S&P 500 continues the recovery during Wednesday session

The S&P 500 initially pulled back a bit during the day on Wednesday but has turned around completely. By the end of the New York session, the futures market had formed a nice-looking hammer, which of course is a bullish sign. It appears that the 2800 level continues to offer psychological support at the very least, but there are a whole host of things to consider going forward.

Technical concerns

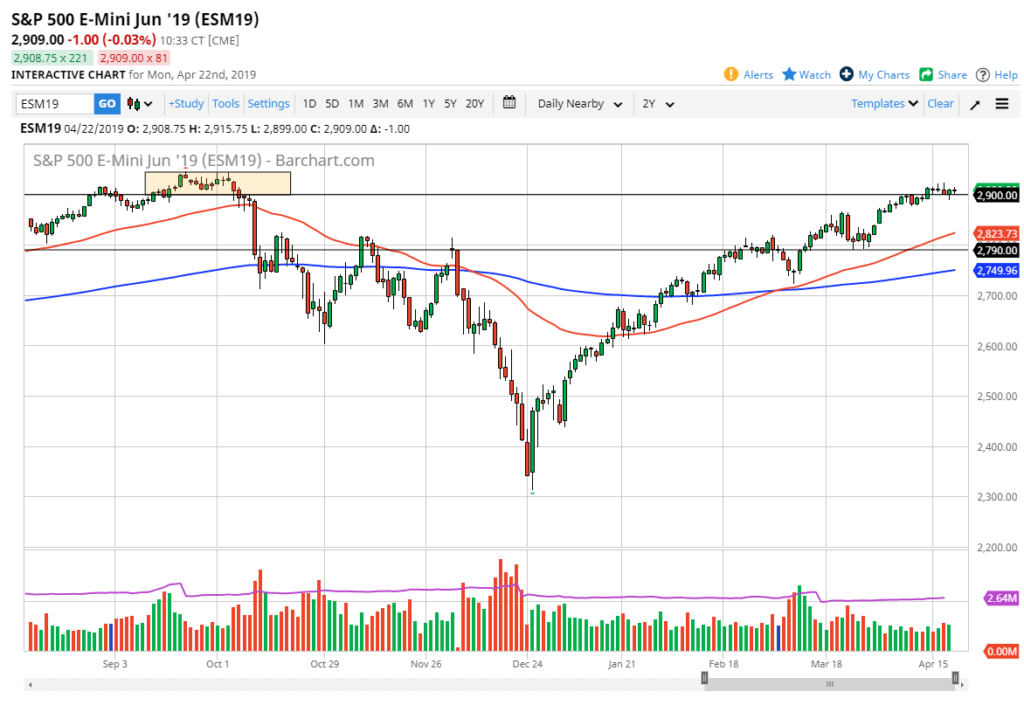

Technical concerns continue to be an issue in this market, as we still haven’t filled the gap from the Monday session. That of course will offer a bit of resistance, which starts at roughly 2860. Beyond that, we are currently testing the 50 day EMA, which is also an area that can be support or resistance depending on the attitude of the market. Going even further and the bearish column is the fact that we are still below the trend line that we broke to start selling off, so it’s likely there is going to be a lot of selling somewhere above us.

And finally, we had recently broken below a couple of candlesticks that were hammers, and that of course is a very negative sign. You don’t see that very often, but when you do alarm bells should be going off. With that in mind, there has been a lot of technical damage done.

Technical support

S&P 500 daily chart

There is a significant amount of technical support built into the 2800 level, and that has most certainly held. By doing so, it shows the resiliency of the market, and of course the importance of that large, round, psychologically significant figure. The candle stick being a hammer doesn’t hurt either, and the fact that we tried to sell off right away but turned around is a good sign.

Those are the two main reasons why we could rally, but we do also have the 200 day EMA underneath, which generally means that longer-term traders still view this is a bullish market. Recent comments out of the Treasury Department suggest that there is still hope for some type of China trade deal, but one has to wonder how long that will help the market.

Fundamental issues

During the day on Wednesday we had gotten less than stellar retail figures coming out of the United States, which of course missed. Germany has recently released softer than expected ZEW numbers, so there are economic figures out there supporting a global slowdown. Beyond that, we obviously have the problems between the United States and China, and the likelihood that we will see some type of tweet or headline that throws the market around.

The main take away

The main take away from all of this is that this is a market that will continue to be extraordinarily volatile, and quite frankly this could be the way going forward for several weeks, if not months. If we break down below the 2800 level, that would bring in a fresh new era of bearish pressure and could have this market unwinding rather quickly. On the other hand, if we can clear the gap just above, we could make a run towards 2900. Regardless, keep your position size small and buckle your seat belts.