Using the Fibonacci Expansion Tool Efficiently

The whole of Elliott Waves theory is based on Fibonacci levels and sequences, and it is not possible to count waves or to trade with Elliott if no Fibonacci levels are involved. Trading platforms acknowledge this and they all offer all kinds of Fibonacci tools for the everyday trader to use.

The most popular one by far is the Fibonacci Retracement tool, as it allows traders to look at the exact retracement level a market reaches, and based on that level, future patterns can be identified. In Elliott Waves theory, the Fibonacci Retracement tool has great application when interpreting the second and the fourth waves in an impulsive wave, as well as the overall a-b-c corrective structure that follows a five-wave impulsive move.

Fibonacci Expansion is another technical analysis tool used in close relation with Elliott Waves theory because, as mentioned in the previous articles dedicate to this trading theory, in a five-wave structure, at least one wave needs to be extended. This extension can be effectively calculated with this Fibonacci Expansion tool, which offers both a target for the opening trades, and the correct labelling.

| Broker | Bonus | More |

|---|

Fibonacci Time Zones is also widely used with Elliott Waves theory, as this trading theory is one of the few that allows a trader to incorporate the time element into any price forecast. Time is as important as price, and Elliott offers invalidation of specific counts if time is not respected. Unfortunately, there are few Elliotticians who know how to incorporate the time element, and as a result the Fibonacci Time Zones tool is not that popular. However, it represents a must-have in order to reap all the benefits the Elliott Waves theory can offer.

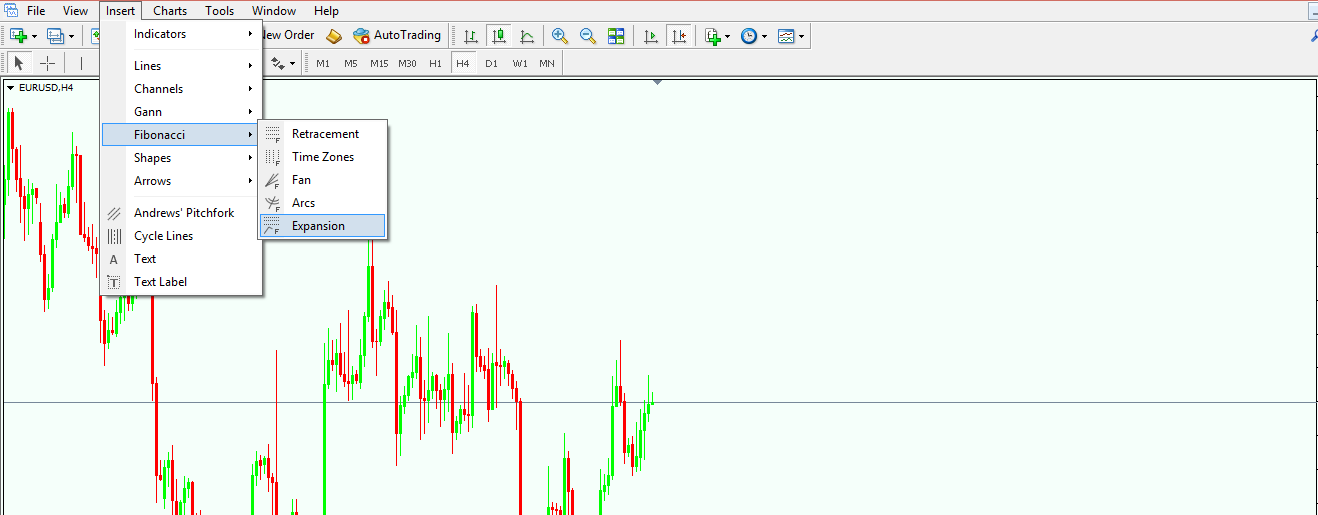

These three Fibonacci trading tools are the only ones that are used together with the Elliott waves theory, and are also offered by the MetaTrader 4 trading platform. On top of them, Fibonacci Fans and Arcs tools also exist, but they have applications and interpretations in other areas.

Searching for the Extended Wave

Because for any impulsive wave or five-wave structure it is mandatory to have at least one extended wave, traders struggle to find it in order to position for the move that is about to come. Everyone wants to ride the extended wave, as it is one wave that appeals to the overall trading motivation: quick profits as fast as possible. The extended wave can offer that, and much more.

Finding the extended wave is not an easy task, though. It requires a lot of knowledge and correct market interpretation of the moves prior to the extended wave and, moreover, meticulous attention to detail.

Assuming a trader believes an extended wave in a five-wave sequence is forming, there are several things to do in order to find out the target for the move to follow. The key to correct market interpretation comes with the Fibonacci Expansion tool.

Projecting the third Wave

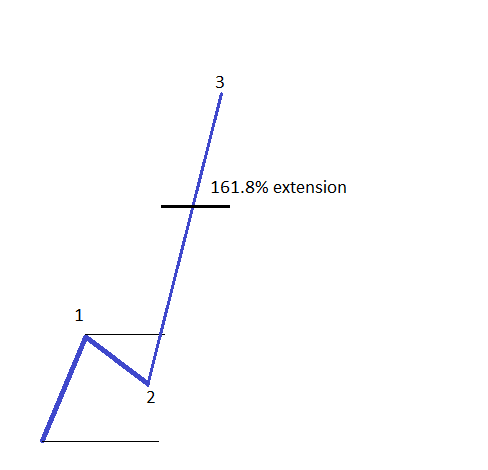

The article dedicated to defining impulsive waves mentioned the fact that the third wave is the one that is most likely to be extended. That means that a trader has an idea about the minimum distance that the third wave will have already travelled by the time the first wave has ended. At that moment in time, it is not possible to know the length of the fifth wave (actually we may already have an idea about its length, but this will be explained later) and therefore the projected third wave will be calculated based on the length of the first wave. To do that, traders use the Fibonacci Expansion tool.

The first thing is to select the Expansion tool and click at the start and end of the first wave. Moving forward, the way to go is to drag the third point of the Expansion tool to the end of the second wave. The result is a projected 161.8% level that starts from the end of the second wave. That is the minimum distance the third wave must travel in order for it to be considered an extended wave in an impulsive move.

Please keep in mind that extended waves are usually explosive moves, and this helps to explain why traders are keen to position themselves ahead of such a move. The 161.8% extension level is actually the minimum level to be reached, but extensions often go all the way to 261.8%, and even 461.8% or more. This is how important is to ride the right wave!

If these extended levels are not offered by the Fibonacci Expansion tool, they can be easily added. To do that, just select the tool, right-click, choose the Properties tab, and under the Levels tab, any value can be added.

How to Actually Trade with the Fibonacci Expansion Tool

Now that we know how to find the extended wave with the Fibonacci Expansion tool, the very next question is, how do we actually trade with it? How do we profit from the Forex market with this powerful tool? To answer that question, it is time to put to use everything we’ve learned so far on the Elliott Waves subject here on the Forex Trading Academy. Remember that any trade taken should be the result of a due diligence process that leads to one, and only one, right decision.

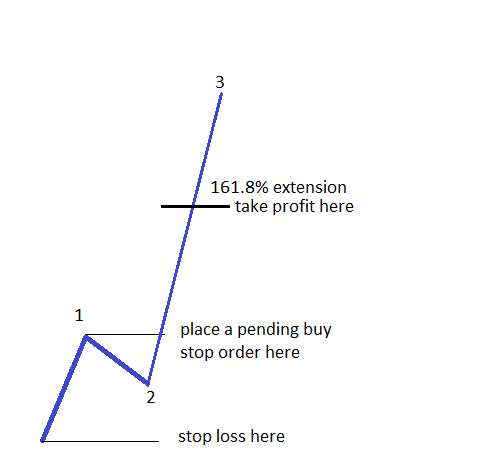

We know by now that it is not possible for the second wave to retrace beyond the start of the first wave. This is one of the defining rules of impulsive waves that we discussed earlier in this project. Hence, any trade one might take should have a stop loss at the level where the first wave started.

The entry level can be based either on a Fibonacci retracement level, like 38.2% or 50% retracement of the first wave, or traders can use pending orders to enter at the moment the market moves beyond the end of the first wave.

So far we have the entry and the stop loss, but how about the take profit? This should be interpreted based on the 161.8% extension that was mentioned earlier in this article. However, considering that 161.8% is the minimum level to come for a wave to be considered as extended, in reality, the market may travel way beyond that level.

To avoid exiting too early from the right trade, a trailing stop order can be used. Such an order should be set up in such a way that its activation should ensure that the extended wave is completed.

Other educational materials

- What is Elliott Waves Theory?

- Defining Impulsive Waves

- Defining Corrective Waves

- Different Fibonacci Levels Important When Trading with Elliott

- Trading Different Types of Extended Waves

- Bill Williams – How to Use Williams Indicators When Trading Forex

Recommended further readings

- The applications of the Fibonacci sequence and Elliott wave

theory in predicting the security price movements: a survey, Amitava Chatterjee, Ph.D., cs

F, 2002 - Mastering Elliott Wave Principle: Elementary Concepts, Wave Patterns, and Practice Exercises, Constance Brown, John Wiley & Sons, 2012