Australian dollar pulling back

During early trading on Thursday, we’ve seen the Australian dollar pulled back a bit after initially searching higher. This has been the pattern as of late, watching the Aussie rally a bit only to give back the gains. We simply cannot take off quite yet, but that’s not a huge surprise considering that the Australian dollar is so highly correlated with all things China related.

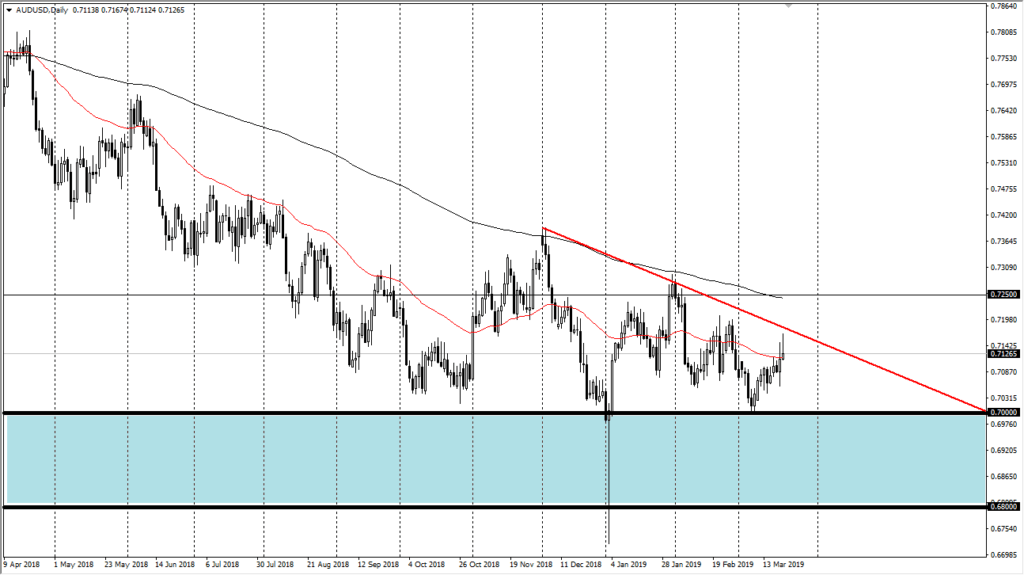

AUD/USD daily

USA/China trade talks

Obviously, the most widely followed driver of the Australian dollar right now is whether or not we are going to get some type of trade talk resolution between the Americans and the Chinese. Granted, the real risk is probably to the downside, but that is only if we have some type of breakdown in the discussions, or a horrific ending. At this point, that seems to be very unlikely because both countries desperately need in agreement. Remember, Australia is the biggest exporter of raw materials to China, so as China goes, so goes Australia.

Quite frankly, I think that this pair is probably more or less killing time, waiting for some type of solution to the trade negotiations. Given enough time, that should happen but you may need to be a bit patient before we get an explosive move to the upside in the Aussie.

Play the market you’ve got, not the one you want

This is a perfect example of that statement, as the Australian dollar continues to find buyers underneath, but we are not seeing explosive moves to the upside. The one thing that we do know is that the 0.70 level continues offer significant support, extending down to the 0.68 level, which is an obvious support range on longer-term charts, so it’s going to take a significant amount of inertia to break down through that level.

At the moment, it looks like you simply buy short-term pullbacks as they offer a bit of value, but you can’t expect some type of major break out quite yet. There is a downtrend line that we have drawn on the chart, and if we can break above there then we could pick up the momentum to go to the 0.7250 level. Overall, the Australian dollar continues to look as if it is trying to build some type of base, but that can take months, so unless you are an investor it’s going to be difficult to hang onto.

The alternate scenario

If for some reason the United States and China can come to some type of terms, that will be extraordinarily bearish for the Australian dollar. Not only would there be concerns about whether or not the Chinese can export to the united states, but then there becomes an issue as to whether or not the Australians will be able to export to China, at least at levels that are needed to sustain current economic conditions. Adding even more fuel to the fire is that in a situation like that it’s likely that most institutions would start buying US treasuries, which of course drives up the demand for the US dollar as well.

This is not a likely scenario, but it is the alternate scenario that you should be aware of. In the meantime, buying dips for short-term trades continues to work.