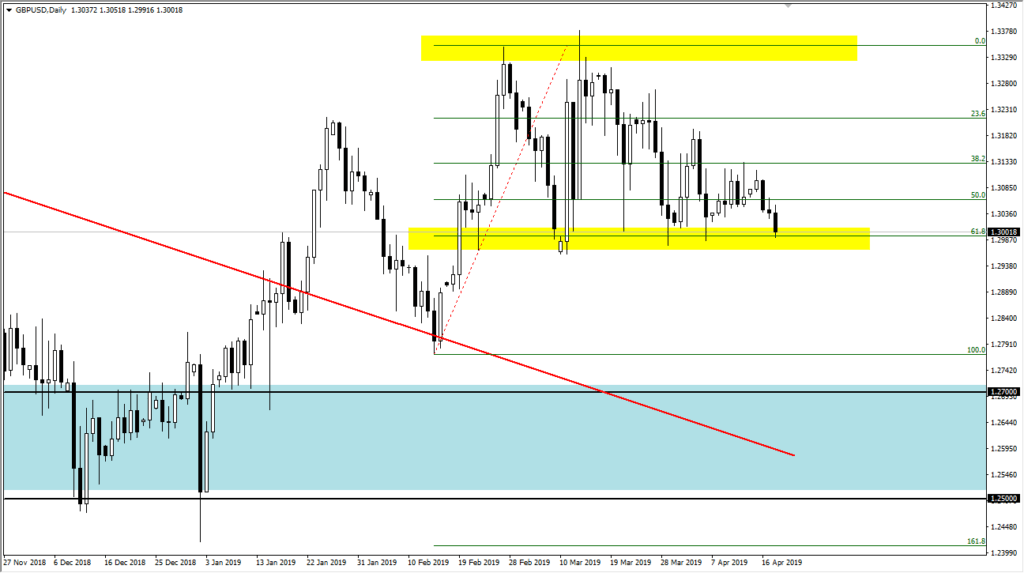

British pound testing major support

The British pound fell slightly during the trading session in early trading on Thursday, but we are at the bottom of a major consolidation area so it’s interesting to see how this market has been playing out. We got a six month extension on the Brexit, and now it seems as if the market really has no idea what to do with that information.

Testing major support

You will have to forgive me for using the word “major”, but probably what I should say is that is the short-term major support. We have been bouncing around for a while now, with the 1.30 level being reliable support. However, as you look at the chart you can see that we have been making “lower highs”, so ultimately it looks as if the market is trying to break down. If we can slice through the 1.2950 level, then it’s likely that we will continue to go a bit lower. That being said, with the flurry of headlines that will undoubtedly be attached to the British pound, it’s likely that we will continue the confusion going forward.

GBP/USD daily

Descending triangle

It doesn’t take much imagination to look at this chart and see a descending triangle, so I think at this point it makes sense that we will probably break down. The descending triangle suggests a move down towards the 1.27 level, which is the beginning of major support from previous action. That would make sense, because we just don’t have much in the way to move the needle at this point. Technical traders will certainly be looking at this chart and paying attention, so market participants continue to look at the chart with interest, and will probably continue to sell the British pound out there is no catalyst to send it higher. That being said, it doesn’t necessarily mean that we are going to break apart rapidly. This will probably be a bit of a controlled dissent to lower levels where there will be plenty of value.

With all of that being said…

With all that being said, the market is probably a drifting lower type of situation that perhaps you can short at the 1.2950 level, but don’t expect fireworks. Beyond that, the British pound has certainly bottomed longer-term unless there’s some type of absolute disaster, so I believe that the 1.27 level underneath will more than likely attract value hunters that will take advantage of “cheap Pounds.” In short, this is a situation where you have short-term negativity but longer-term value hunting going on. In that sense it’s a bit of a two speed market.

The alternate scenario

The alternate scenario of course is that we find support and bounce from the region that we are trading at. If that’s the case we could make a move towards the 1.3133 level, where we have seen significant resistance. A break above there would be very bullish for the British pound, but I would expect a lot of choppiness all the way to the 1.3350 level which is the top of the current consolidation area. At this point, all we can do is sit and wait for some type of confirmation as to directionality, but longer-term charts suggest a drift lower is probably more likely than not.