Silver Markets Walk the Line

- Silver markets continue to walk trendline

- Uptrend still intact

- Markets await ECB

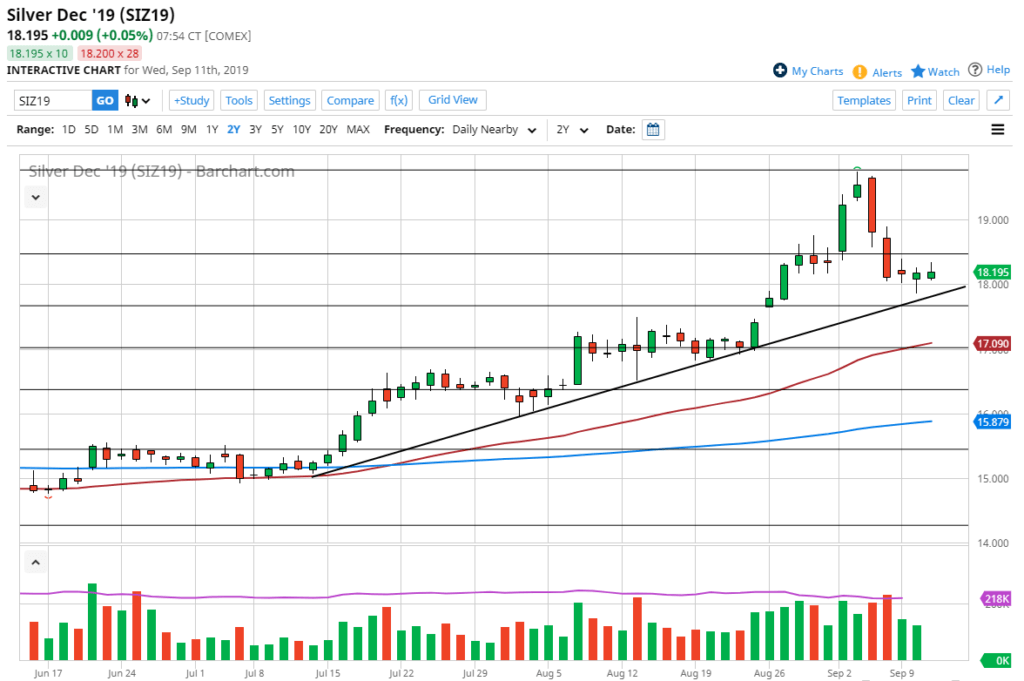

Silver markets continue to walk along an uptrend line that goes back several months, offering massive support for the precious metal. At this point, the market seems to be waiting for the European Central Bank (ECB) on Friday, which will determine whether there is more monetary policy easing coming out of the European Union. Most traders believe that there will be, but for now the question remains how much, and in what form.

Central banks contribute to strength of metals

Central banks continue to be a major contributor to the strength of precious metals overall, as there has been a massive run higher in gold and silver. In fact, August saw a 15% gain for silver alone. The ECB continues to look very soft, and traders will get some more information during the trading session on Friday, which could be a major market-moving event. Beyond that, the Federal Reserve is also due for another interest rate cut later this month, which should drive precious metals higher over the longer term.

At times, precious metals can be a haven from low interest rates, as a world of more than $17 trillion in negative yielding government bonds has people looking for yield anywhere they can get it. While precious metals don’t necessarily offer that, they do offer the ability to appreciate in value much quicker than bonds. Flows into the precious metals market have been massive as of late.

Various levels

Silver daily chart

The various levels that the trading public will be watching include the uptrend line that is now testing the $18.00 level. Obviously, the $18.00 level has attracted a bit of support, as it is a large, round, psychologically significant figure. Ultimately, the uptrend line being broken to the downside could open the door to the gap below, which is closer to the $17.50 level. Concurrently, the 50-day EMA is just above the $70.00 level and racing towards that gap. It is because of that confluence that there could be a lot of buying pressure in that neighborhood.

To the upside, there is a certain amount of interest in the $18.50 level, and then possibly the $19.00 level. The most important level, though, will be the $20.00 level. This is of great importance from a psychological standpoint, as the market has gotten far ahead of itself lately. Markets can’t be parabolic forever, so the pullback makes a certain amount of sense.

Beyond that, the fundamental argument hasn’t changed for the value of silver going higher, so it’s likely that the overall trend should continue higher. In fact, selling silver seems to be anything but an impossibility until, at the very least, the $17 level is broken below. The rest of the year should be good for precious metals, but there will be the occasional massive pullback like the market had offered just a few days ago.