US Dollar Strengthens Against Yen as PMI Improves

- ISM PMI surprises to the upside

- “Phase 1” may have had a positive effect on US economy

- Technical bounce seen on the charts

The US dollar bounced against the Japanese yen during trading on Monday, as the weekend ended and all the Chinese returned to work. While initially the market had a lot of “risk-off” sentiment, PMI figures coming out in the United States have moved markets in general.

After all, the ISM Manufacturing PMI figure is one that quite often precedes the GDP announcement and shows its directionality 85% of the time. This all means, in effect, that the “Phase 1” deal has worked out well for the Americans.

The announcement came out strong

The ISM Manufacturing PMI figures came out at 50.9, which was much better than the 48.5 anticipated for the reading. This is a sign that manufacturing in the United States is starting to pick up.

What’s interesting is that purchasers started to pick up expenditures after the so-called “Phase 1 deal” between the United States and China. This should continue to see the US GDP climb, which is positive for the US dollar.

Furthermore, the USD/JPY pair is highly sensitive to risk appetite. It could be one of those places money goes into to express more “risk-on” sentiment in the market.

Keep in mind that the announcement, although strong, does not take into account the effect that the coronavirus has had on US manufacturing and perhaps the supply chain in general, as so many of the smaller pieces of US manufacturing come from places like China. It will have a “ripple effect” through the economy, as the global supply chain is so interconnected these days.

Economic sentiment pushes USD/JPY

The USD/JPY pair is highly sensitive to economic sentiment in general, so it can be thought of as a “barometer” measuring where global growth is headed.

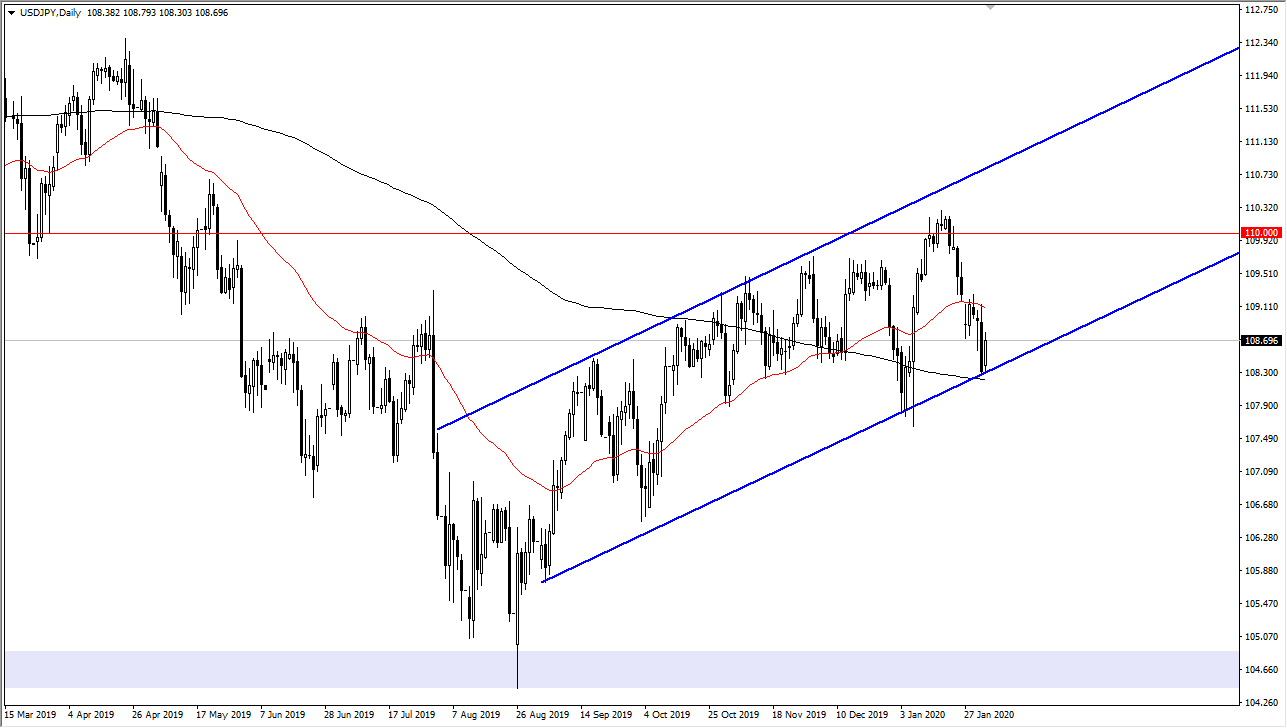

As a result, it’s likely that traders will be watching the pair with great interest. The trend has been higher for several months, but it should be noted that the longer-term chart suggests that ¥110 is essentially “fair value”, being the midway point of monthly consolidation.

USD/JPY chart

That being said, perhaps some profit-taking had been conducted recently. However, with the coronavirus and the shutdown of so many factories in China, it’s difficult to understand exactly where PMI figures go globally. That is because it is not known where and for how long these shutdowns will continue.

The longer the shutdowns persist, the more the economic damage caused, driving money into the Japanese yen. PMI figures suggest that the United States may be somewhat insulated, driving money into the US dollar – and possibly, by extension, into US Treasuries – in a bid for safety. That has an influence on this currency pair as well.