S&P 500 suffers shock during Monday session

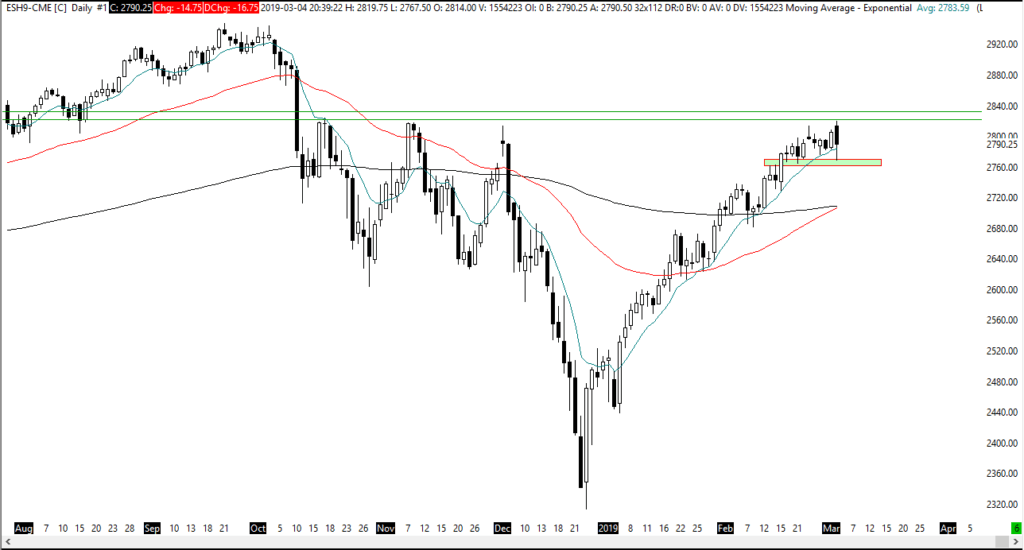

The S&P 500 initially gapped higher overnight in response to the hope of a US/China trade deal. However, you can see that we fell rather hard during the session on Monday, crashing towards the 2770 handle before bouncing quite significantly. By doing so, we formed a negative candle stick, but one would be remiss if they didn’t pay attention to the healthy rally towards the end of the day.

Resiliency

I suppose that one word you can use to describe the stock market right now is resiliency. After all, we were down over 30 points at one point during the day and took back roughly half of it. With that being the case, it looks as if we still have plenty of people willing to jump in and pick this market up, and at this point I think it remains a bit of a “buy on the dips” scenario. However, looking for major moves will probably be the road to ruin.

Until we break above the 2835 handle, it’s very likely that the market will continue to chop around. If we can break above that level though, that would confirm the huge bullish bias, and could send the market towards the 2880 handle.

We’ve seen this movie before, where the market sold off drastically in the buyers come back in. In fact, it’s been that way since the bottom back in December, and today was a microcosm of that attitude. It is in that environment that we continue to see short-term opportunities. Longer-term opportunities are going to be very difficult to get to though.

Golden Cross

There is the so-called “golden cross” about to happen underneath, which is when the 50 day EMA crosses the 200 day EMA, it typically longer-term bullish sign. I don’t know that it’s a big deal right now, but if we break out to the upside and that happens, then it’s very likely we should continue to go much higher. After all, when you look at the massive “V-shaped bottom” that we have formed, you have to be impressed. Moves like this don’t happen very often, so therefore when they do happen you should be paying attention. After all, the ferocity of the move higher has caught a lot of people off guard and has been very difficult to jump into because of the ferocity of the selloff previously.

The alternate scenario

As traders, we should simply react to what we see, not what we think. Do I believe that this market should go much higher? Known, not at all. However, one of the golden rules about trading is you do with the market says, not what you think. If we break out to the upside, we simply are buyers. If we dip and can hold above the green box on the chart, it’s a buying opportunity.

However, the alternate scenario is that we break down below the 2670 level, at least on a daily close, and then that should bring in more selling, perhaps down to the 200 day EMA which is pictured in black on the attached chart. That can open up the door to 2720, which of course could be a significant move. Breaking down below there could send this market as low as 2640 next. That being said, the action towards the end of the session on Monday suggests that it’s going to take something rather negative to break this market down. Quite frankly, we have had every opportunity to melt down after the rally started, as we have had a lot of different headlines out there that were rather negative. However, the market has completely ignored them, and therefore it shows you exactly where wants to go by its actions, not what people say.