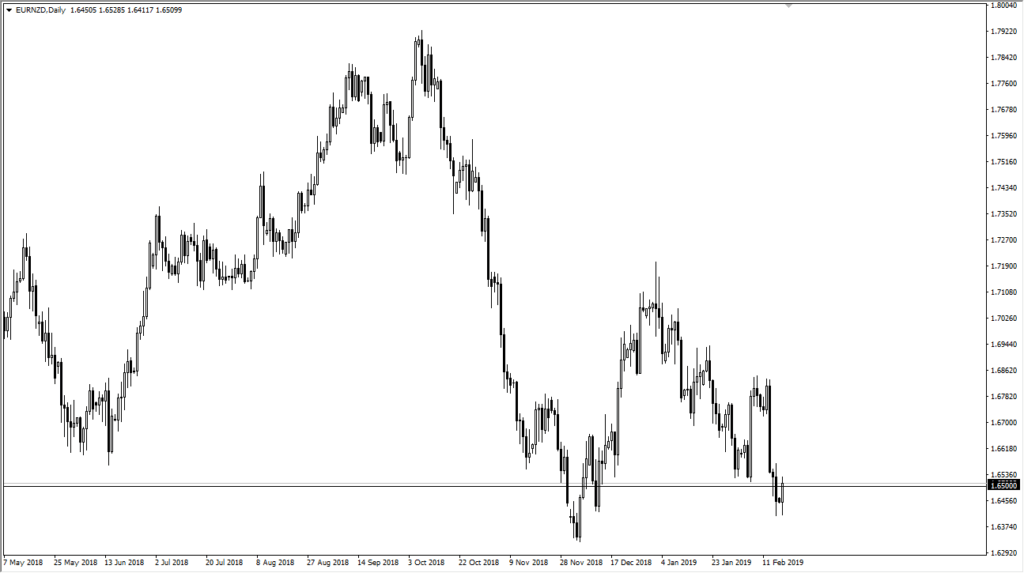

Euro testing major support against Kiwi

The Euro has been trying to find a bit of a base against several currencies during the trading session on Monday, as it is historically cheap against several major players such as the US dollar, and in this case the New Zealand dollar. We end the day testing the 1.65 level to the upside, as this is a level that has been important more than once.

Long-term support

The 1.65 level has been interesting to say the least on longer-term charts in the EUR/NZD pair. At this point, the market is getting historically cheap, and as the Euro has been trading near the 1.13 level gives the US dollar, I suspect that some longer-term value hunters are starting to come back to work. The market has seen the Euro trade as low as 1.10 or so against the US dollar, which is very cheap to say the least. At this point, as the Euro rises against the US dollar, it will rise against many other currencies.

As I looked back at this chart, the 1.65 area begins significant support back to the June 2017 timeframe. It was also supported previously, as well as resistance. In other words, there is a lot of interest in this area. This is the type of level that I’m looking at for bigger trades.

New Zealand dollar weakness

What I also find interesting about going long of this pair is the fact that the New Zealand dollar looks like it’s rolling over against other currencies as well. The New Zealand dollar is rolling over near the ¥76 level against the Japanese yen, it’s currently struggling against the Canadian dollar as we are running into major resistance, and that of course we see the New Zealand dollar struggling to strengthen against the Euro. With all that in mind, it’s easy to imagine a scenario where we go higher from here. In a sense, that’s the very essence of trading: matching strength, or in this case potential strength, against weakness.

Resistance above

I do see a lot of resistance above in the form of the last couple of candles. This would include the drop from the 1.68 level that occurred last week, and the fact that we have been in a downtrend recently of course suggests that it’s not going to be easier to go higher, but if the Euro can continue to strengthen against the US dollar, it’s very likely that we will see this pair rally as well, as the US dollar is by far the benchmark of how to gauge a currency strength.

I believe that short-term pullbacks will continue to be opportunities to go long, and therefore I’m going to be buying little bits and pieces along the way. I believe that the support extends down to at least the 1.6250 level, and as a result it’s likely to be a scenario where value hunters eventually overwhelm the markets. However, if we were to break down below the 1.6250 level, then we probably will end up falling back down to the 1.60 level as it is supportive as well.

48 hour hammer?

You can make an argument for the last couple of trading sessions forming a 48 hour hammer, if you smash the two candlesticks together. This is another reason why I believe that the buyers are starting to come in and pick this thing out. Remember, when you are trading these crosses, it’s important to watch how they react against the US dollar. Essentially, you are betting that the EUR/USD rises, while the NZD/USD falls, or at least doesn’t rise as quickly as the Euro. All things being equal, as we have the US/China trading talks going forward, that could have an effect on Asian and antipode currencies, which could come into play here as well.