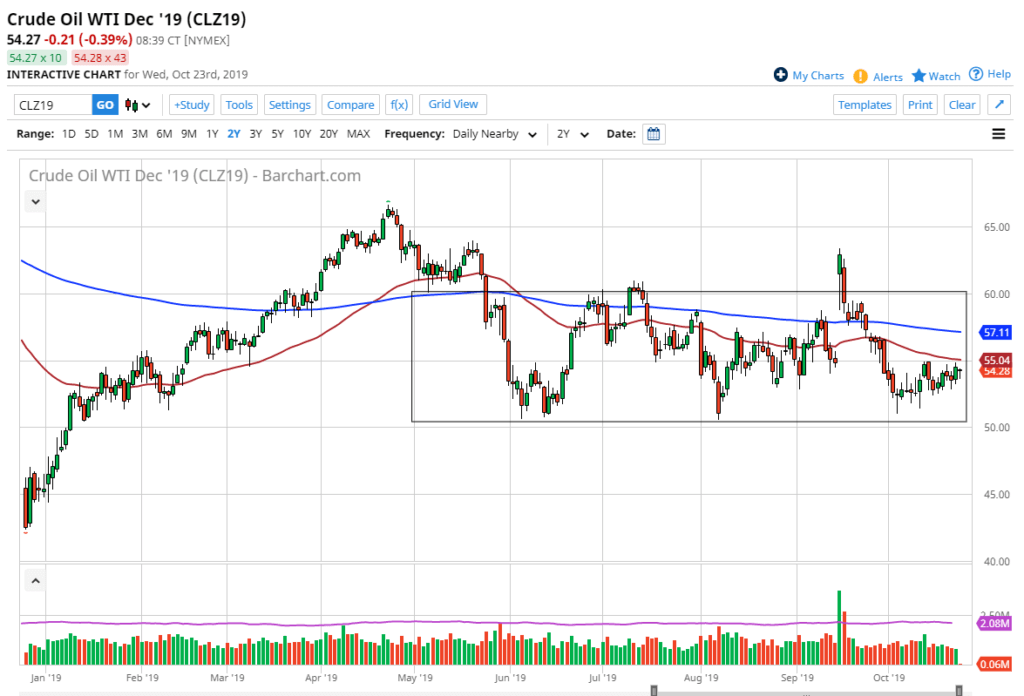

WTI Crude Oil Building a Base

- Crude oil grinding sideways

- Price at bottom of larger consolidation

- Pressing major moving averages

The West Texas Intermediate Crude Oil market has been rather choppy lately, grinding away in a relatively tight range between $52.50 and $55 to the upside. The market has been more or less a short-term scalping environment. This makes quite a bit of sense considering how much noise was seen in the market just a few weeks ago, due to the drone attack on Saudi oil refinery capacity.

With that being said, the grind sideways can be looked at from a couple of different angles. The first angle could be that the market is trying to form a bearish flag. If that’s the case, crude oil markets are going to be in a lot of trouble. However, the resiliency is something that should be paid attention to.

Recently, there have been rumors that OPEC is going to announce new production cuts at the December meeting. That could provide a little bit of the floor in the market although, admittedly, OPEC has lost some of its stranglehold on the crude oil markets.

Grinding sideways

WTI Crude Oil

The market has been very sideways over the last couple of weeks, but it should be noted that there is a slight “tilt higher”. That’s typically a good sign because it shows that the resiliency of buyers continues to be a steady feature of the market.

With that being the case, the market is likely to continue favoring the upside, and perhaps buying short-term dips. The $55 level above is going to be crucial from a trend-following scenario, as it will cause a significant amount of psychological and structural resistance. Beyond that, the 50-day EMA sits just above that level.

Building momentum

The market seems to be building upward pressure, as we are pressing the psychologically and structurally important $55 handle. The market could also be looked at through the prism of an ascending triangle. That means the market could be reaching another $4 higher on the breakout, which would put the market at the $59 level, right at the beginning of significant resistance that extends to the $60 handle.

The trade going forward

The trade going forward is to simply wait for breakout and then take advantage of it. The alternate scenario could be buying short-term dips, but it appears that the breakout is probably the easier trade to take of the two potential setups.

Selling seems to be very unlikely to be profitable, unless of course the market was to break down below the $50 level, an area that it has defended vigorously more than once. At this point, crude oil looks as if it is trying to build a base to go higher.