Learn how to Place Pending Orders

The trading theory developed by Ralph Elliott is highly regarded among traders, not only for its accuracy, but because it allows clear money management rules to be applied when trading. One of these rules consists of using pending orders as often as possible, as trading with such orders implies that a trading plan is in place. If a trading plan is in place, it means the trader knows exactly when to enter the market (this goes without saying as a pending order can only be placed for future prices); where to put a stop loss (usually at an invalidation level); and what the expected target will be. Pending orders are very useful when trading with Elliott, as this trading theory deals with patterns that are most likely to form. A pending order will be filled when the completed pattern and the price confirm it. If the pending order is not filled, it means eitherthe pattern is still forming, or the whole Elliott Waves count is wrong.

In both cases, using pending orders with Elliott Waves theory is highly recommended. Before moving on to what are the best places to use pending orders with this trading theory, a short review of the types of pending orders is necessary. These pending orders can be placed on any trading platform. When a trader wants to buy from higher levels compared with the current prices, a pending buy stop order should be placed. When the buying is intended to take place at lower levels, a pending buy limit order can be used. For selling, a pending sell stop order can be placed in order to sell from lower levels, or a pending sell limit in order to sell from higher levels. These are the instruments a trader can use to buy or sell from either higher or lower prices.

| Broker | Bonus | More |

|---|

Where to Place Pending Orders with Elliott Waves Theory

The decision to trade with pending orders is one that should come after wave counting is completed on longer timeframes, and when patterns on those timeframes indicate a specific outcome. Again, it is worth emphasising here that counting or labelling waves should NEVER be done at current prices, as current price action needs to confirm the labelling on the longer timeframes. As mentioned so far here on our Forex Trading Academy, Elliott found that waves are of two types: impulsive and corrective. Based on the type of move the market is making and where it is forming, pending orders can be used.

Using Pending Orders with Impulsive Waves

Using Pending Orders with Corrective Waves

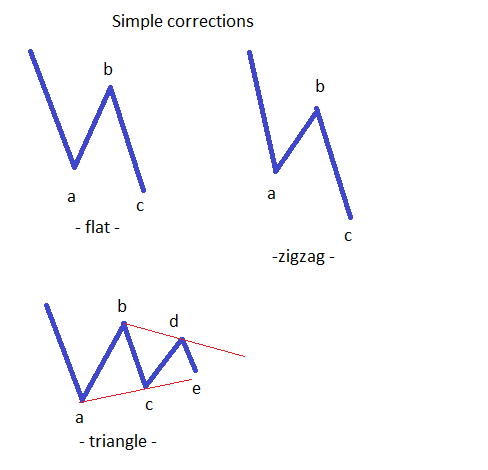

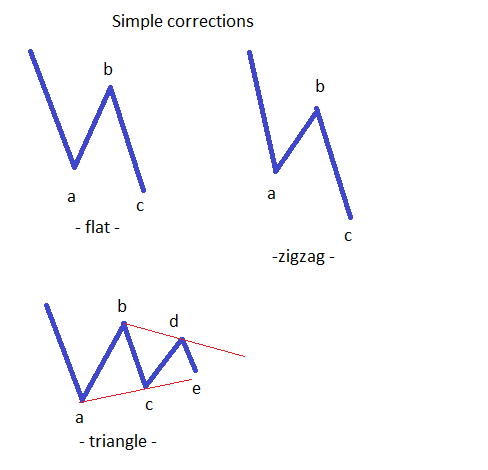

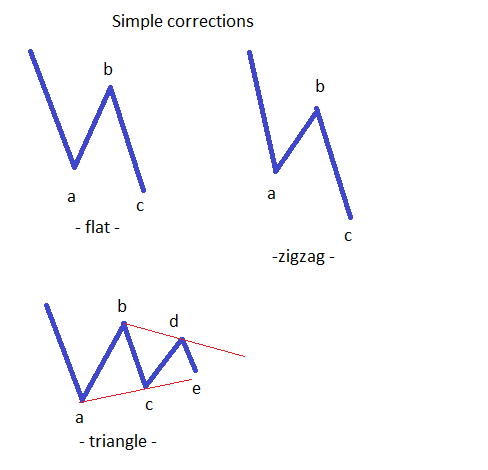

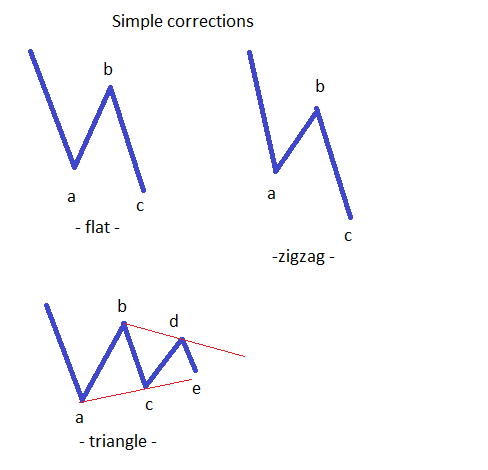

When it comes to corrective waves, using pending orders is a bit more complicated. For this, one needs to know whether a correction is a simple or a complex one; and having clarified that, pending orders can be used. In order to prepare for our next subjects to be covered on the Forex Trading Academy, the basic simple corrections will be listed here, illustrating the possibility of trading them with pending orders.

A zigzag is a simple correction that has an a-b-c structure, with waves a and c being impulsive, while the b-wave is the only corrective wave. As a rule, the b-wave cannot end beyond 61.8% retracement compared to the a-wave. Therefore, what traders do is to place pending sell limit orders (in a bearish zigzag) or buy limit orders (in a bullish zigzag) in order to find the perfect entry for the c-wave to come.

Pending Orders with Flats

Flats are the most complicated simple corrections, as there are no less than 10 types of flats the market can form. In a flat, which also has an a-b-c structure, only the c-wave is an impulsive one, while waves a and b are corrective in nature.

Pending Orders with Triangles

It is very simple to use a pending order when trading a triangle: All you have to do is to identify the b–d trendline and place a pending buy stop order (i f the triangle is a bullish one) or a pending sell stop order (if a triangle is a bearish one). Stop loss should be set at the end of the e-wave.

The examples in this article are only meant to show you the importance of having a trading plan, and using pending orders should be part of any trading plan. In turn, this will lead to profitable trades.

Other educational materials

- Types of Contracting Triangles

- Special Types of Triangles

- Types of Expanding Triangles

- Trading with X Waves

- The Concept of a Running Correction

- Double Three Running Patterns

Recommended further readings

- “Noise Filtering of Foreign Exchange Data.” Bailey, Donald, and Giovanni Moretti.

- “The dynamics of exchange rates.” Szczepanski, Ileana. PhD diss., uniwien, 2009.