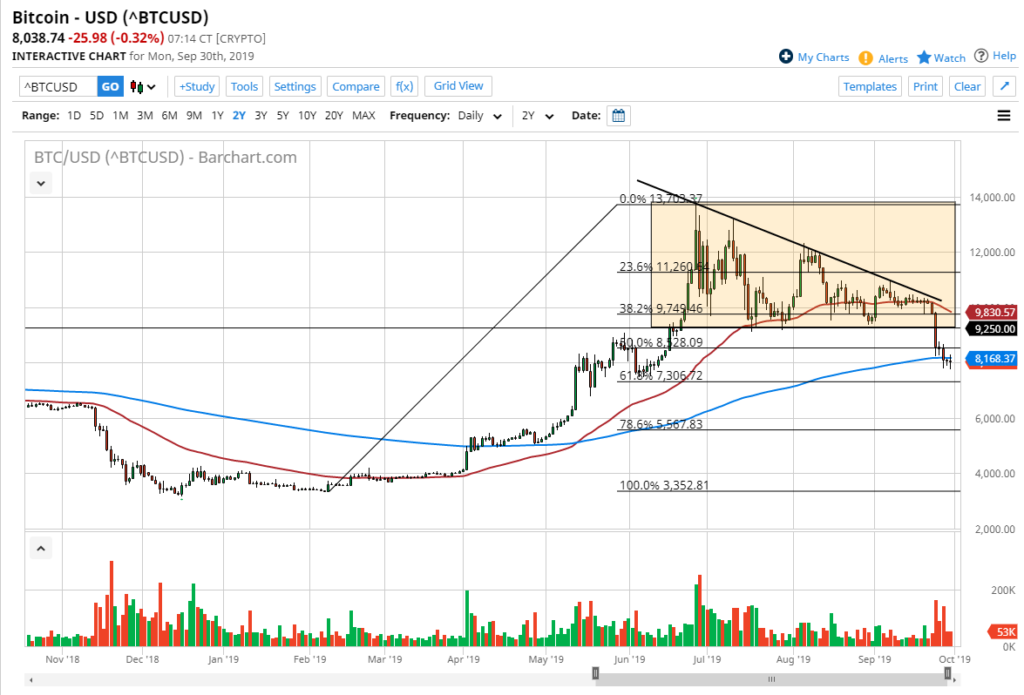

Will Bitcoin Be Able to Recover?

- Bitcoin trading just below 200-day EMA

- Leading crypto-asset below 50% Fibonacci retracement level

- Just broke through bottom of descending triangle

Bitcoin has been very quiet over the last couple of trading sessions, but it has now broken below the bottom of a descending triangle. This major pattern should continue to attract a lot of attention. Bitcoin had been bullish before this past summer, when things suddenly died down.

We had started to chop sideways, which isn’t necessarily a major problem, except that we have now broken down. Ultimately, this is a market that had every chance to continue an uptrend, and it had plenty of time and reasons to go higher in theory. However, it has not done so. At this point, one has to ask the question: will Bitcoin be able to recover?

Technical breakdown

Bitcoin daily chart

Bitcoin has broken down rather significantly over the last week and a half. By breaking below the $9250 level, the market looks likely to continue offering negative pressure, based on the fact that it was the bottom of a massive descending triangle. There have been a couple of major descending triangles in the Bitcoin market over the last couple of years, and they always lead to bad news for cryptos.

Beyond that, we are now just below the 200-day EMA. This should attract a lot of attention and could therefore send this market even lower. We do have the 61.8% Fibonacci retracement level just below, at roughly $7300. That could be the next potential support barrier, but one would have to think that if that level gets broken on a daily close, the market is very likely to come unwound and start looking for the measured move in the descending triangle.

The descending triangle suggests that Bitcoin could drop below the $5000 level. This is a large, round, psychologically significant level in the market that will attract a lot of attention overall.

Fundamental issues

One of the biggest issues that Bitcoin traders face is that it can’t be used as a currency. It might be able to someday, but the adoption rate isn’t exactly strong. Plus, with the massive swings in value, it’s difficult to use it as a stable and viable means of exchange. As long as that’s the case, this market will be susceptible to massive moves in both directions.

More recently, central banks around the world are loosening monetary policy. As most Bitcoin believers will tell you, it’s a great way to get away from fiat currency and value destruction that comes with those currencies. However, as we are seeing a “race to the bottom” when it comes to the central banks, Bitcoin should be rallying. It obviously isn’t, and that is an ominous sign.

Will Bitcoin be able to recover? At this point, it doesn’t look promising. However, if the market were to recapture the $9250 level, then you can start to look at it in a more positive light. Until then, the downward pressure seems to be relentless.