EUR remains very quiet in range bound session

The Euro did very little during the training session on Tuesday, even though the Americans came back from Memorial Day weekend. The increase liquidity didn’t do much in the way of conviction, and perhaps this is something that we need to get used to: the idea that it is this summer and markets may quiet down. One of the biggest slowdowns can typically be seen in this currency, especially against the US dollar.

Summer trading

Don’t be discouraged by summer trading, it’s simply a fact of life. Unfortunately for many retail traders, they don’t understand that there are nice trading opportunities during these times, as markets tend to settle into nice tight ranges. Granted, they are huge moves, but they don’t need to be get some of them in a row that line up quite nicely. As we have just passed the traditional beginning of summer in the United States, and of course the Europeans are on the same basic calendar, we are getting close to that time a year where things simply slow down.

If that’s going to be the case, then take advantage of what we have here and to sell on rally to show signs of exhaustion and buy markets that get a little oversold signs of support. It doesn’t sound like rocket science, and quite frankly it is in. However, every year during the summer months I received correspondence from new traders not understanding why they are getting chopped up.

By trading smaller positions and more frequently going back and forth, typically I have found that helps trade some of the most liquid pairs in the world during these months. Quite frankly, USD/JPY, USD/CAD, EUR/USD, and under normal circumstances the GBP/USD pairs all tend to fall and volatility this time here, but it’s something to take advantage of.

Levels to watch

EUR/USD

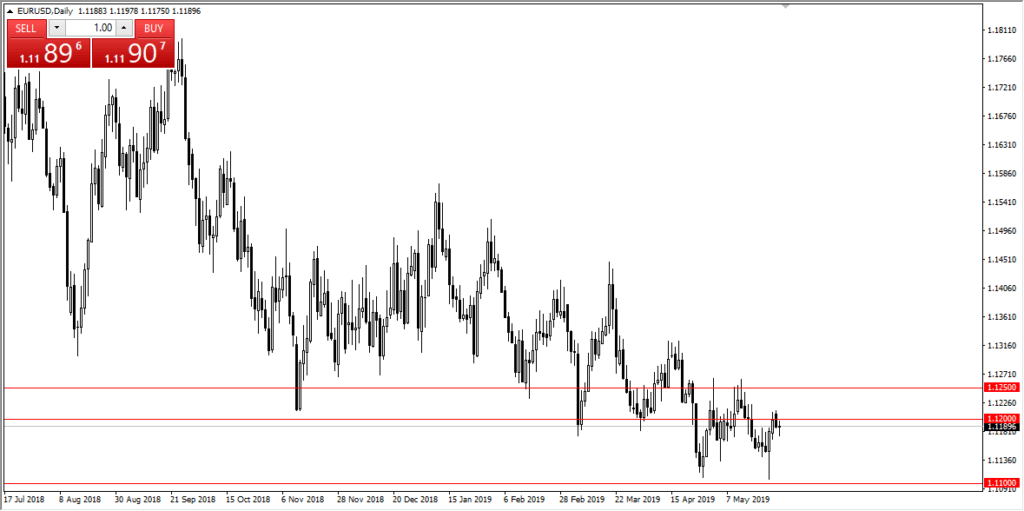

At this point in time it looks as if the markets are going to carve out a nice little range here, with the 1.12 level beginning significant resistance that extends to the 1.1250 level. Any sign of exhaustion such as a shooting star on a short-term charts could be thought of as a nice selling signal, with an obvious stop loss level above the 1.1350 handle. The same thing could be said for the 1.11 level underneath, which should be massive support. If we break down below there obviously things will change.

That being said, employing a shorter-term sideways trading system is probably the way to go, at least historically speaking. Obviously there can always be the outlier the causes major problems, and quite frankly news can change anything at any moment. However, as it looks like we are settling down, this should be the way forward. Simply take with the market gives you and trade accordingly.

One word of caution

While the natural instinct for retail traders and newer traders is to trade huge positions in these ranges, I learned a long time ago that it is far more dangerous than it’s worth. In fact, if you can find a couple of a range bound markets, it is better to trade smaller positions in several markets that are doing the same thing than it is to lever up in one specific market.