Euro/Yen Looking to Bounce and Start the Week Positively

The EUR/JPY pair is one that tends to measure risk quite effectively. However, recently we have seen a bit of a divergence from this because there are so many crosswinds to deal with out there. That being said, we have seen the Japanese yen strengthened. However, it does appear that we are at least putting up a fight at these low levels.

Double Bottom?

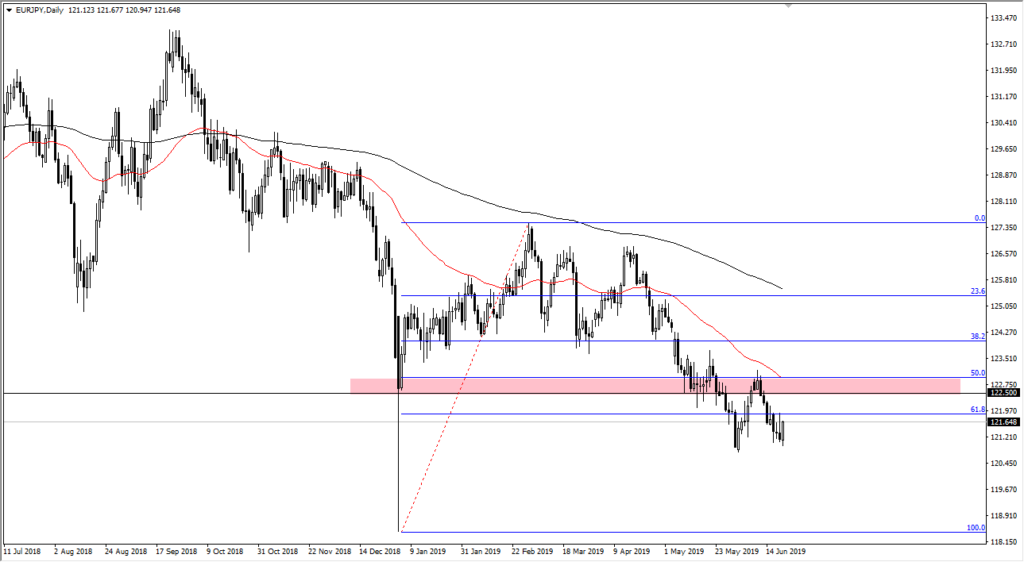

If the candlestick can hold the way it’s trying to print for the session, this is a potential short-term double bottom. As you can see above there though, I have a red barrier that suggests where I believe there is going to be a significant amount of resistance. That resistance will more than likely come in the form of a daily exhaustive candle, backed by the 50 day EMA which is pictured in red. However, we are starting to see the Euro get a bit of a boost against the US dollar, which of course is the benchmark on how you measure a currency strength.

This could, in fact, offer a bit of buoyancy to the Euro across the board, meaning that we could see a rally over here on the first signs of a global “risk on” move. This will be especially true if we can break out above the range we have been in recently when it comes to the EUR/USD pair.

EURJPY Chart June 25th

Global Drivers Pressuring the Market

I believe at this point the EUR/JPY pair is paying attention to the rest of the world like everyone else is. This means that the US/China trade negotiations picking up and showing signs of life would be just what the doctor ordered for this pair to continue going higher. We are dancing around the 61.8% Fibonacci retracement level so certainly, this is an area where people would be looking for something to happen, but at this point, I think it’s fair to say that there are still a lot of questions to be answered.

The Set Up

I do believe that this pair is trying to bounce. If we can clear the ¥122 level it should open the door for a move towards the ¥123 level. It’s at that point that I think we could get a significant break out. Pay attention to a daily close above the 50 day EMA, that should send this pair higher from a longer-term technical analysis standpoint. To the downside, if we make a fresh, new low then I think we go down to the ¥119 level which was the most recent bottom.

The biggest problem with this pair right now isn’t so much the European Union or Japan, it’s Donald Trump and President Xi. If they can somehow come together that will alleviate some of the buying pressure when it comes to the Japanese yen, and then we could see this pair rally a bit. Until then, I suspect anything involving the JPY will continue to be very choppy and difficult to manage. However, we certainly have the makings of a technical set up in this currency pair right now.