Elliott Waves Theory – Trading Forex with Double and Triple Combinations Part II

Two articles ago we laid down the grounds for what a double and a triple combination are: complex corrections with a minimum of one x-wave, which almost always ends with a triangular formation. If that article was dedicated mostly to understanding the patterns and defining them, the purpose of this one is to show how to trade them. It is important to know how to trade them, as double and triple combinations are extremely common. Of the two patterns, double combinations are forming all over the place. If you analyse a currency pair and make a top-down analysis process, which should stretch to all the timeframes (monthly, weekly, daily, 4 hours, and even the hourly timeframe), you’ll find out that it is virtually impossible not to find at least one double combination pattern on each one of those timeframes. Such a frequency of appearance tells much about their importance.

| Broker | Bonus | More |

|---|

Trading Plan for Double and Triple Combinations

When it comes to complex corrections, a trader doesn’t know from the start whether the correction will be a double or a triple one. This is valid most of the time, but in the case of double and triple combinations, things are not like that. This comes from the fact that triple combinations appear only in specific situations: either as the longest leg of a triangle, or as part of terminal patterns. It means that if you’re not looking for such a count, then most likely the market is going to form a double combination.

Three Concrete Steps to Trading a Double Combination

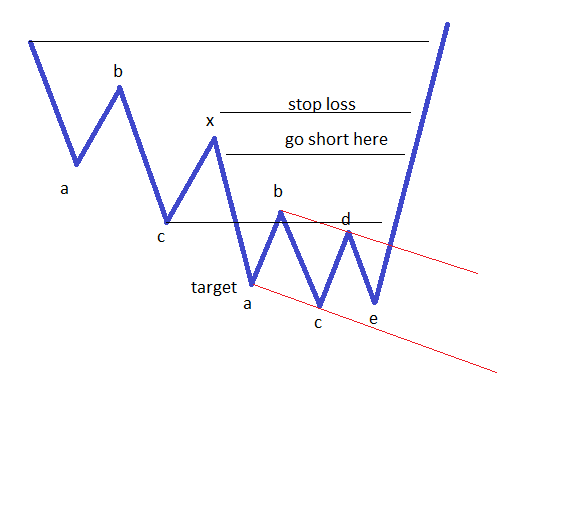

This opens the gates for the next step needed to be taken to trade a double combination. This second step consists of taking a Fibonacci retracement tool and measuring the exact length of the first correction, from its originating point until its end. Find out the exact 61.8% level and the 23.6% and 38.2%. These levels are most likely to be reached by the x-wave, with the 23.6% almost always being hit. This should therefore be the entry for a trade in the same direction as the direction of the first correction. It follows that the third step is to place a pending order or to trade on the market by the time the price reaches the 23.6% level, with a stop loss around 80% retracement level.

Why do we need a stop loss that high if the x-wave is not supposed to end beyond the 61.8% level? This is because parts of the x-wave can retrace more than 61.8%, but the end of it should be below. In other words, it is possible for the price to move beyond that level, to 65% or even 70%, but this doesn’t mean that the end of the x-wave is there. As for the take profit, an appropriate level would be the one given by the waterfall effect. (Please refer to the article dedicated to that subject here on our Forex Trading Academy.) In short, this means 61.8% of the first correction, projected from the end of the first a-wave.

Two More Steps for Trading a Triple Combination

The next thing to do is to look at the nature of the second correction. We know that in the case of a double combination, the second correction is almost always a triangle. However, what do we do if the move that follows the first x-wave turns out to be an impulsive wave? This is not possible in a triangle, as all the segments of a triangle are corrective waves. The answer to such a question is that the market is going to form one more correction, namely, a triple combination. In such a case, the first step is to take a trade at market just as the impulsive wave is ending. Why is that? The logic behind this is that there will be little retracement for the second correction if the first part of it is an impulsive wave. It means that the second correction in the triple combination is a zigzag, so we’re trading the b-wave in such a pattern. The second step is to take another trade in anticipation of the triangle that always forms at the end of the triple combination. This means that by the time the zigzag is completed, a small move in the opposite direction is expected, only for that move to fade and a new trade to be taken following exactly the steps described in the double combination case. By the time the take profit is reached, it means that the a-wave of the triangle is completed, and from this moment on we should look to trade the triangle. Between a contracting and an expecting triangle at the end of a complex correction, a contracting one should be always favoured.

Aggressive traders will trade in the opposite direction of the triple combination by the time the a-wave of the triangle is completed, but this trade should be short-term oriented. This is because the triangle after such a complex correction should be one that takes quite some time, and what traders should focus on is on the break in the b-d trendline. In the meantime, other trades can be taken on other currency pairs, and by the time the b-d trend line is in place, a break in it should be the signal that the whole triple combination pattern has ended. In this way, following a logical process, both double and triple combination patterns can be traded successfully if traders know what to expect.

Other educational materials

- Trade with Double and Triple Combinations Part I

- Bollinger Bands – Profit from One of the Best Trend Indicators

- Trading with the Cloud – Use Ichimoku Cloud to Spot Reversals

- Forex Market Terminology

- Paris Stock Exchange – Euronext Paris

- S&P 500

Recommended further readings

- Multi-agent Forex trading system. Barbosa, R.P. and Belo, O., 2010. In Agent and Multi-agent Technology for Internet and Enterprise Systems (pp. 91-118). Springer Berlin Heidelberg.

- “Long-Term Investing With Leveraged Exchange Traded Funds.” Loehr, Ross, and Reinhold Lamb. International Journal of Arts and Commerce 2, no. 4 (2013): 27-34.