British pound breaks resistance against Japanese yen

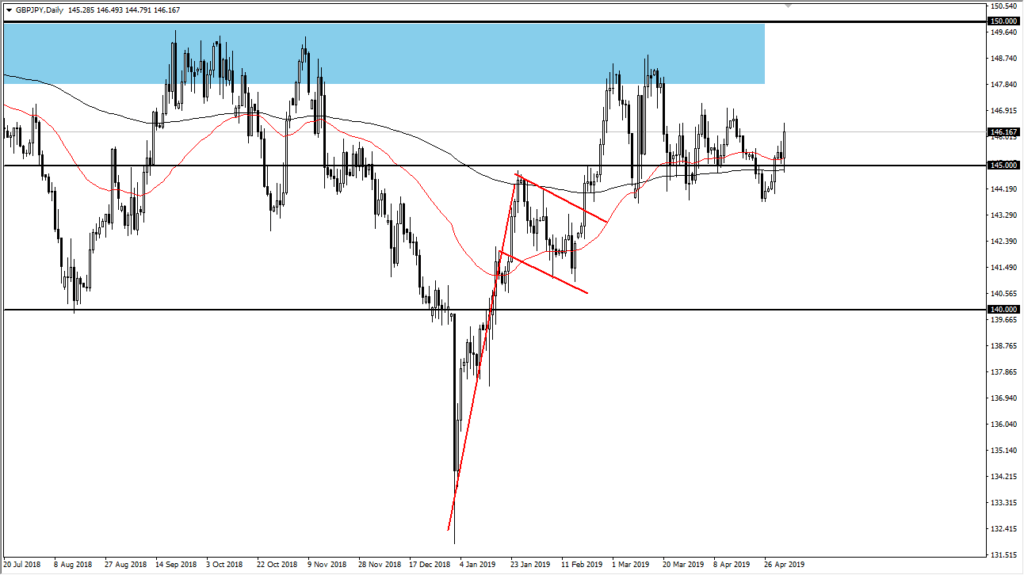

The British pound initially pulled back a little bit during the trading session on Friday but found enough support at the 200 EMA to turn around and break above the past couple of shooting stars. That of course is a very bullish sign, and therefore it’s likely that we could go reaching towards the next resistance barrier.

The next hurdle

The next hurdle to overcome will be the ¥147 level. If we break above that level, we could then go to the ¥148 level but it’s going to take some effort to get to that point. Once we do, it’s possible that the market could even try to go higher than that. However, the biggest problem that the British pound is going to have against any currency is the fact that we are still in the midst of the Brexit, and quite frankly it’s only a matter time before some headline comes out to spook the market. Keep in mind that could be a problem, and therefore you should probably continue to focus on shorter-term charts more than anything else.

GBP/JPY Chart

Convergence of support

There is a certain amount of support built into this area though, because not only does the ¥145 level attract a lot of attention, we also have the 50 day EMA, pictured in red, and the 200 day EMA pictured in black. Because of this, there is a confluence of support and buying pressure here. However, the 147 level above is an area that we need to get past, and it should be resistance.

Brexit

One of the biggest problems with trading the British pound right now is that there are so many headlines out there involving the Brexit. Ultimately, if we get some type of deal, I fully anticipate that this market will explode to the upside. It will take out the ¥150 level, and perhaps extend all the way to the ¥155 level which is what the bullish flag marked on the chart suggests. All things being equal though, if we can continue to go higher it’s likely that it will be due to some anticipation or tweet from someone out there about the situation.

Until then, I anticipate that we will continue to see lots of choppy behavior, and a bit of a floor at the ¥144 level. A break down below there would send this market down to the ¥140 level. This is still a very news driven pair, just as anything involving the British pound is. The other pressing issue of course is global risk appetite, so pay attention to that. If global risk appetite falls, this pair will as well as the Japanese yen is a major safety currency.

Expect volatility, but if you have ever traded “The Dragon”, you know that is quite typical and it’s very likely that you should take your profits relatively quick. Part of the move that we have seen may have been exaggerated due to the fact that it was Friday as well, people getting flathead of the weekend.