Trump sends markets into turmoil

No matter how you feel about President Donald Trump, you must pay attention to what the man says. And that seems to be especially obvious during trading markets early this week. After all, after he tweeted that there was the likelihood of increasing tariffs against the Chinese, markets tanked. Beyond that, it looks as if the Chinese are just as irked.

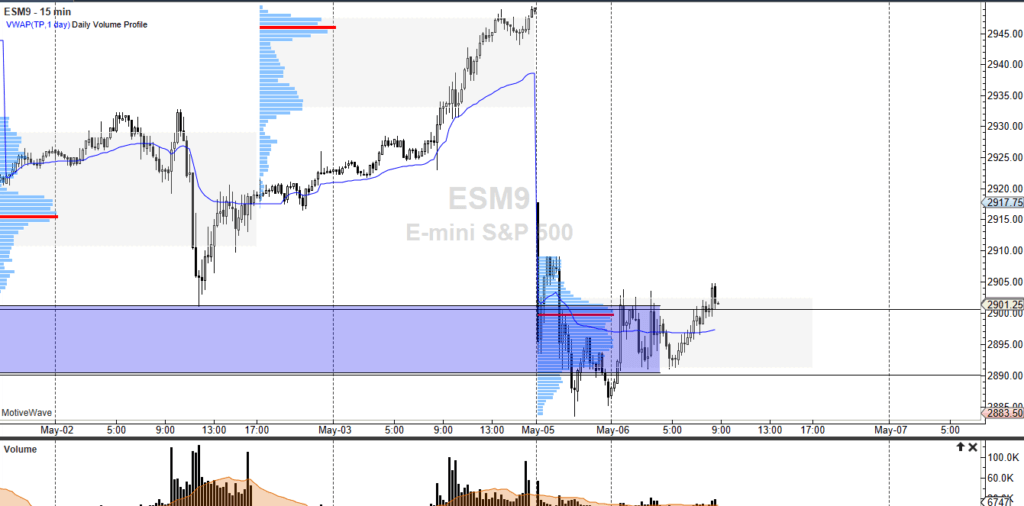

S&P 500

The E-mini S&P 500 contract fell apart almost immediately at the open. This is just five scant hours after the tweet that he put out, and then of course reports that the Chinese weren’t going to bother coming to the United States to negotiate the trade deal next week. This suggests that perhaps the Americans and the Chinese are at a bit of an impasse, and that of course at the markets very concerned. The E-mini contract gapped lower to kick off the session, losing 30 points immediately. After that, it then reached down towards the 2890 level, an area that is major support on longer-term charts.

Obviously, it wasn’t just the S&P 500 that felt the effects of increasing tensions, but it was probably the most dramatic place. Crude oil was still down 1% by the time the Americans woke up but had recovered quite a bit of the losses. In other words, it looks as if there are willing participants underneath.

S&P 500 chart – 15min.

Value

After an initial head fake like this, and a major meltdown in what is the opposite direction of the overall trend, quite often you will have traders out there looking for value. After all, the march higher has been relentless, and therefore it’s hard to fight what we see on the chart. Yes, it can be a bit scary after a move like this to go long, but the reality is that we need to look for value and take advantage of it when the market offers it. It has been very obvious that the markets have been in and uptrend as far as risk appetite is concerned, and this is especially true in the US markets. Ultimately, the question is whether or not you are willing to risk taking a shot on the longer-term trend.

Mind the gap

There is that 30 point gap still above that has yet to be filled. It gaps do get filled in the futures markets quite often, although that doesn’t necessarily mean it has to happen right away. Quite frankly, it could happen a month from now. Ultimately though, with the action that we have seen coming out of Europe it’s likely that we are going to continue to see people willing to jump into this market and pick it up “on the cheap.” After all, cooler heads will eventually prevail because quite frankly they have to.

Whether we can break above the top of the gap might be an entirely different situation, but as I look at this chart, that’s 50 points away so it would be a bit remarkable to recover all of that in the same session anyway. If we make a fresh new low, below the 2883.50 level, then we may have to reevaluate everything.