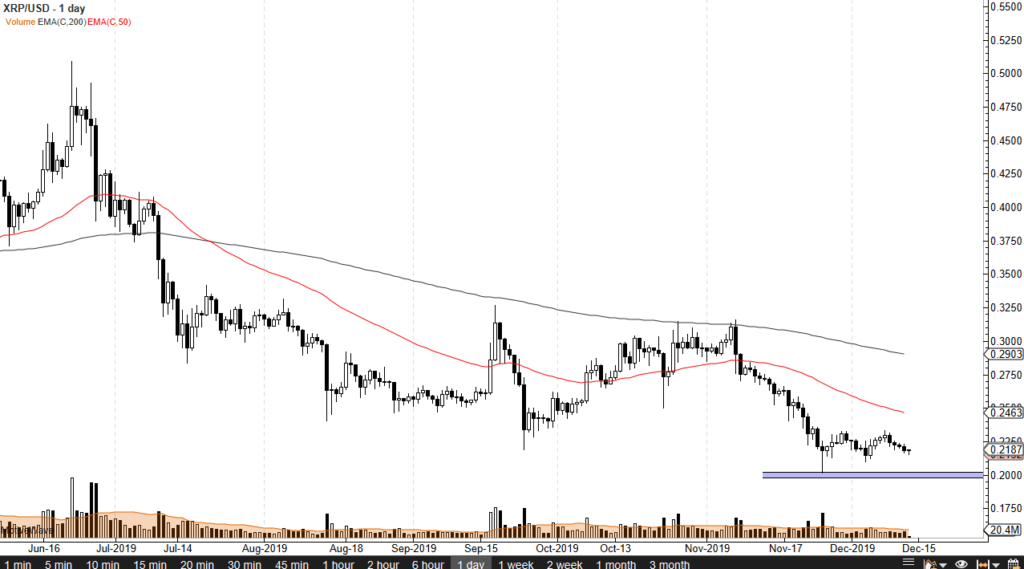

Ripple Trying to Form Support

- 50 day EMA reaching towards price

- $0.20 likely to be important

During a relatively quiet trading session on Friday, the market looks as if it is trying to form some type of basing pattern, sitting just above the $0.20 level. Ripple continues to struggle in general, as the cryptocurrency markets have been pummeled during most of the year. However, Ripple has made a bit of a stand-in in this general vicinity.

Ripple technical analysis

The technical analysis for this pair is rather bleak, all things considered. The 50 day EMA is just below the $0.25 level, a significant area from the aspect of psychology. The 200 day EMA is sitting just below the $0.30 level, which also has a certain amount of psychological significance to it. The moving averages are spread out quite nicely, and both tilting lower, a very negative sign indeed.

That being said, $0.20 is psychologically important as well, as it is also a large, round, whole number. There has also been a massive hammer forming on high-volume in this area last month, so it will be interesting to see whether or not this holds. So far, it has already formed a “double bottom.” If it can hold here, this would then be a “triple bottom”, which would be very bullish. If prices were to break down below the $0.20 level, it would be extraordinarily negative, and probably open up Ripple for another $0.05 lower pricing.

XRP/USD chart

Bitcoin

Unfortunately for Ripple, most volume in cryptocurrency these days is done through Bitcoin. In other words, market participants will need to see Bitcoin take off to the upside in order for other cryptos to have a fighting chance to change the overall trend. At this point, Bitcoin is crucial as it is the “grandfather” of most cryptos. With that in mind, the Bitcoin chart can be used as a secondary indicator.

Going forward

Going forward, it’s very likely that the market will continue to chop around this area. There has already been some churning in this area, and the question now is whether or not things can hold. Because of this, a break below the $0.20 level is an obvious bearish signal, but if the market can turn around and overtake the 50 day EMA, it would be a sign that perhaps things are going higher.

A break above the 50 day EMA would bring in fresh short covering, and people looking for value. Adoption of Ripple has been a bit slow, but the adoption of cryptocurrency, in general, has been slow. The $0.20 level has been important more than once in the past, and it certainly looks as if it’s likely to be so yet again.