New Zealand dollar rocked after surprise rate cut

The New Zealand dollar got absolutely pummeled during trading overnight as the Royal Bank of New Zealand cut interest rates, in what would have been a surprise move. Most pundits speculated that the central bank would not cut rates, but perhaps give a bit of a dovish statement. As they did cut rates, the New Zealand dollar did of course lose quite a bit of ground.

Japanese yen, perfect instrument

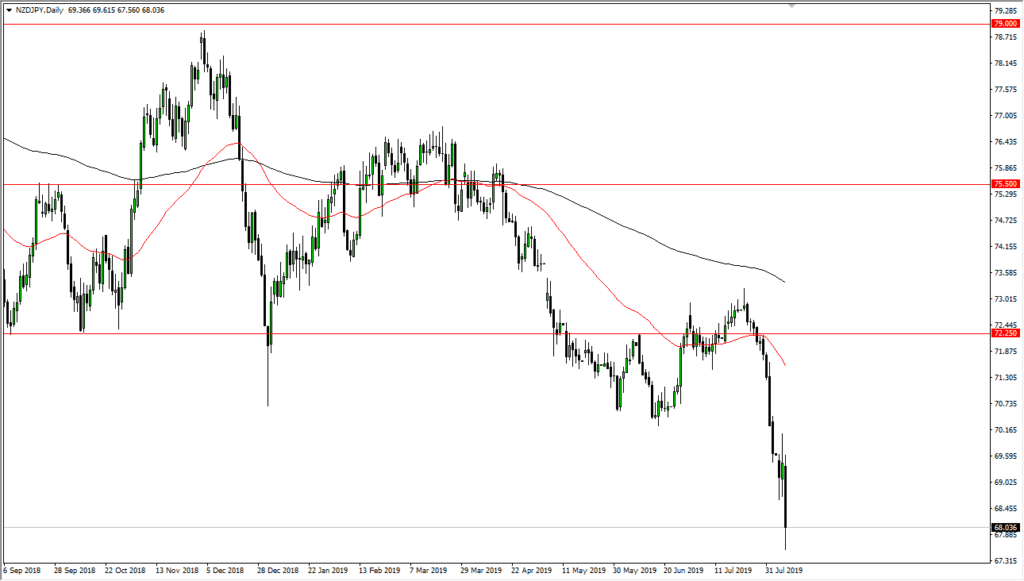

NZD/JPY

The Japanese yen against the currency like this is essentially the “perfect instrument” in this type of environment. It is considered to be a major “safety currency”, so as the interest rate was cut in New Zealand, it makes sense that money floods out of the country and back to the relative safety of Japan. This only continues the downward sentiment that we have seen in the NZD/JPY pair, as we have reached the ¥68 level during north American trading. This type of Japanese yen strength is seen around the world right now, and the fact that New Zealand is cut rates only exacerbates this pair.

Global growth concerns

The New Zealand dollar has been falling anyway as we have a lot of global growth concerns, and the fact that the central bank decided to cut interest rates shows just how dire things may be getting. Beyond that, we also have the trade war situation which directly affects New Zealand as they are a major exporter of commodities to places like China, Indonesia, and other parts of Asia. Ultimately, this is a market that measures risk appetite, and it’s very thin right now.

As central banks cut interest rates and let us not forget that India and Thailand both did the same thing within the space of a few hours, it shows that people will be able to take advantage of as much in the way of interest rate differential. This weighs upon the New Zealand dollar, which of course in times of strength we see get bit higher.

Technical analysis

The interest rate cut of course has only exacerbated what we have seen as of late. The ¥68 level of course will cause a bit of psychological support as well as structural, but the fact that we had broken down below a couple of choppy candlesticks before shows an acceleration. At this point, the ¥69.50 level should be resistance, and most certainly the 50 day EMA, which is pictured in red, it should be an area where we can start selling again. On the other hand, if we were to break down below the candle stick for the trading session on Wednesday, then likely that we go down looking towards the ¥65 level as it is a large, round, psychologically significant figure. At this point, unless there’s some type a US/China trade deal, it’s very unlikely that we will find anything along the lines of a buying opportunity. That being said, the market looks very likely to continue to be a “sell on the rallies” type of situation.