Price Market review

This broker was not featured in our 2024 Broker Review Audit. This is because, in the past 12 months, it has failed to pass our initial screening process and is not recommended by our team of experts. As such some of the information found here may be out of date.

We review all brokers to a strict and unique methodology, to ensure that we only promote high quality brands that you can trust. This methodology considers over 200 criteria points, covering the categories of safety, fees, platforms, products, payments and customer support. All brokers are then given a score out of 100. We update this methodology and our recommended reviews yearly, so that you’re only given up to date information.

If a broker has a score less than 80, like this one, we won’t recommend it to you. So that we don’t waste your time, we don’t update these reviews either. We know you don’t want to read a long review of an untrustworthy broker. Instead, you can use the tool below to find a high-scoring broker that accepts clients from your country.

Brokers available in

Discover a broker you can trust by reading our in-depth and honest reviews, created by industry experts. Since 2015, we’ve reviewed over 200 forex brokers.

Price Markets is an independant broker, offering foreign exchange and CFD trading services for both retail and institutional clients located all over the world. Its registered address is Cannon Street, London, and Price Markets Prime Brokerage is the trading name of Velocity Trade International (VTI). Launched in 2013, it is licensed and regulated by the FCA (Financial Conduct Authority). It is also regulated by the Australian Securities and Investment Commission. It has offices in a number of major cities, including Montreal, Toronto, New York, Sydney, Auckland and Cape Town. In 2014, Price Markets won a prestigious award by International Finance Magazine. It was recognised with the Best New Prime of Prime Broker Award. This award is given to global FX brokers and banks, who stand out in terms of net profitability, market share and contributions to the industry.

|

|

|

Bonus |

Rewards Points |

|

Regulation |

FCA |

|

Mobile |

Yes |

|

Instruments |

Forex ECN, gold, oil, and indices |

|

Website |

www.pricemarkets.com |

| Not Verified | |

A great range of trading platforms offered by Price Markets

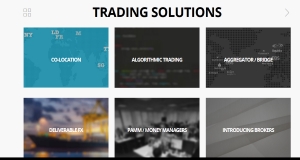

Through the MT4 ECN trading model, retail traders can trade in over 300 global markets, including Forex ECN, gold, oil, and indices. Trading fees are transparent and start as low as $1 per contract (100k). This account is designed only for professional traders and institutions or white labels. For those of you wondering what White Labels are let’s give you an explanation. A white label broker is just a little different than a traditional broker, in that they sell another company’s product or services, acting as an affiliate in order to make profit. This can be done by using a profit sharing model or by charging a hefty commission. So the MT4 ECN trading platform is designed with this type of service provider in mind. Price Markets also runs a number of other trading platforms including:

Liquid X – This is a platform specially for large order execution, particularly for FX Spot and precious metals

Currenex ECN – Again this is more for the advanced type of trader for FX Spot, FX Forwards, FX Swaps, and precious metals

Integral FX – A direct market access system for FX trading and available with a Prime Brokerage account

Hotspot FX ECN – A limit order-driven ECN platform providing full market transparency and a blend of Tier 1,2, and 3 bank and non-bank market makers

ICAP EBS – One of the world’s premier interdealer brokers with an average daily transaction volume of more than $2.3 trillion

Although Price Markets seems to aim its services more at institutional customers, retail clients are able to trade Forex by opening a trading account. And as many of the readers of our reviews are ordinary retail traders we’ll take a look at what’s on offer if you decide to open a trading account.

Opening a trading account with Price Markets

Trading products

- Commodities – Gold, silver, coffee, cotton, oil, sugar and many more

- Stocks – Blue-chip stocks from 11 different countries including UK, USA, Europe, Asia, and Australia

- Indices – European, Asian, and US stock indices

- ETF (Exchange Traded Funds) – Barclays, MSCL, Developed and Emerging Markets

- Bonds – European and Japanese Bonds, Liquid US

There is free VPS for active traders, which are those with a turnaround of more than 10 standard lots per calendar month. And we shouldn’t forget to mention PAMM for money managers which allows you to manage clients accounts across 600 global markets, all from one account.

It seems that Price Markets are more than happy for new clients to get in touch and ask their questions. There is a telephone number, and email address, as well as a contact form that is simple to complete.

While Price Markets may be a prime brokerage firm there is still a lot to offer the retail trader. Why not try out a demo account first? And if you like what you find then you can start trading with real money.

Have a look at our Top Rated Forex Brokers in your country:

What’s next

-

Find Your Broker We helped new traders to find their path.

-

Compare broker See what benefits one offers over the other.

-

Learn Trading financial markets has never been easier.