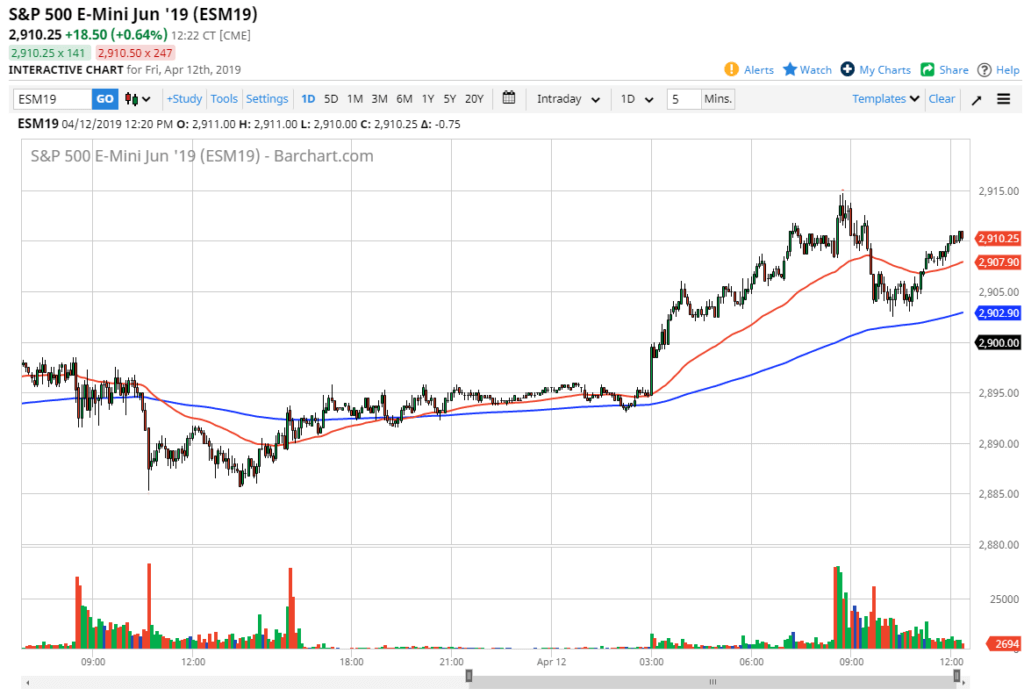

S&P 500 futures show complete reversal during Friday session

The S&P 500 E-mini futures contract fell rather hard at the open of New York trading after a positive European and Asian session. In fact, we reach down towards the 2902 level before turning around. It seems as soon as the Europeans left the market, the Americans picked up the ball and continue to go higher.

S&P 500 E-Mini contract

Headlines for the day

During the trading session Federal Reserve Chairman Jerome Powell suggested that the Federal Reserve had its monetary policy “just about correct”, signaling that the market could count on no interest rate hikes this year. If that’s going to continue to be the case, that of course is good for stock markets in general. As long as the Federal Reserve is willing to add liquidity to the marketplace, it makes sense that money will flow into stocks as bond simply won’t offer any yield.

Beyond that, we have also had a strong earnings report coming out of J.P. Morgan, as it beat on just about every metric necessary to kick off the earnings season. This could have been part of what started the premarket rally, but at the end of the Globex session, we started to see massive selling as soon as New York came on. Perhaps this was a bit of profit taking, or perhaps acknowledgment of the fact that being above the 2900 level is going to be difficult.

The significance of the close

As we head into the weekend, the significance of the daily close cannot be overstated. If we can stay above the 2900 level, and it certainly looks as if we are going to, especially after this significant rally mid-day, this is a very positive turn of events for equities in the United States. We still see a significant amount of resistance above at the 2940 handle, so keep in mind that this is probably going to be more of a grind but clearly it looks as if people are continuing to try to press to the upside.

This could have been seen earlier this week as we continue to see the market refused to break down, so at this point it shouldn’t be much of a surprise. Essentially what we had seen is Americans waiting for the rest of the world to get out of the conversation so that they can pick up value.

Longer-term target

The longer-term target is the 2940 level, which is the top of the overall range. If we can break above that range, then the even more aggressive target would be to the 3000 level which is one of the most common targets talk about by the end of the year. To the downside, there seems to be massive support trying to dictate itself at the 2900 level so it’s very likely that this will continue to be a “buy on the dips” market. If that is in fact the case, look for headline shock when it comes to earnings reports that you can take advantage of. They will not the market back down but it looks as if value hunters are willing to step in.