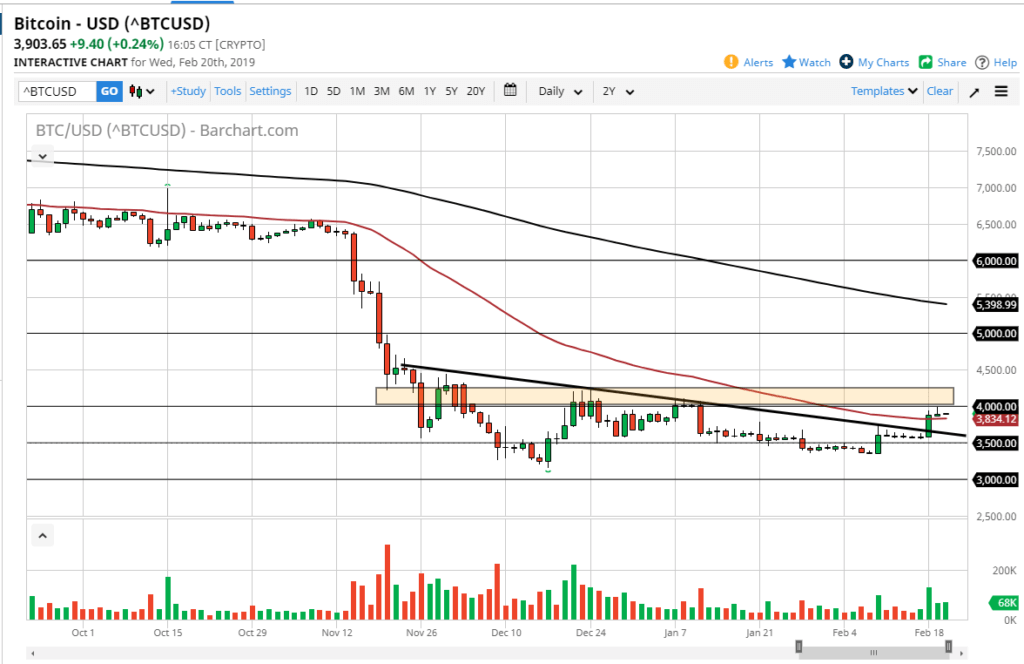

Bitcoin has broken a downtrend line – now what?

Over the last couple of trading sessions, we have seen bitcoin break above a significant downtrend line against the US dollar. While a bullish sign, the following session, meaning Tuesday, featured the bitcoin market testing the $4000 level and failing significantly. At the end of the day, the candle stick is a shooting star which of course will attract a lot of price action trading.

Clear resistance above

Unfortunately for those who are bullish on Bitcoin, there is a significant barrier just above that will certainly make its presence known. In fact, during the trading session on Tuesday we have seen just that. By forming a shooting star, a lot of price action traders will be paying attention to whether we break down below the bottom of the Tuesday session, because not only does it kick off a sell signal again, but it also is a break down below the 50 day EMA, pictured in red on the chart.

Now that we have broken through the downtrend line, we have in fact cleared one of the first major hurdles to buying pressure, but at the end of the day we are in a very strong downtrend over the last 14 months or so, and that has not changed by the last few dollars to the upside.

The easier trade

The easier trade when it comes to crypto currency has been to sell it for several months now. Every time we have rallied, there have been sellers jumping right back into the market to push prices lower. Unfortunately, this will probably be the way this market behaves for the foreseeable future, because there are so many retail traders trapped above. They have been absolutely walloped over the last year, and quite frankly most retail crypto currency traders have simply either sold their positions at massive losses or will be more than willing to get out of the market closer to breakeven. This will continue to cause a bit of a weight around the neck of Bitcoin.

Going forward, selling the first signs of exhaustion should continue to work, as we have seen these bounces more than once. I think that the area above the $4000 level continues offer significant resistance to at least the $4200 level, so it’s not until we clear that level that we have the appropriate bullish sign to put money to work.

US dollar weakness

The US dollar was extraordinarily weak during the trading session on Tuesday, and even in this scenario Bitcoin could not break out. If it can’t break out against one of the softest currencies out there right now, when can it? This has been one of the biggest problems with the rallies in Bitcoin, is they simply don’t take advantage of weakness in the currency that it is being traded against, in this case the greenback.

On a day that we had seen the British pound, Euro, Swedish krone, and many other currencies showed extraordinarily bullish moves against the US dollar during the day, Bitcoin couldn’t get out of its own way. This shows just how tenuous any rally is going to be in this market.

Fading rallies has worked, and should continue to

As fading rallies has worked for quite some time, it’s very likely that it will continue going forward. Granted, we have made an initial move higher and have shown signs of life, but I think at best we are looking at a bit of a basing pattern. The basing patterns take some time to change the trend, which under the best of circumstances is what is happening. This means there will be plenty of time to take advantage of weakness. If we break above the $4200 level, then we could go as high as $5000 where I would expect even more selling pressure as the 200 day EMA should catch up at that point.

I anticipate seeing short-term choppy trading yet again, as we have seen that be the norm in this market for some time. Volume has been extraordinarily light most days, and I don’t see that changing anytime soon either. Bitcoin still looks bearish, even though we’ve had a couple of good days as of late.