for a bearish turn of events, that won’t happen until the $17.00 level gets broken on a daily close. After that happens, it’s likely that the market will probably go looking towards the blue 200-day EMA, which currently sits at the $16.00 level. That is an area that must hold firm to try to save the market, because if it doesn’t, then it’s a longer-term selling signal. At that point, silver would be a market that should be shorted.

At this moment in time, there is nothing on this chart that suggests it is going to start falling apart. Obviously, with central banks around the world behaving the way they are, and in view of geopolitical concerns, a flight to safety – and therefore to the precious metals sector – still makes good sense.