Different Types of Extended Elliot Waves

An impulsive wave has a minimum of one extended wave, and it is classified based on the wave that is extended. There are no less than four types of impulsive wave, and they all related to the wave/waves that is/are extended. The purpose of this article is to correctly identify the types of impulsive wave, and to establish what is the correct way to interpret and trade them. You will find out that, on top of what has been mentioned so far as being valid for all impulsive waves, the analysis for different types of impulsive wave can go even deeper in order to find profitable trades.

| Broker | Bonus | More |

|---|

Types of Impulsive Waves

In order of their importance and based on the extended wave/waves, there are four types of impulsive wave: Third-wave extension impulsive waves, first-wave extension, fifth-wave extension, and double extended impulsive waves. All of them are common on the Forex market, with the fifth-wave extension and the double extended waves occurring less frequently.

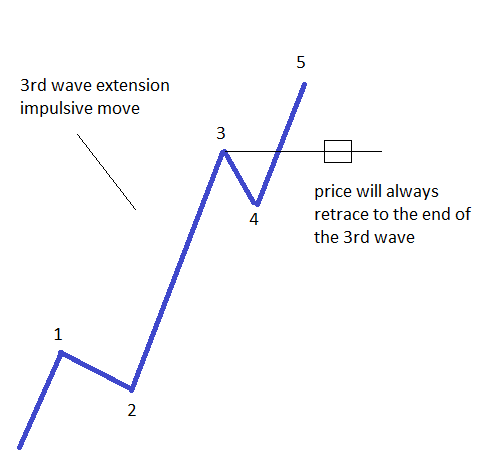

Third-Wave Extension Impulsive Waves

By far the commonest wave to be extended in any five-wave structure is the third wave. One cannot put this exactly in percentages, but I would say that more than 70% of impulsive waves fall into this category.

In a third-wave extension impulsive wave, the third wave is the longest, and the one that stands out from the crowd. The minimum extension here is 161.8%, and usually this refers to the length of the first wave, added from the end of the second wave. Depending on the type of correction that forms for the second wave, the third wave can travel more, and possibly much more, than the 161.8% level. A correct interpretation will therefore always involve the structure of the second wave.

The standard way to trade such an impulsive wave is to trade the extension. Of course it is extremely unlikely that the whole extension will be traded, as no one can pick exactly the top or bottom of a move, but most of it should be enough. One should consider that if such an impulsive wave is forming on a longer timeframe such as the daily chart or longer, then there are plenty of pips to be made by riding the extended wave.

A third-wave extension impulsive move can be traded as price action is unfolding, but the move that follows can be interpreted and traded as well. As a rule of thumb, after a third-wave extension is completed, the price will always return to the end of the third wave. As a result, a new trade can be found even after the impulsive wave has finished.

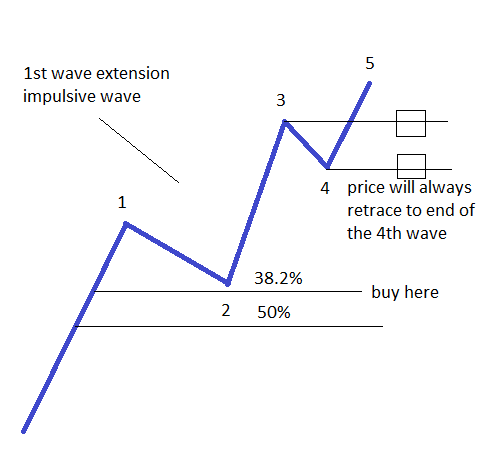

First-Wave Extension Impulsive Waves

Going by the name of this impulsive wave, the first wave must be the longest. If you look back at what we’ve said so far about impulsive waves, namely that the third wave cannot be the shortest wave, it means that it is mandatory for the first wave to be longer than 161.8% when compared with the third wave.

Taking this into account, we can safely say that the first wave is the extended wave, and the whole five-wave structure is called a first-wave extension impulsive wave. In such patterns, the second wave plays an important role, as it cannot retrace much into the territory of the first wave. More exactly, look for the second wave to retrace a maximum of 38.2%–50% into the territory of the first wave. That being the case, we have an entry for a trade that should have a target less than 61.8% of the length of the first wave, and a stop loss below the 50% retracement level of the first wave.

Price action to follow such an impulsive wave will not only return to the end of the third wave, but will move all the way beyond the end of the fourth wave as well. This tells us much about the power of this pattern when it comes to predicting future price levels.

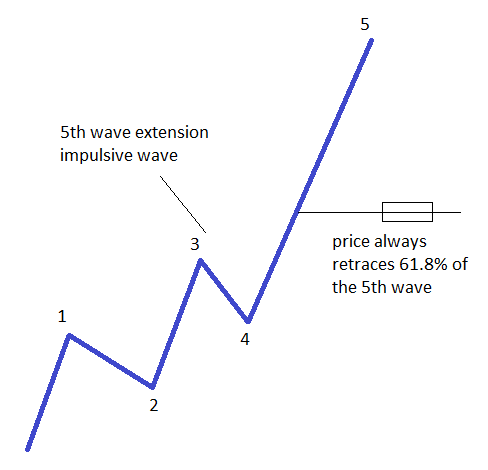

5th Wave Extension Impulsive Waves

These types of impulsive waves are extremely difficult to trade, and as a consequence, traders will notice them only after the fact. It is common that when the fifth wave extends, margin calls are triggered as the vast majority of traders are caught in the wrong direction.

The reason for them being difficult to anticipate comes from the nature of the first four waves, as they resemble a corrective move that has ended. Such confusion ends up with traders being lined up on the other side of the market, only to see price exploding in the opposite direction. However, even if a fifth-wave extension is difficult to trade when it is actually forming, it can be traded, and with quite some success, after it ends, as price will always retrace a minimum 61.8% of the length of the fifth wave. This means that the way to trade this type of impulsive wave is to use a Fibonacci Retracement tool, measure the fifth wave in order to find out the 61.8%, and wait for that target to arrive.

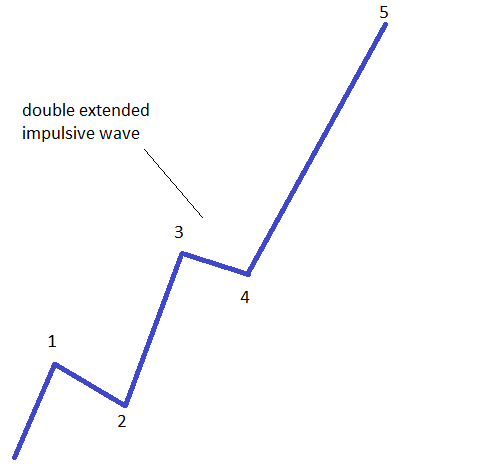

Double Extended Impulsive Waves

As the name suggests, these impulsive waves have not one, but two extended waves. The only waves subject to being extended here are the third and the fifth waves. As was the case with the fifth wave extension impulsive wave, there’s no way of knowing in advance that the market will form a double extension. This means that usually a trader will first be stopped, but then will recover all the losses by reversing the original trade.

A double extended impulsive wave will have the third wave almost equal to 161.8% of the first wave, and the fifth wave almost equal to 161.8% of the length of the third wave. Needless to say, if caught on the wrong side of the market when this pattern unfolds, chances of survival are really slim.

These are all the types of impulsive wave a market can form, and their correct interpretation depends very much on correctly interpreting which is the wave that extends. As impulsive waves are not that common on the Forex market in particular, or on any financial product in general, the focus should turn to corrective waves, their types and structure, and the way to trade them.

When it comes to corrective waves though, they are more numerous and complex, and if impulsive waves seem difficult to understand, then corrective waves will bring even more confusion. The key to success comes from practising on a daily basis, as this is the only way these rules will make sense, and then the whole Elliott Waves theory will produce meaningful results.

Other educational materials

- What is Elliott Waves Theory?

- Defining Impulsive Waves

- Defining Corrective Waves

- Use the Fibonacci Extension Tool in Elliott Waves Theory

- Different Fibonacci Levels Important When Trading with Elliott

- Bill Williams – How to Use Williams Indicators When Trading Forex

Recommended further readings

- Stock Market Multi-Agent Recommendation System Based on the Elliott Wave Principle, Monica Tirea, Ioan Tandau, Viorel Negru

- Who is R.N. Elliott and Why is He Making Waves?, Fred Gehm, Financial Analysts Journal, January/February 1983, Volume 39 Issue 1