New Zealand Dollar Likely to Roll Over

- NZD struggling with area just above

- 50-day EMA just above

- Global risk appetite waning

- Asian economy struggling

The New Zealand dollar initially tried to rally during the trading session on Tuesday, but then turned around to show signs of exhaustion. At this point, it looks very likely that we are going to continue to see quite a bit of trouble, because the risk appetite around the world is struggling in general. The New Zealand dollar is highly levered to the Asian economy, which is in the midst of contracting a little due to the US/China trade talks.

Technical analysis

NZD/USD daily chart

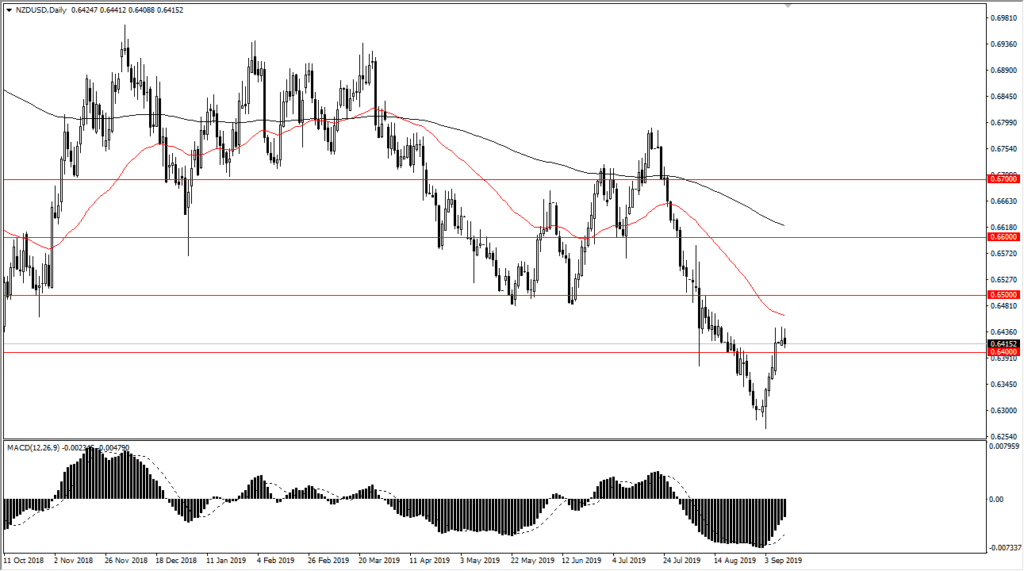

The technical analysis in this pair is very bearish. We had formed a shooting star on Monday but stopped at the 0.6450 level, just as we did on Friday. Beyond that, the trend has been down for some time, and now it appears that we are getting close to the 50-day EMA, which is just above that level and reaching even lower. The 0.64 level underneath would be support, but only from a psychological standpoint from what the chart indicates.

If we were to break down below the 0.64 level, there would be even more psychological damage done overall, so it would make a certain amount of sense that more traders would be short of this market. Overall, one thing that should also be paid attention to is the fact that the bounce has been somewhat parabolic. It’s only a matter of time before we get some type of reversion to the mean, which should show this market drifting lower from here.

China and the NZD

China is a major influence on what happens with the New Zealand dollar, and by extension, the New Zealand economy. While the country is more of an agricultural exporter to Asia, the overall attitude of the Asian economy will have a major influence on New Zealand itself. As long as the Americans and the Chinese are pummeling each other in the trade negotiations situation, the Chinese economy will suffer a bit as exports to the United States are officially listed as having gone down 22%. Ultimately, things are only going to get worse before they get better, as the Americans and the Chinese are very unlikely to come to some sort of agreement.

The trade going forward

The trade going forward is to simply sell the New Zealand dollar underneath the 0.64 USD level. At that point, it’s very likely that the market will return to the 0.63 level underneath, and perhaps even down to the 0.6250 level, which was the most recent low. Rallies are to be faded, as the 50-day EMA, pictured in red in the chart above, is going to offer a certain amount of dynamic resistance as well. The fact that the candlesticks over the last couple of days are starting to form shooting stars tells you there is a lot of trouble above. All things being equal, it does look as if the Kiwi dollar will continue to show downward pressure.