EasyMarkets Mobile – A Quick Look

It’s impossible to run a forex broker without mobile trading these days. A large chunk of most FX traders trade on the go and every broker needs to accommodate them. EasyMarkets Forex trading platform is no exception. The broker has a decent mobile app that is accessible from any place in the world and all you need is just a stable Internet connection.

EasyMarkets is one of the most reliable and trustworthy brokers in the Forex industry. The operator cares a lot about clients’ satisfaction and a mobile app, designed in a perfect way says a lot about that. EasyMarkets app has numerous features and benefits for traders. First of all, you can access market news and live prices without leaving the app. The features are user-friendly, focused on clients’ needs, and absent from useless details. We will talk more about the characteristics of EasyMarkets Mobile below.

What Does EasyMarkets Mobile App Look Like?

EasyMarkets mobile app has great visuals, decent user experience, and interface. Developers have put a lot of effort to make the app visually appealing. The visual side is really minimalistic, with white, blue, and green colors dominating. Everything is logically connected with each other so both experienced and rookie traders will have no problems with accessing different features.

From a technical point of view, there are no significant bugs and problems that impact the overall experience. For sure there could be moments when the app is lagging, but such things do not happen frequently.

Every feature that the app offers is categorized and finding them is pretty easy. The mobile app is available both on Android and iOS devices. You can make deposits and withdrawals through the app itself, check the market news, open and close positions. In short in every possible way, EasyMarkets mobile app is simple to use.

EasyMarkets Trading Features

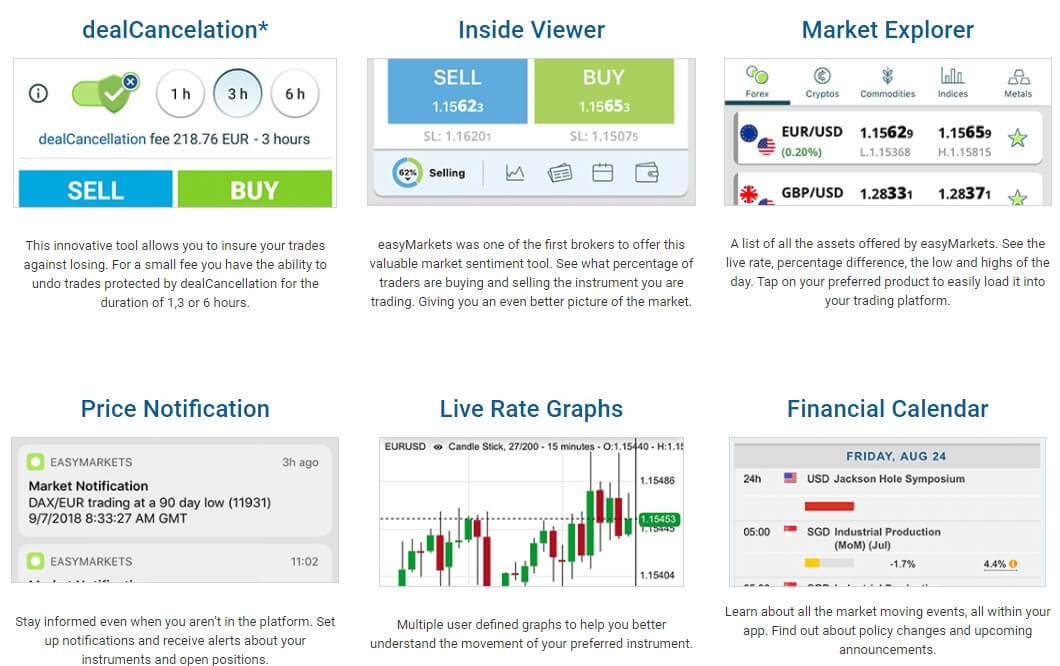

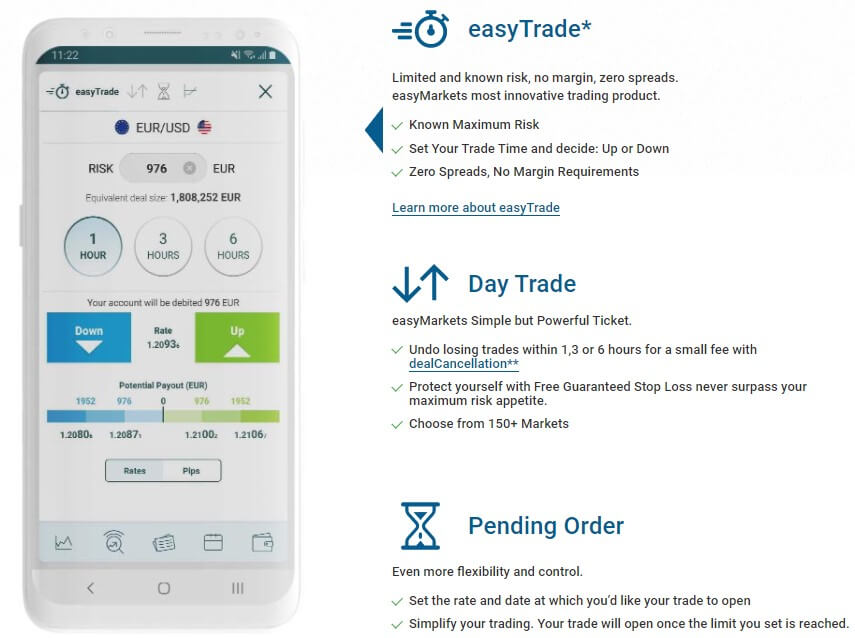

EasyMarkets has a lot of trading features that distinguish it from its competitors. Some of them include live graphs, financial calendars, price notifications. DealCancelation is a unique tool that you won’t see on many apps and EasyMarkets provides this opportunity. For a small fee, you have the ability to ensure your trades against loss for the duration of 1,3 or 6 hours. Various analytical tools are available as well as the possibility to monitor your account in real-time.

This is only a small list of the advantages and features of the EasyMarkets app. We should also pay attention to the available leverage, spreads, and assets.

Available Leverage

On EasyMarkets there are 3 types of accounts, that you can create: VIP, Premium, and Standard. Each of them has different features and suit a different kind of traders. The maximum available leverage is 1:400. This is a pretty decent amount which will mostly benefit experienced traders who already have some experience in trading. For Web/App platforms, however the leverage different, meaning that if you are into mobile trading the maximum leverage will be 1:200. Leverage generally is a double-edged sword and should be dealt with carefully – especially by beginners.

Spreads

Spread is another indicator of a broker. It is the difference between the ask and bid price. Various accounts and currency pairs have different spreads. Fixed spreads on the mobile app platform start from 1.2 pips. This is for the VIP account. On Premium and Standard, they start from 1.5 and 2.0 pips respectively.

It is also important to pay attention to the currency pairs. EUR/USD may have different spreads than GBP/USD. That’s why the majority of brokers have several types of accounts to ensure the best option for any type of FX trader.

Assets

The diversity of trading assets is pivotal because the many options the client has to choose from – the better for him and a broker as well. Available assets for trading on EasyMarkets include CFD, Forex, cryptocurrency, commodities, shares. Also EasyMarkets trades in several financial asset types. You can clearly see the list in the mobile app and navigate between them. Of course, Forex is the most preferred option for traders, but crypto trading is also gaining a foothold. With EasyMarkets mobile app you will have everything in front of you – in just a few clicks.

Pros & Cons of EasyMarkets Mobile

An easyMarkets mobile app is a great tool for traders and it significantly impacts the overall experience. However, nothing in life comes with only advantages and there are some cons as well which we should definitely point out in order to provide a comprehensive analysis.

Pros

There are quite a lot of pros to the EasyMarkets mobile app. The first one is obviously a great design that the app has and user experience is the first and foremost priority for any kind of mobile application. The navigation should be simple and users should be able to select everything. Market Explorer, Live Rate Graphs, and Financial Calendar are one of the greatest advantages of EasyMarkets.

Market Explorer

EasyMarkets mobile app provides a list of the offered assets on the broker’s website. You can easily check live rates, percentage difference, lows, and highs of the day. In order to load the product on your trading platform tapping is enough. Market explorer is a really unique tool that is not available on many apps.

Live Rate Graphs

The movement of a trading instrument is one of the key factors, to better understand the trends. Live rate graphs available in the mobile app will help you to better understand and analyze the events that are taking place. They are understandable and designed perfectly for traders.

Financial Calendar

Announcements have a massive impact on the trading process – especially if they are connected with currencies. Inside the app, you can get thorough information on various events, understand policy changes and have a look at upcoming announcements. Such details might significantly reshape your trading experience.

Start Trading With EasyMarkets

Cons

As for the cons of the EasyMarkets mobile app, there are not too many of them, that we can actually single out. The most obvious one is the unavailability of the app on Windows phones. The majority of traders use Windows phones in addition to Android and iOS devices.

Not supporting Windows phones

At the present moment, the app can only be downloaded through Play Store and App Store, meaning that there is no support for Windows phones. Because of that, if you are an experienced trader and looking for the best experience, purchase either an Android or iOS device.

Limited Educational Information

Another slight disadvantage of the app is limited educational information. You cannot actually discover an interesting piece of information that will help you to improve your trading. The information and tools available inside the app are useful for those who have some knowledge in Forex trading, but the rookies should search for additional information outside the app.

FAQ on EasyMarkets Mobile Apps

How can I download Easy Market?

Downloading EasyMarkets mobile app is pretty easy. If you are a user of iOS head to the App Store search for the EasyMarkets app and download it directly on your phone. The process will be automatic. If you are a user of Android head to the Google Play Store and install the app from this source.

Does EasyMarket Mobile consume a lot of data?

It depends on the operations you are doing inside the app. Generally, mobile trading apps are consuming, as they execute a lot of operations and sufficient mobile data is pivotal to better organize these processes. If you are only checking some information, it is not likely that the app will consume a massive amount of mobile data.