NZD/JPY continues the bounce started yesterday

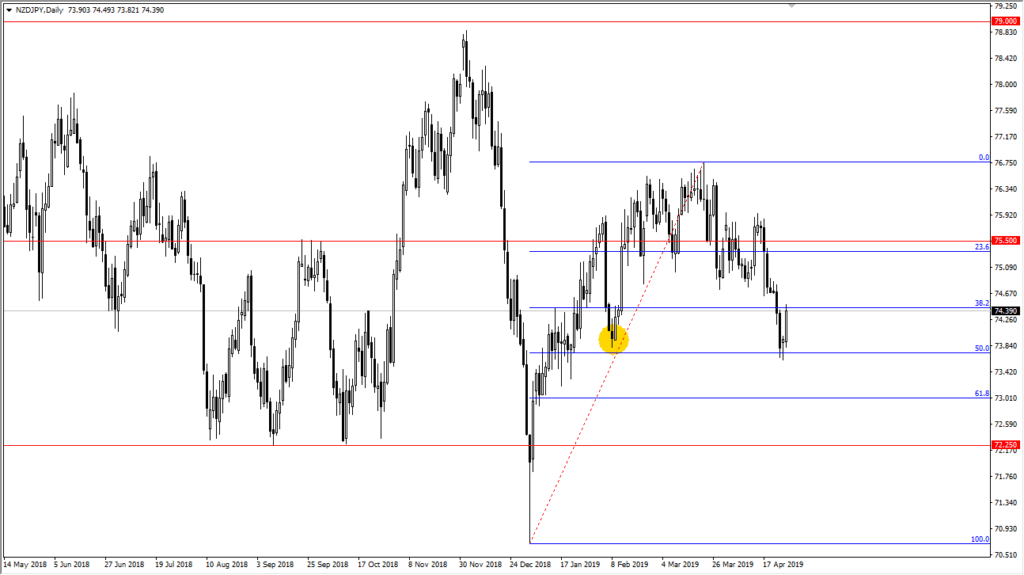

The New Zealand dollar had a very strong trading session on Friday, reaching towards the ¥74.40 level, continuing the bounce that started during the day on Thursday. What’s interesting about that bounce is that it occurred at the 50% Fibonacci retracement level, and an area that has previously been supportive, as shown by the gold ellipse on the chart.

Technical level

This was an obvious technical level, because not only have we seen supported previously, but as mentioned earlier it was the 50% retracement level. The market had been a bit oversold as we had gone straight to the floor, and therefore it’s very interesting that we couldn’t keep up the downward pressure. If you look just left of the circle, you can also see that there were several hammers in that area, so it makes perfect sense that we would have buyers in that region as well. Beyond that, the ¥74 level has been crucial in the past.

NZD/JPY chart

Market sentiment

Market sentiment has a major influence on what happens with the NZD/JPY pair, as it typically will rally when markets are going well and fall when there is a big risk aversion wave. I do recognize that market sentiment and swaying at the drop of a hat, but currently it looks as if we are trying to break out in the S&P 500, although sluggishly. That’s an excellent sign of risk appetite, so keep in mind that as long as we don’t melt down in stock markets, that should keep this market somewhat levitated.

That being said, if we start to break down in the stock markets, we will probably turn around and try to break through the 50% Fibonacci retracement level and the hammer from the Thursday session. There is a lot of support underneath there, extending all the way down to the 73 young level. That is an area that continues to be very noisy on the chart, so if we do break down below there we would need to see some type of major event or sell off proposition.

Although the crude oil markets don’t directly affect this currency pair, oil got absolutely hammered while the stock market sat relatively still during the day on Friday. This could be a bit of a “canary in the coal mine”, but that still remains to be seen. Overall, commodities are great way to express risk appetite, and the New Zealand dollar itself is tied to a lot of commodities, as New Zealand is a major agricultural exporter to Asian economies.

On the other side of the market is the Japanese yen, which is essentially the ultimate safety currency. If we start to see fear enter the marketplace, this should be the first place you look. If we start to see exuberance, that should also be one of the first places you look. In the short term though, it looks as if we are going to grind towards the ¥75 level, and then possibly even the ¥75.50 level.