Things to Consider when Trading 5th Wave Extensions

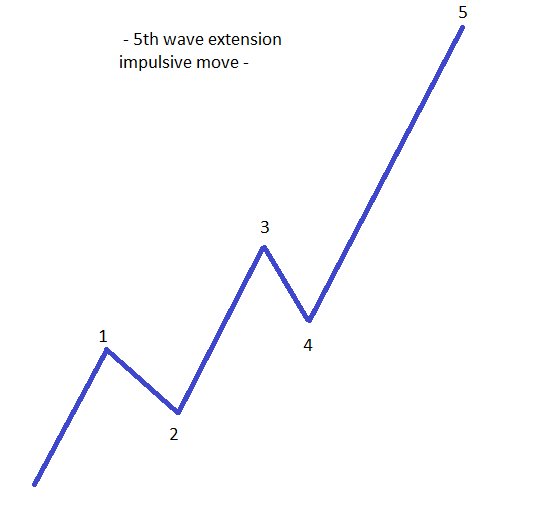

Besides first- and third-wave extensions, Elliot found that there is another type of extension suitable for an impulsive wave: the fifth-wave extension. Such an impulsive move, while rare, is characterised by a sharp move in the fifth wave, taking everyone by surprise. This impulsive wave is a tricky one in the sense that it starts like a corrective wave. Many traders will look at it as a flat pattern, mistaking the first three waves of the impulsive move for the a–b–c of a flat. Because of that, by the time the fifth wave starts in the opposite direction, stop losses are triggered as traders are taken by surprise. There are some important things to consider when dealing with a fifth-wave extension, and they refer mostly to the post-impulsive wave activity.

| Broker | Bonus | More |

|---|

Things to Consider in a Fifth-Wave Extension Impulsive Move

Even though this impulsive move looks unfamiliar and strange, all the basic rules of an impulsive wave, as described here in previous articles in our Forex Trading Academy, must be respected, as follows:

- In a five-wave structure, the first, third and fifth waves are impulsive waves in their own right.

- The second and the fourth waves are corrective.

- At least one wave is extended.

- The third wave cannot be the shortest one when compared with the first and the fifth.

Because of the confusion created by the first three waves in the impulsive move, traders rarely manage to trade such a pattern, and they will most of the time be caught on the wrong side of the market. However, even after the fact, a fifth-wave extension can provide a very good set-up for profitable trades.

Alternation Between the Non-Extended Waves

Minding the Overlapping

Overlapping is an important aspect often overlooked by traders. Firstly, few people understand what overlapping stands for when it comes to impulsive waves. Secondly, the overlapping concept is so important that it can invalidate a count regardless of whether other measurements are correct or not. No parts of the fourth wave should go into the territory of the second wave. In doing that, overlapping is avoided, and traders have a green light for counting an impulsive move. Overlapping is specifically important in fifth-wave extensions because the fourth wave has the tendency to retrace quite a lot into the territory of the previous third wave. This retracement level is often even more than 50%. However, the price may retrace, but overlapping should not occur.

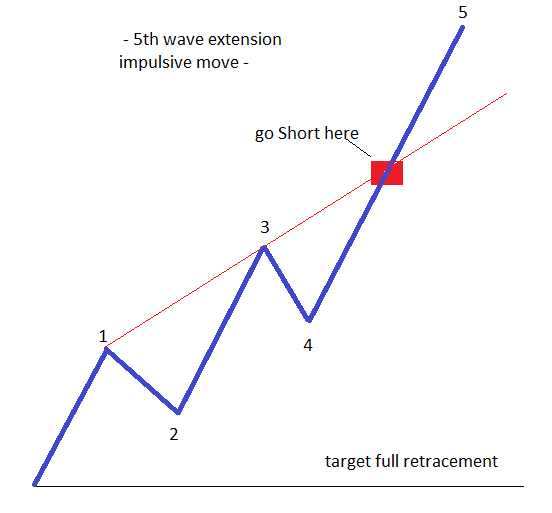

Fading the Fifth Wave

- Draw a trendline from the end of the first wave until the end of the third wave, and project it further onto the right side of the chart.

- By the time the fifth wave breaks this trendline (such a break is mandatory), it represents a good opportunity to take a trade in the opposite direction. That is, if the impulsive wave is a bullish one, then the trade should be a short one, and if the impulsive wave is a bearish one, then the trade should be a long one.

The target for the trade should be the start of the overall impulsive move, so we’re looking for a 100% retracement of the whole move. As for the stop loss, this one can be calculated by measuring the whole distance from the start of the impulsive wave until the end of the third wave, multiplying it by 2, and adding it on the top of the third wave.

Places where Fifth-Wave Extensions Appear

As mentioned at the start of this article, such impulsive waves are not common, and this limits the places where it is possible to find a fifth-wave extension. As a matter of fact, it appears almost always as the c-wave of a flat pattern. Remember, the c-wave of a flat pattern is always an impulsive wave, and it can be a fifth-wave extension. If this is the case, look for it to be completely retraced by the move that follows. This means that the flat will be either the end of a complex correction (such as a double or triple flat, or a double combination that ends with a flat) or a simple corrective wave. Of these two possibilities, it is most likely that the flat will be a simple correction and the full retracement of the c-wave will result in the flat being confirmed.

With this article, the Elliott Waves section of our Forex Trading Academy is complete, and we must say that it is the most comprehensive one in our educational project. The reason for this comes from the fact that Elliott Waves is based on so many rules that one cannot simply count waves correctly without knowing them all. Even though all those rules make the theory look like a complicated one (which, to some extent, it is), Elliott Waves theory is one of the most powerful, if not the most powerful, trading theory that exists. Traders will not only consider price when making a forecast, but also time. There is no other trading theory that uses the time element like the Elliott Waves theory does, and this is important when making a forecast. One may have an idea regarding a specific price target, but if that idea is not backed up by a time horizon, the whole forecast is useless.

The articles in this project dedicated to Elliott Waves theory offer clear guidance for counting waves and reaching profitable trade set-ups. Other factors are needed, though, for successful trading: factors such as money management, understanding of market psychology, etc. All these aspects will be covered in future articles here on the Forex Trading Academy.

Other educational materials

- How to Use Parabolic SAR to Buy Dips or Sell Spikes

- Bollinger Bands – Profit from One of the Best Trend Indicators

- Trading with the Cloud – Use Ichimoku Cloud to Spot Reversals

- Dow Jones Industrial Average

- Euronext

- FTSE 100 Index

Recommended further readings

- “International trade and financial integration: a weighted network analysis.” Schiavo, Stefano, Javier Reyes, and Giorgio Fagiolo. Quantitative Finance 10, no. 4 (2010): 389-399.

- “Evolving neural networks for static single-position automated trading.” Azzini, Antonia, and Andrea GB Tettamanzi. Journal of Artificial Evolution and Applications 2008 (2008): 1.