Gold Falls Precipitously as Wall Street Rallies

- Wall Street rallies significantly

- Gold plummets in risk appetite return

- Gold to offer value

During trading on Tuesday, Wall Street has been in a buying frenzy. Clorox gained 7% and Tesla an astounding 15% on the back of a 20% gain during the previous session. Now, the S&P 500 is almost 2% higher than it was at the opening, as more of a “risk-on” move has come into the markets.

Recently, there have been concerns about global supply chain disruption and a strengthening of the coronavirus outbreak. Now, it looks as if Wall Street is willing to look past that, perhaps in a bid to shelter money from Asia as well.

Quite often, as Asia falls apart, money comes back to the United States or leaves Asia to find the safety of American indices (in the case of foreign investment). Either way, the volume is strong on Wall Street during Tuesday trading, as the S&P 500 has broken above the 3300 level again.

Gold plummets

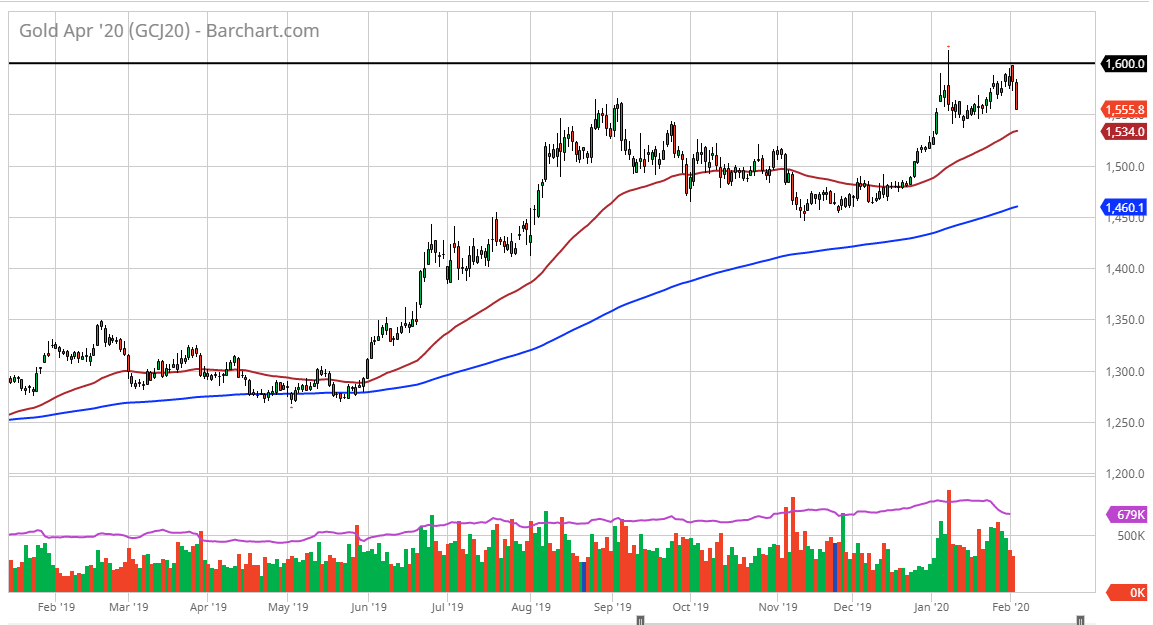

Gold yearly chart

Gold, the long-term champion of safety, has been hit rather hard during trading on Tuesday, with traders willing to take on more risk. April 2020 futures markets, the forward market, have fallen as low as $1555 at noon in New York. The $1550 level just below should offer a certain amount of support, based on previous action.

Furthermore, the 50-day EMA is coming into the same area, so it is possible that a certain amount of technical support should show itself. However, as gold has dropped 1.7% during the day, it looks as if until there is some type of reason to run for safety, gold will probably be on its back foot.

Furthermore, US Treasuries have sold off as well, bringing in higher yields. This is a sign of more risk appetite coming back into the marketplace, and with the strength of Wall Street, it is difficult to envision that much gold will be bought in that environment.

Facing difficulties

Going forward, it is obvious that it will be very difficult for the gold markets to break above the $1600-an-ounce level. This is the third opportunity to break above there, and if gold does slice through that level, it would be a sign that is going to go much higher. In the short term, though, it’s very likely that gold will continue to suffer at the hands of risk appetite coming back into the marketplace.

Beyond that, bad news coming out of Asia could also have gold rallying significantly, as the coronavirus continues to spread all across the region. The number of infected people continues to climb, which cannot do much for risk appetite over the longer term.

In the short term, it does look as if gold is going to pull back in order to offer a bit of value for those who are patient enough.