British Pound Continues to Struggle Against Japanese Yen

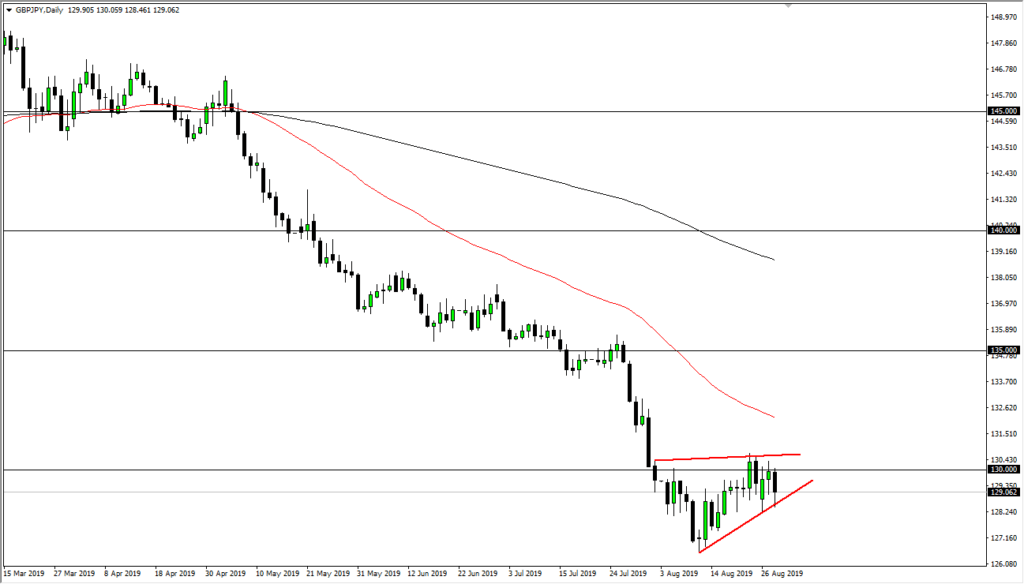

- GBP/JPY pair forming rising wedge-like pattern

- British pound sits below the ¥130 level

- Still in a downtrend

The British pound has fallen a bit against the Japanese yen during trading on Wednesday, as the ¥130 level has offered a bit of resistance. Beyond that, there seems to be a lot of noise in this general vicinity as we have been shopping around for some time. We are a bit overextended, but at this point it makes quite a bit of sense that we remain a bit negative due to the fact that the Brexit still can’t be solved, and it’s very unlikely that were going to see that resolution anytime soon.

Granted, we have seen a couple of short-term headlines that suggest that perhaps people are willing to work with each other, but we’ve seen this movie before. It’s only a matter of time before the whole thing falls apart, because quite frankly there’s no way that these people were going to get it together. At this point, somebody has to capitulate, and it certainly doesn’t look like it’s about to happen.

Crucial round figure

GBP/JPY Chart August 29th

The ¥130 level is a crucial round figure that attracts a lot of attention. That’s one of the main reasons why we continue to grind back and forth, as the level will catch a lot of headlines. We also have a bit of a rising wedge forming, which of course is a technically negative pattern. At this point, if we break down below the bottom of the candlestick for Wednesday, it’s likely that we will go looking towards the 126 young level underneath, which is the bottom of that pattern. Ultimately, if we were to break to the upside, it’s very likely that we would then go towards the 50 day EMA above.

The 50 day EMA above is near the ¥132.50 level, an area that has a certain amount of structural importance to it on short-term charts. This is a market that has been negative and will be negative, so it’s very interesting to see that there is a lot of noise.

Risk barometer

The GBP/JPY pair is known as a risk barometer, as the Japanese yen is considered to be a safety currency. Typically, this pair will break down at times of concern, and the fact that we have the whole Brexit thing going on only adds more fuel to the fire. For a simple measurement of the strength of the British pound, you simply look at the GBP/USD pair. As it is negative, it means the British pound itself is negative. All currencies are measured against the US dollar by the time it’s all said and done.

Trading this market

Trading this market is quite simple. I’m a seller every time we try to rally, but I look for short-term signs of exhaustion in order to take advantage of what has been a very reliable and strong downtrend. In fact, buying this pair is all but impossible until the Brexit is solved and of course the geopolitical concerns, down.