Boeing continues to struggle with 737 MAX issues

With the 737 MAX 8 being one of the most important planes that Boeing puts out, the recent accidents in both Ethiopia and Indonesia have cause major issues for the company. Not only is it a financial issue, it suddenly puts what is the majority of cash flow rich pipeline material in jeopardy for the company.

Reactions

After the Ethiopian Airlines crash on Sunday, combined with the Lion Air accident in October, there has been a long list of reactions around the world. Most importantly will be the fact that China has decided to ground all Boeing 737 MAX 8 aircraft from flying. This is a huge concern for Boeing, as it will be one of its most important clients going forward. Boeing of course has a huge stake in China, and if it starts to lose orders, this could cause major issues. Boeing estimates that the Chinese will need 7690 commercial jets by 2037, emphasizing just how negative this could be.

We are starting to see airlines ground these planes around the world, and places such as South Africa, China, and Indonesia. So far, the US-based carriers have not grounded any of these aircraft, but this certainly could be an issue going forward. With that being the case, headlines of course will be crucial to pay attention to as this still is a very fluid reaction.

The stock falls hard

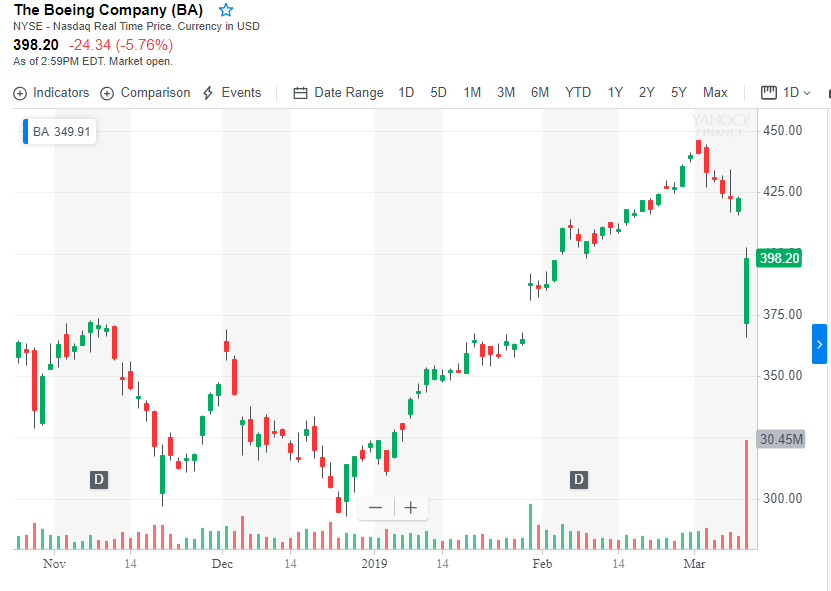

Boeing fell hard to kick off the Monday session, dropping more than 10% at the beginning of trading. However, traders have stepped in and started buying almost immediately, which of course gives the saw quite a bit of support from its initial knee-jerk reaction. The market was trading at $400 as we reached the final hour of trading. Which means we are still down roughly 5%. It’s obvious that although there are a lot of issues out there, the reality is that Boeing is one of the strongest stocks that we have been following all year.

The one-year target estimate based upon a pool of analysts we track is $443.75, well above current trading. The market seems to be attracting a lot of value hunters, so therefore it seems as if the market participants recognize that the underlying fundamentals are still very strong. Granted, we may get quite a bit of volatility going forward but the reality is that most traders bet on Boeing getting answers to the issues quite quickly and employing the correct countermeasures to make sure 737 MAX 8 aircraft are running at peak performance.

Institutional holding

Boeing is a standard for most institutional funds, and therefore it is somewhat insulated to these issues unless there is some type of catastrophic concern, or perhaps a reoccurring issue. Granted, we have had a couple of crashes in the last five months, but the reality is that the market recognizes that the 737 series of planes are one of the most widely used were courses in the air, so therefore this is very likely going to end up being a short-term phenomenon, as most hedge funds will simply hold on to this market, perhaps even adding to positions as we may have seen early in Monday trading. While it has been a tragedy, the reality is that the initial knee-jerk reaction is probably an opportunity.