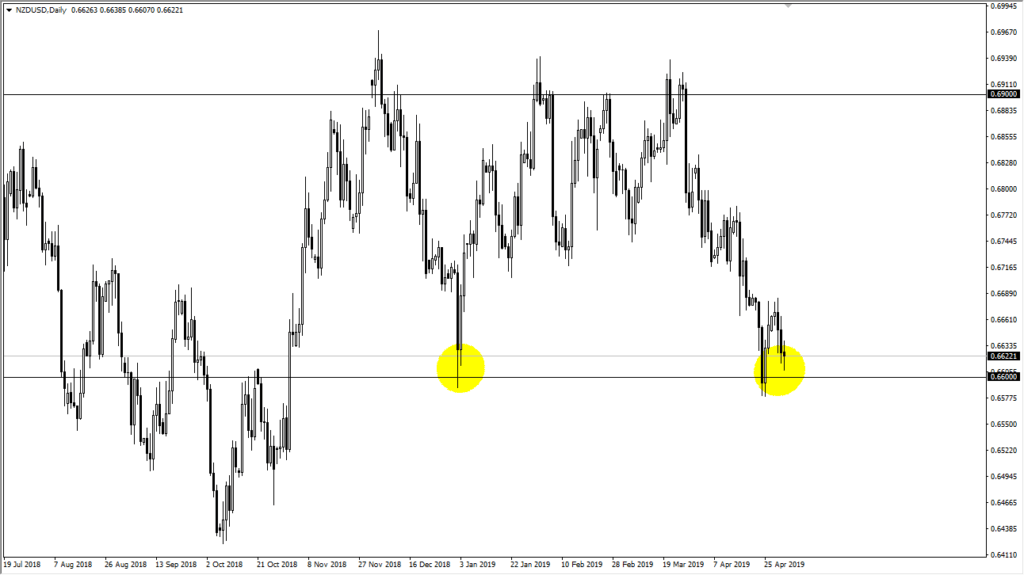

New Zealand dollar looking for support

The New Zealand dollar has been very noisy over the last several sessions, bouncing from the 0.66 handle to reach towards the 0.67 handle, only to fall right back down. As we are starting to close the Thursday session outcome we are right back down to the 0.66 level where we are awaiting for the jobs number to come out. This of course will move the US dollar rather drastically and could dictate whether or not there is going to be any risk appetite.

New Zealand dollar and the nonfarm payroll announcement

Most traders won’t necessarily equate the New Zealand dollar with the jobs numbers coming out of the United States, but that’s only because they are paying attention to both factors in this market. After all, when we’re trading currency were trading two different assets. If the US jobs number is rather strong, that could help the US dollar and perhaps send this market below the 0.66 handle. However, that is probably going to be a bit of a fake move, as we could see more of a “risk on” move, which does help the New Zealand dollar.

In general, the one thing I think you can count on is going to be a lot of volatility but that’s thinking to be any different than any other job’s day. Remember that liquidity will disappear, and the market could get rather noisy. Overall though, the end of the day should be rather interesting and could tell us where were going longer-term.

NZD/USD Chart

Asia

The New Zealand dollar is also heavily influenced by Asia in general, as the New Zealand economy provides a lot of soft commodities to that marketplace. Overall, the New Zealand dollar is a proxy for commodity markets in general but it especially follows agriculture. So at this point it’s possible that we are going to see an Asian play as well, and that’s why the “risk on” attitude have a good jobs number may help the New Zealand dollar after the initial fake out.

Pay attention to the Asian stock markets, that could lead the way as well, maybe not necessarily on Friday, but when Asia wakes up on Monday morning, before the Europeans and the Americans jumped on board, stronger stock markets in China could be a major lift for the Kiwi.

The main take away

The main take away in this pair is that we are in an area that has massive support. The support has been seen on longer-term historical charts, so that should continue to come into play as well. In general, I suspect that a lot of value hunters will be down at these extraordinarily low levels looking for value. Remember, the New Zealand dollar tends to follow right along with the Australian dollar, so if that currency rallies against the greenback, the Kiwi dollar should go right along with it.

A break down in this level, I would be a bit cautious about shorting, because there’s such a high probability of buyers entering the market, but I also wouldn’t jump in and try to anticipate that move. I’d let the jobs number get out of the way first.